You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60<br />

700,000<br />

600,000<br />

500,000<br />

400,000<br />

300,000<br />

200,000<br />

100,000<br />

0<br />

Dwt<br />

An identical trend occurred on the ex-Mediterranean<br />

trade <strong>to</strong> Europe. On this route, increased activity was<br />

generated mainly in spot cargoes of lubricants, chemicals<br />

and acids. Freight rates for 3,000 <strong>to</strong>nne cargoes on a<br />

West Coast Italy/Rotterdam route reached around<br />

$24/<strong>to</strong>nne in September, a modest rise compared <strong>to</strong> the<br />

$22-23/<strong>to</strong>nne figures of last March.<br />

In the United States/Europe direction, the market progressed<br />

slightly after levelling off in the early part of the year.<br />

Freight rates for 3000 <strong>to</strong>nne cargoes of easy chemicals<br />

on the Hous<strong>to</strong>n/Rotterdam route began <strong>to</strong> climb after<br />

July, rising from $25/<strong>to</strong>nne at the beginning of March <strong>to</strong><br />

$30/<strong>to</strong>nne. These rates have held steady at that level<br />

over the last few months. The increase in freight rates<br />

was mainly due <strong>to</strong> higher consumption related <strong>to</strong> healthy<br />

economies in northern Europe.<br />

As for the Europe/United States routes, the market was<br />

less profitable for shipowners, as September freight rates<br />

remained at nearly the same level as last March. Freight<br />

rates for 5,000-7,000 <strong>to</strong>nne cargoes of easy chemicals<br />

on a Rotterdam/Hous<strong>to</strong>n route reached levels of<br />

$18.50/<strong>to</strong>nne compared with $17/<strong>to</strong>nne last March.<br />

Freight rates increased during the second quarter <strong>to</strong><br />

$22/<strong>to</strong>nne during the last two weeks of April, then fell<br />

back down again with the approach of summer. This market<br />

experienced intermittent highs caused by momentary<br />

shortages of available ships, which sometimes led <strong>to</strong> delays<br />

or <strong>to</strong> the withdrawal of certain cargoes.<br />

The three or four shipowners operating parcel tankers<br />

have continued <strong>to</strong> dominate the Europe/Far East market,<br />

and this situation has had the effect of reducing erratic<br />

freight rate fluctuations. The very structure of this market,<br />

in conjunction with the overall improvement of Asian<br />

economies has resulted in shipowners obtaining satisfac<strong>to</strong>ry<br />

load fac<strong>to</strong>rs for their ships.<br />

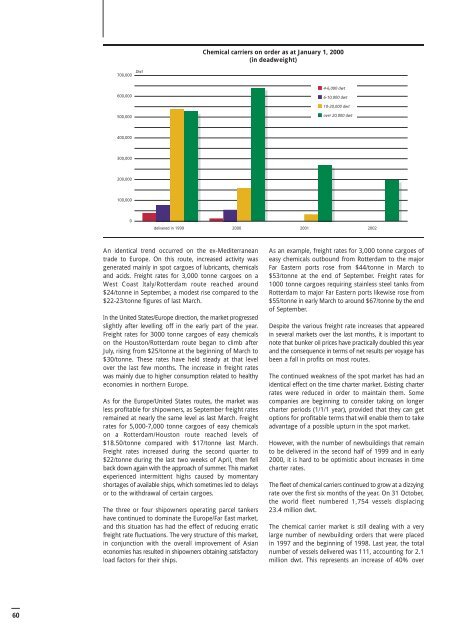

Chemical carriers on order as at January 1, 2000<br />

(in deadweight)<br />

4-6,000 dwt<br />

6-10,000 dwt<br />

10-20,000 dwt<br />

over 20,000 dwt<br />

delivered in 1999 2000 2001 2002<br />

As an example, freight rates for 3,000 <strong>to</strong>nne cargoes of<br />

easy chemicals outbound from Rotterdam <strong>to</strong> the major<br />

Far Eastern ports rose from $44/<strong>to</strong>nne in March <strong>to</strong><br />

$53/<strong>to</strong>nne at the end of September. Freight rates for<br />

1000 <strong>to</strong>nne cargoes requiring stainless steel tanks from<br />

Rotterdam <strong>to</strong> major Far Eastern ports likewise rose from<br />

$55/<strong>to</strong>nne in early March <strong>to</strong> around $67/<strong>to</strong>nne by the end<br />

of September.<br />

Despite the various freight rate increases that appeared<br />

in several markets over the last months, it is important <strong>to</strong><br />

note that bunker oil prices have practically doubled this year<br />

and the consequence in terms of net results per voyage has<br />

been a fall in profits on most routes.<br />

The continued weakness of the spot market has had an<br />

identical effect on the time charter market. Existing charter<br />

rates were reduced in order <strong>to</strong> maintain them. Some<br />

companies are beginning <strong>to</strong> consider taking on longer<br />

charter periods (1/1/1 year), provided that they can get<br />

options for profitable terms that will enable them <strong>to</strong> take<br />

advantage of a possible upturn in the spot market.<br />

However, with the number of newbuildings that remain<br />

<strong>to</strong> be delivered in the second half of 1999 and in early<br />

2000, it is hard <strong>to</strong> be optimistic about increases in time<br />

charter rates.<br />

The fleet of chemical carriers continued <strong>to</strong> grow at a dizzying<br />

rate over the first six months of the year. On 31 Oc<strong>to</strong>ber,<br />

the world fleet numbered 1,754 vessels displacing<br />

23.4 million dwt.<br />

The chemical carrier market is still dealing with a very<br />

large number of newbuilding <strong>orders</strong> that were placed<br />

in 1997 and the beginning of 1998. Last year, the <strong>to</strong>tal<br />

number of vessels delivered was 111, accounting for 2.1<br />

million dwt. This represents an increase of 40% over