Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

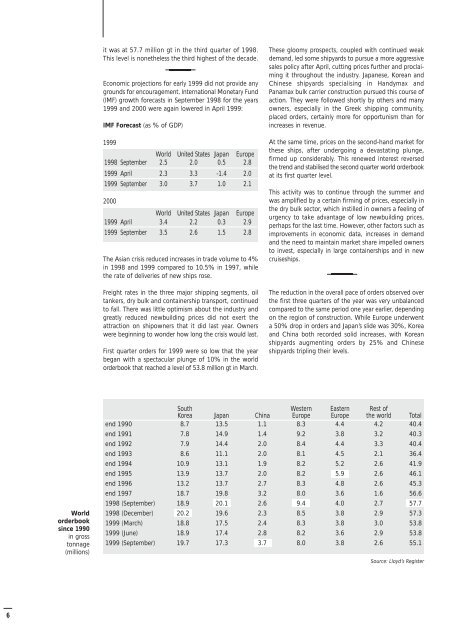

World<br />

orderbook<br />

since 1990<br />

in gross<br />

<strong>to</strong>nnage<br />

(millions)<br />

it was at 57.7 million gt in the third quarter of 1998.<br />

This level is nonetheless the third highest of the decade.<br />

Economic projections for early 1999 did not provide any<br />

grounds for encouragement. International Monetary Fund<br />

(IMF) growth forecasts in September 1998 for the years<br />

1999 and 2000 were again lowered in April 1999:<br />

IMF Forecast (as % of GDP)<br />

1999<br />

World United States Japan Europe<br />

1998 September 2.5 2.0 0.5 2.8<br />

1999 April 2.3 3.3 -1.4 2.0<br />

1999 September 3.0 3.7 1.0 2.1<br />

2000<br />

World United States Japan Europe<br />

1999 April 3.4 2.2 0.3 2.9<br />

1999 September 3.5 2.6 1.5 2.8<br />

The Asian crisis reduced increases in trade volume <strong>to</strong> 4%<br />

in 1998 and 1999 compared <strong>to</strong> 10.5% in 1997, while<br />

the rate of deliveries of new ships rose.<br />

Freight rates in the three major shipping segments, oil<br />

tankers, dry bulk and containership transport, continued<br />

<strong>to</strong> fall. There was little optimism about the industry and<br />

greatly reduced newbuilding prices did not exert the<br />

attraction on shipowners that it did last year. Owners<br />

were beginning <strong>to</strong> wonder how long the crisis would last.<br />

First quarter <strong>orders</strong> for 1999 were so low that the year<br />

began with a spectacular plunge of 10% in the world<br />

orderbook that reached a level of 53.8 million gt in March.<br />

These gloomy prospects, coupled with continued weak<br />

demand, led some <strong>shipyards</strong> <strong>to</strong> pursue a more aggressive<br />

sales policy after April, cutting prices further and proclaiming<br />

it throughout the industry. Japanese, Korean and<br />

Chinese <strong>shipyards</strong> specialising in Handymax and<br />

Panamax bulk carrier construction pursued this course of<br />

action. They were followed shortly by others and many<br />

owners, especially in the Greek shipping community,<br />

placed <strong>orders</strong>, certainly more for opportunism than for<br />

increases in revenue.<br />

At the same time, prices on the second-hand market for<br />

these ships, after undergoing a devastating plunge,<br />

firmed up considerably. This renewed interest reversed<br />

the trend and stabilised the second quarter world orderbook<br />

at its first quarter level.<br />

This activity was <strong>to</strong> continue through the summer and<br />

was amplified by a certain firming of prices, especially in<br />

the dry bulk sec<strong>to</strong>r, which instilled in owners a feeling of<br />

urgency <strong>to</strong> take advantage of low newbuilding prices,<br />

perhaps for the last time. However, other fac<strong>to</strong>rs such as<br />

improvements in economic data, increases in demand<br />

and the need <strong>to</strong> maintain market share impelled owners<br />

<strong>to</strong> invest, especially in large containerships and in new<br />

cruiseships.<br />

The reduction in the overall pace of <strong>orders</strong> observed over<br />

the first three quarters of the year was very unbalanced<br />

compared <strong>to</strong> the same period one year earlier, depending<br />

on the region of construction. While Europe underwent<br />

a 50% drop in <strong>orders</strong> and Japan’s slide was 30%, Korea<br />

and China both recorded solid increases, with Korean<br />

<strong>shipyards</strong> augmenting <strong>orders</strong> by 25% and Chinese<br />

<strong>shipyards</strong> tripling their levels.<br />

South Western Eastern Rest of<br />

Korea Japan China Europe Europe the world Total<br />

end 1990 8.7 13.5 1.1 8.3 4.4 4.2 40.4<br />

end 1991 7.8 14.9 1.4 9.2 3.8 3.2 40.3<br />

end 1992 7.9 14.4 2.0 8.4 4.4 3.3 40.4<br />

end 1993 8.6 11.1 2.0 8.1 4.5 2.1 36.4<br />

end 1994 10.9 13.1 1.9 8.2 5.2 2.6 41.9<br />

end 1995 13.9 13.7 2.0 8.2 5.9 2.6 46.1<br />

end 1996 13.2 13.7 2.7 8.3 4.8 2.6 45.3<br />

end 1997 18.7 19.8 3.2 8.0 3.6 1.6 56.6<br />

1998 (September) 18.9 20.1 2.6 9.4 4.0 2.7 57.7<br />

1998 (December) 20.2 19.6 2.3 8.5 3.8 2.9 57.3<br />

1999 (March) 18.8 17.5 2.4 8.3 3.8 3.0 53.8<br />

1999 (June) 18.9 17.4 2.8 8.2 3.6 2.9 53.8<br />

1999 (September) 19.7 17.3 3.7 8.0 3.8 2.6 55.1<br />

Source: Lloyd’s Register