Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

56<br />

US$/day<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

0<br />

The direct consequence of these events in the refined<br />

product transport market is the shortening of traditional<br />

routes (Europe/India) and/or the end of Middle East Gulf/<br />

India traffic.<br />

The European market was affected by the slowing of<br />

Russian exports from Black Sea and Baltic ports.<br />

The consolidation phenomenon occurring among oil<br />

companies served <strong>to</strong> restrain end-of-year trading activity.<br />

Despite this, the overall level of demand exceeded that<br />

of the previous year. Lower rates recorded in 1999 are<br />

much more a result of excess <strong>to</strong>nnage and shortened<br />

routes than of weak demand in the sec<strong>to</strong>r.<br />

• A strong increase in the capacity<br />

of the refined product transport fleet<br />

Some 85 ships were delivered in 1999, resulting from<br />

the boom in <strong>orders</strong> in 1996 and 1997. Most of the units<br />

were from 43,000 <strong>to</strong> 47,000 dwt (41 units) or of greater<br />

than 70,000 dwt (23 units). The increase in average size<br />

(45,000 dwt in 1999 compared <strong>to</strong> 33,500 dwt in 1998)<br />

coupled with a higher average cruising speed, brought<br />

on an increase of nearly 15% in transport efficiency as<br />

calculated in terms of <strong>to</strong>nnes/miles.<br />

On the other hand, only 13 older vessels <strong>to</strong>talling<br />

430,000 dwt (<strong>to</strong>o few) departed for the scrapyard.<br />

This is relatively disquieting in view of the following:<br />

• The current refined product transport fleet is the largest,<br />

ahead of the Aframax fleet (there are more than 1,500<br />

units exceeding 10,000 dwt compared <strong>to</strong> Aframax<br />

figures of 570-580 units).<br />

• Average age is only slightly over 16 years.<br />

• With fewer technical restrictions because of shorter routes<br />

and less corrosive cargoes, average life is high at 27 years.<br />

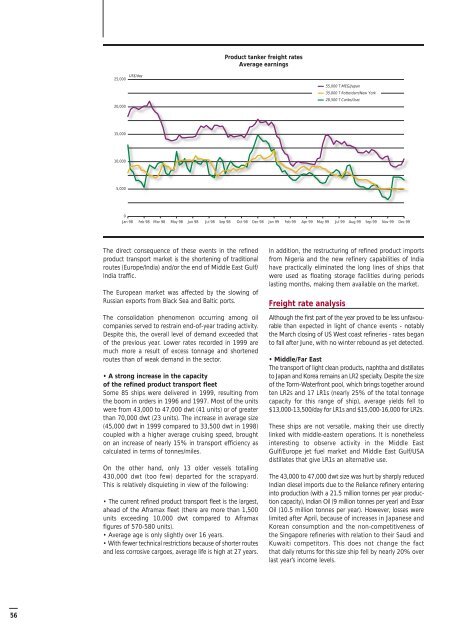

Product tanker freight rates<br />

Average earnings<br />

55,000 T MEG/Japan<br />

In addition, the restructuring of refined product imports<br />

from Nigeria and the new refinery capabilities of India<br />

have practically eliminated the long lines of ships that<br />

were used as floating s<strong>to</strong>rage facilities during periods<br />

lasting months, making them available on the market.<br />

Freight rate analysis<br />

35,000 T Rotterdam/New York<br />

28,500 T Caribs/Usac<br />

Jan 98 Feb 98 Mar 98 May 98 Jun 98 Jul 98 Sep 98 Oct 98 Dec 98 Jan 99 Feb 99 Apr 99 May 99 Jul 99 Aug 99 Sep 99 Nov 99 Dec 99<br />

Although the first part of the year proved <strong>to</strong> be less unfavourable<br />

than expected in light of chance events - notably<br />

the March closing of US West coast refineries - rates began<br />

<strong>to</strong> fall after June, with no winter rebound as yet detected.<br />

• Middle/Far East<br />

The transport of light clean products, naphtha and distillates<br />

<strong>to</strong> Japan and Korea remains an LR2 specialty. Despite the size<br />

of the Torm-Waterfront pool, which brings <strong>to</strong>gether around<br />

ten LR2s and 17 LR1s (nearly 25% of the <strong>to</strong>tal <strong>to</strong>nnage<br />

capacity for this range of ship), average yields fell <strong>to</strong><br />

$13,000-13,500/day for LR1s and $15,000-16,000 for LR2s.<br />

These ships are not versatile, making their use directly<br />

linked with middle-eastern operations. It is nonetheless<br />

interesting <strong>to</strong> observe activity in the Middle East<br />

Gulf/Europe jet fuel market and Middle East Gulf/USA<br />

distillates that give LR1s an alternative use.<br />

The 43,000 <strong>to</strong> 47,000 dwt size was hurt by sharply reduced<br />

Indian diesel imports due <strong>to</strong> the Reliance refinery entering<br />

in<strong>to</strong> production (with a 21.5 million <strong>to</strong>nnes per year production<br />

capacity), Indian Oil (9 million <strong>to</strong>nnes per year) and Essar<br />

Oil (10.5 million <strong>to</strong>nnes per year). However, losses were<br />

limited after April, because of increases in Japanese and<br />

Korean consumption and the non-competitiveness of<br />

the Singapore refineries with relation <strong>to</strong> their Saudi and<br />

Kuwaiti competi<strong>to</strong>rs. This does not change the fact<br />

that daily returns for this size ship fell by nearly 20% over<br />

last year’s income levels.