You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

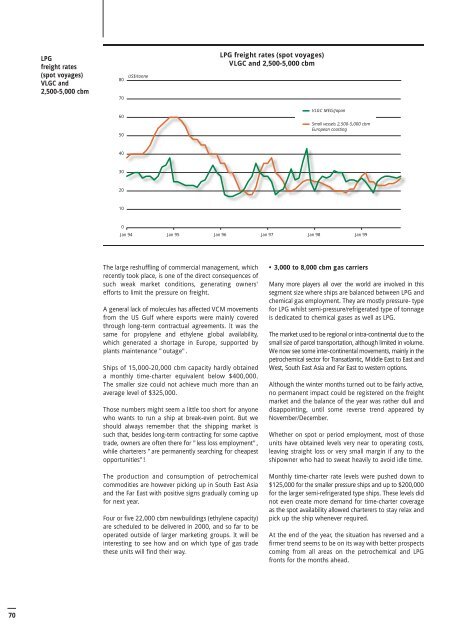

LPG<br />

freight rates<br />

(spot voyages)<br />

VLGC and<br />

2,500-5,000 cbm<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

US$/<strong>to</strong>nne<br />

The large reshuffling of commercial management, which<br />

recently <strong>to</strong>ok place, is one of the direct consequences of<br />

such weak market conditions, generating owners'<br />

efforts <strong>to</strong> limit the pressure on freight.<br />

A general lack of molecules has affected VCM movements<br />

from the US Gulf where exports were mainly covered<br />

through long-term contractual agreements. It was the<br />

same for propylene and ethylene global availability,<br />

which generated a shortage in Europe, supported by<br />

plants maintenance "outage".<br />

Ships of 15,000-20,000 cbm capacity hardly obtained<br />

a monthly time-charter equivalent below $400,000.<br />

The smaller size could not achieve much more than an<br />

average level of $325,000.<br />

Those numbers might seem a little <strong>to</strong>o short for anyone<br />

who wants <strong>to</strong> run a ship at break-even point. But we<br />

should always remember that the shipping market is<br />

such that, besides long-term contracting for some captive<br />

trade, owners are often there for "less loss employment",<br />

while charterers "are permanently searching for cheapest<br />

opportunities"!<br />

The production and consumption of petrochemical<br />

commodities are however picking up in South East Asia<br />

and the Far East with positive signs gradually coming up<br />

for next year.<br />

Four or five 22,000 cbm newbuildings (ethylene capacity)<br />

are scheduled <strong>to</strong> be delivered in 2000, and so far <strong>to</strong> be<br />

operated outside of larger marketing groups. It will be<br />

interesting <strong>to</strong> see how and on which type of gas trade<br />

these units will find their way.<br />

LPG freight rates (spot voyages)<br />

VLGC and 2,500-5,000 cbm<br />

VLGC MEG/Japan<br />

Small vessels 2,500-5,000 cbm<br />

European coasting<br />

Jan 94 Jan 95 Jan 96 Jan 97 Jan 98 Jan 99<br />

• 3,000 <strong>to</strong> 8,000 cbm gas carriers<br />

Many more players all over the world are involved in this<br />

segment size where ships are balanced between LPG and<br />

chemical gas employment. They are mostly pressure- type<br />

for LPG whilst semi-pressure/refrigerated type of <strong>to</strong>nnage<br />

is dedicated <strong>to</strong> chemical gases as well as LPG.<br />

The market used <strong>to</strong> be regional or intra-continental due <strong>to</strong> the<br />

small size of parcel transportation, although limited in volume.<br />

We now see some inter-continental movements, mainly in the<br />

petrochemical sec<strong>to</strong>r for Transatlantic, Middle East <strong>to</strong> East and<br />

West, South East Asia and Far East <strong>to</strong> western options.<br />

Although the winter months turned out <strong>to</strong> be fairly active,<br />

no permanent impact could be registered on the freight<br />

market and the balance of the year was rather dull and<br />

disappointing, until some reverse trend appeared by<br />

November/December.<br />

Whether on spot or period employment, most of those<br />

units have obtained levels very near <strong>to</strong> operating costs,<br />

leaving straight loss or very small margin if any <strong>to</strong> the<br />

shipowner who had <strong>to</strong> sweat heavily <strong>to</strong> avoid idle time.<br />

Monthly time-charter rate levels were pushed down <strong>to</strong><br />

$125,000 for the smaller pressure ships and up <strong>to</strong> $200,000<br />

for the larger semi-refrigerated type ships. These levels did<br />

not even create more demand for time-charter coverage<br />

as the spot availability allowed charterers <strong>to</strong> stay relax and<br />

pick up the ship whenever required.<br />

At the end of the year, the situation has reversed and a<br />

firmer trend seems <strong>to</strong> be on its way with better prospects<br />

coming from all areas on the petrochemical and LPG<br />

fronts for the months ahead.