You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

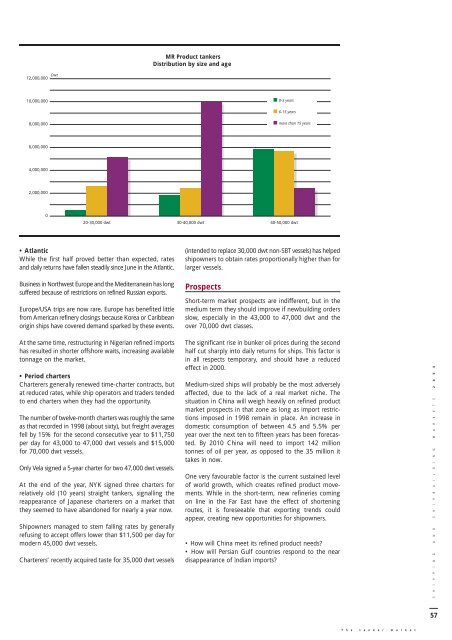

Dwt<br />

12,000,000<br />

10,000,000<br />

8,000,000<br />

6,000,000<br />

4,000,000<br />

2,000,000<br />

0<br />

• Atlantic<br />

While the first half proved better than expected, rates<br />

and daily returns have fallen steadily since June in the Atlantic.<br />

Business in Northwest Europe and the Mediterranean has long<br />

suffered because of restrictions on refined Russian exports.<br />

Europe/USA trips are now rare. Europe has benefited little<br />

from American refinery closings because Korea or Caribbean<br />

origin ships have covered demand sparked by these events.<br />

At the same time, restructuring in Nigerian refined imports<br />

has resulted in shorter offshore waits, increasing available<br />

<strong>to</strong>nnage on the market.<br />

• Period charters<br />

Charterers generally renewed time-charter contracts, but<br />

at reduced rates, while ship opera<strong>to</strong>rs and traders tended<br />

<strong>to</strong> end charters when they had the opportunity.<br />

The number of twelve-month charters was roughly the same<br />

as that recorded in 1998 (about sixty), but freight averages<br />

fell by 15% for the second consecutive year <strong>to</strong> $11,750<br />

per day for 43,000 <strong>to</strong> 47,000 dwt vessels and $15,000<br />

for 70,000 dwt vessels.<br />

Only Vela signed a 5-year charter for two 47,000 dwt vessels.<br />

At the end of the year, NYK signed three charters for<br />

relatively old (10 years) straight tankers, signalling the<br />

reappearance of Japanese charterers on a market that<br />

they seemed <strong>to</strong> have abandoned for nearly a year now.<br />

Shipowners managed <strong>to</strong> stem falling rates by generally<br />

refusing <strong>to</strong> accept offers lower than $11,500 per day for<br />

modern 45,000 dwt vessels.<br />

Charterers’ recently acquired taste for 35,000 dwt vessels<br />

MR Product tankers<br />

Distribution by size and age<br />

(intended <strong>to</strong> replace 30,000 dwt non-SBT vessels) has helped<br />

shipowners <strong>to</strong> obtain rates proportionally higher than for<br />

larger vessels.<br />

Prospects<br />

0-5 years<br />

6-15 years<br />

more than 15 years<br />

20-30,000 dwt 30-40,000 dwt 40-50,000 dwt<br />

Short-term market prospects are indifferent, but in the<br />

medium term they should improve if newbuilding <strong>orders</strong><br />

slow, especially in the 43,000 <strong>to</strong> 47,000 dwt and the<br />

over 70,000 dwt classes.<br />

The significant rise in bunker oil prices during the second<br />

half cut sharply in<strong>to</strong> daily returns for ships. This fac<strong>to</strong>r is<br />

in all respects temporary, and should have a reduced<br />

effect in 2000.<br />

Medium-sized ships will probably be the most adversely<br />

affected, due <strong>to</strong> the lack of a real market niche. The<br />

situation in China will weigh heavily on refined product<br />

market prospects in that zone as long as import restrictions<br />

imposed in 1998 remain in place. An increase in<br />

domestic consumption of between 4.5 and 5.5% per<br />

year over the next ten <strong>to</strong> fifteen years has been forecasted.<br />

By 2010 China will need <strong>to</strong> import 142 million<br />

<strong>to</strong>nnes of oil per year, as opposed <strong>to</strong> the 35 million it<br />

takes in now.<br />

One very favourable fac<strong>to</strong>r is the current sustained level<br />

of world growth, which creates refined product movements.<br />

While in the short-term, new refineries coming<br />

on line in the Far East have the effect of shortening<br />

routes, it is foreseeable that exporting trends could<br />

appear, creating new opportunities for shipowners.<br />

• How will China meet its refined product needs?<br />

• How will Persian Gulf countries respond <strong>to</strong> the near<br />

disappearance of Indian imports?<br />

T h e t a n k e r m a r k e t<br />

S H I P P I N G A N D S H I P B U I L D I N G M A R K E T S 2 0 0 0<br />

57