Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

for us just how stagnant this market has been. The reasons<br />

for this are readily identifiable <strong>to</strong> all players. They may be<br />

summarised as follows:<br />

• Newbuilding prices are down since 1997 and are being<br />

maintained at attractive levels in comparison with actual<br />

or probable prices for modern ships.<br />

• Over-capacity of vessels with respect <strong>to</strong> <strong>to</strong>nnage <strong>to</strong> be<br />

transported and distances <strong>to</strong> cover.<br />

• The dearth of available time-charters offered by shipping<br />

companies.<br />

• Returns for shipowners on the time-charter and spot<br />

markets are weak.<br />

• The ratio of units scrapped and new units entering the<br />

fleet - by the end of November 1999, 30 units had been<br />

scrapped compared <strong>to</strong> 23 vessels delivered. Although<br />

this ratio should reach an equilibrium in terms of numbers<br />

of ships by the end of the year, the new ships have a<br />

higher performance rating.<br />

• To these, some add the low consolidation effort in the<br />

sec<strong>to</strong>r ; however, it can be justifiably maintained that<br />

shipowners in other domains, such as the large chemical<br />

carriers, have been hurt by the crisis despite ventures of<br />

this type.<br />

• Almost all buyers for FSO or FPSO conversion projects<br />

have disappeared.<br />

These reasons, combined with charter opera<strong>to</strong>rs growing<br />

selectivity through vetting policies in markets favourable<br />

<strong>to</strong> them, have generated a perceptible acceleration of<br />

scrapping <strong>to</strong> levels observed in 1998.<br />

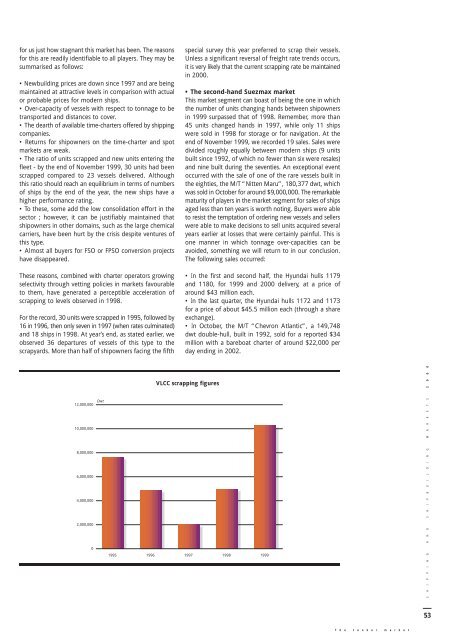

For the record, 30 units were scrapped in 1995, followed by<br />

16 in 1996, then only seven in 1997 (when rates culminated)<br />

and 18 ships in 1998. At year’s end, as stated earlier, we<br />

observed 36 departures of vessels of this type <strong>to</strong> the<br />

scrapyards. More than half of shipowners facing the fifth<br />

Dwt<br />

12,000,000<br />

10,000,000<br />

8,000,000<br />

6,000,000<br />

4,000,000<br />

2,000,000<br />

0<br />

special survey this year preferred <strong>to</strong> scrap their vessels.<br />

Unless a significant reversal of freight rate trends occurs,<br />

it is very likely that the current scrapping rate be maintained<br />

in 2000.<br />

• The second-hand Suezmax market<br />

This market segment can boast of being the one in which<br />

the number of units changing hands between shipowners<br />

in 1999 surpassed that of 1998. Remember, more than<br />

45 units changed hands in 1997, while only 11 ships<br />

were sold in 1998 for s<strong>to</strong>rage or for navigation. At the<br />

end of November 1999, we recorded 19 sales. Sales were<br />

divided roughly equally between modern ships (9 units<br />

built since 1992, of which no fewer than six were resales)<br />

and nine built during the seventies. An exceptional event<br />

occurred with the sale of one of the rare vessels built in<br />

the eighties, the M/T “Nitten Maru”, 180,377 dwt, which<br />

was sold in Oc<strong>to</strong>ber for around $9,000,000. The remarkable<br />

maturity of players in the market segment for sales of ships<br />

aged less than ten years is worth noting. Buyers were able<br />

<strong>to</strong> resist the temptation of ordering new vessels and sellers<br />

were able <strong>to</strong> make decisions <strong>to</strong> sell units acquired several<br />

years earlier at losses that were certainly painful. This is<br />

one manner in which <strong>to</strong>nnage over-capacities can be<br />

avoided, something we will return <strong>to</strong> in our conclusion.<br />

The following sales occurred:<br />

• In the first and second half, the Hyundai hulls 1179<br />

and 1180, for 1999 and 2000 delivery, at a price of<br />

around $43 million each.<br />

• In the last quarter, the Hyundai hulls 1172 and 1173<br />

for a price of about $45.5 million each (through a share<br />

exchange).<br />

• In Oc<strong>to</strong>ber, the M/T “Chevron Atlantic”, a 149,748<br />

dwt double-hull, built in 1992, sold for a reported $34<br />

million with a bareboat charter of around $22,000 per<br />

day ending in 2002.<br />

VLCC scrapping figures<br />

1995 1996 1997 1998 1999<br />

T h e t a n k e r m a r k e t<br />

S H I P P I N G A N D S H I P B U I L D I N G M A R K E T S 2 0 0 0<br />

53