Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Quarterly <strong>orders</strong> in gross <strong>to</strong>nnage (millions)<br />

South Western<br />

Japon Korea China Europe<br />

1997 March 3.875 2.585 0.500 1.001<br />

June 2.905 3.728 0.283 1.129<br />

September 2.757 3.533 0.235 0.394<br />

December 5.824 3.887 0.443 0.925<br />

1998 March 2.238 1.379 0.245 1.585<br />

June 2.648 1.741 0.241 1.040<br />

September 3.875 2.801 0.053 1.085<br />

December 2.219 2.898 0.122 0.346<br />

1999 March 1.837 1.345 0.317 0.513<br />

June 1.809 2.877 0.601 0.705<br />

September 2.265 3.199 1.400 0.733<br />

% growth:1-2-3 Qtr. 98/99 -33 % 25 % 330 % -47 %<br />

The drop in <strong>orders</strong> was also unbalanced in as much as it<br />

essentially affected, in the conventional vessel category,<br />

both Aframax and VLCC tankers, although Suezmax carriers<br />

<strong>to</strong> a lesser extent <strong>to</strong>o. Thus the percentage of vessels on<br />

order compared <strong>to</strong> the trading fleet fell.<br />

Very low freight volumes this year seemed <strong>to</strong> have braked<br />

the renewal of the tanker fleet that began in 1997. On the<br />

contrary, bulkers, from Handymax <strong>to</strong> Capesize vessels, and<br />

containerships were being rejuvenated.<br />

Bulker <strong>orders</strong> were probably more speculative this year.<br />

Owners seeking economies of scale, <strong>to</strong> maintain or increase<br />

market share or <strong>to</strong> take advantage of low construction prices<br />

spurred new <strong>orders</strong> for containerships of ever-increasing size.<br />

10,000,000<br />

9,000,000<br />

8,000,000<br />

7,000,000<br />

6,000,000<br />

5,000,000<br />

4,000,000<br />

3,000,000<br />

2,000,000<br />

1,000,000<br />

0<br />

Dwt<br />

31<br />

ships<br />

24<br />

Source: Lloyd’s Register<br />

Many <strong>orders</strong> came from German owners who wanted <strong>to</strong> take<br />

advantage of favourable tax regulations that might disappear.<br />

Specialised <strong>to</strong>nnage, inherently less speculative, was much<br />

more strongly affected by the drop in <strong>orders</strong>, with the<br />

exception of ro-ro vessels, LNG carriers and cruiseships.<br />

Cruise companies once again invested massively, but on<br />

an even greater scale than last year. The four major<br />

European <strong>shipyards</strong> that specialise in building cruiseships<br />

have an overall work load lasting through 2003, not<br />

including optional vessels. The craze for <strong>orders</strong> has resulted<br />

in such a bottleneck in producing these vessels that<br />

owners must place <strong>orders</strong> with less experienced <strong>shipyards</strong><br />

or ones whose experience dates back a very long time,<br />

like Ingalls in the US. The cruise business does closely look<br />

like the <strong>to</strong>urism industry, where supply can create intense<br />

demand. However, in shipping industry, an excess of vessels<br />

has not contributed yet <strong>to</strong> increase the volumes carried.<br />

In 1998, the drop of the Korean won against the dollar,<br />

coupled with a feeling of economic uncertainty, brought on<br />

a fall of 15 <strong>to</strong> 30% in the price of standard vessels. This slide<br />

continued in<strong>to</strong> the beginning of 1999. However, this is<br />

difficult <strong>to</strong> quantify because, as usual, supply in ship<br />

construction is heterogeneous and the requirements of<br />

<strong>shipyards</strong> were widely varied.<br />

Remember, at the end of 1998, Japan and Korea each<br />

gained around 10 million gt of <strong>orders</strong>, and about 20 million gt<br />

remaining in each of their orderbook. In general, shipbuilders<br />

in these two countries had no reason <strong>to</strong> support further<br />

cuts, especially since the won and the yen both appreciated<br />

in the last quarter.<br />

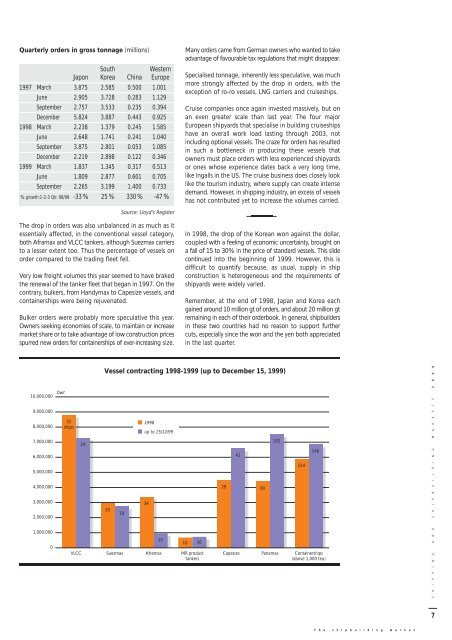

Vessel contracting 1998-1999 (up <strong>to</strong> December 15, 1999)<br />

20<br />

18<br />

1998<br />

up <strong>to</strong> 15/12/99<br />

34<br />

VLCC Suezmax Aframax<br />

10<br />

15<br />

16<br />

MR product<br />

tankers<br />

29<br />

41<br />

60<br />

102<br />

154<br />

146<br />

Capesize Panamax Containerships<br />

(above 1,000 teu)<br />

T h e s h i p b u i l d i n g m a r k e t<br />

S H I P P I N G A N D S H I P B U I L D I N G M A R K E T S 2 0 0 0<br />

7