2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The decrease in tax expense by €3 billion <strong>com</strong>pared with 2010<br />

primarily reflects the changes in the earnings environment.<br />

The effective tax rate has increased from 22 percent in 2010<br />

to 36 percent in <strong>2011</strong>.<br />

German legislation providing for fiscal measures to ac<strong>com</strong>pany<br />

the introduction of the European Company and amending<br />

other fiscal provisions (“SE-Steuergesetz” or “SEStEG”), which<br />

came into effect on December 13, 2006, altered the regulations<br />

on corporate tax credits arising from the corporate imputation<br />

system (“Anrechnungs verfahren”), which had existed<br />

until 2001. The change de-links the corporate tax credit from<br />

distributions of dividends. Instead, after December 31, 2006,<br />

an unconditional claim for payment of the credit in ten equal<br />

annual installments from 2008 through 2017 has been established.<br />

The resulting receivable is included in in<strong>com</strong>e tax assets<br />

and amounted to €153 million in <strong>2011</strong> (2010: €958 million).<br />

The decline in in<strong>com</strong>e tax assets is mainly attributable to the<br />

significant reduction of corporate tax credits in <strong>2011</strong>.<br />

In<strong>com</strong>e tax liabilities consist primarily of in<strong>com</strong>e taxes for the<br />

respective current year and for prior-year periods that have<br />

not yet been definitively examined by the tax authorities.<br />

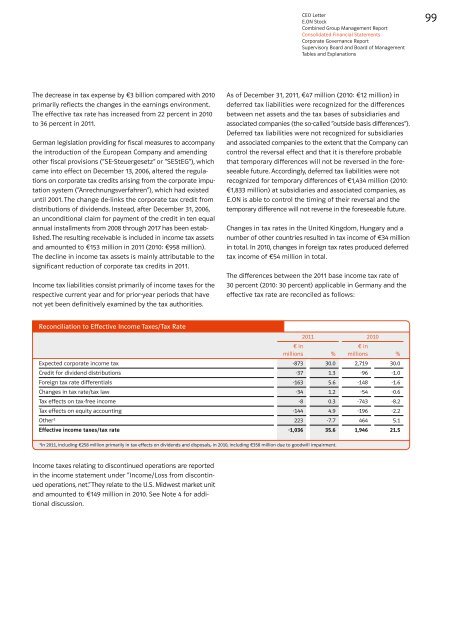

Reconciliation to Effective In<strong>com</strong>e Taxes/Tax Rate<br />

In<strong>com</strong>e taxes relating to discontinued operations are reported<br />

in the in<strong>com</strong>e statement under “In<strong>com</strong>e/Loss from discontinued<br />

operations, net.” They relate to the U.S. Midwest market unit<br />

and amounted to €149 million in 2010. See Note 4 for additional<br />

discussion.<br />

CEO Letter<br />

E.ON Stock<br />

Combined Group Management <strong>Report</strong><br />

Consolidated Financial Statements<br />

Corporate Governance <strong>Report</strong><br />

Supervisory Board and Board of Management<br />

Tables and Explanations<br />

As of December 31, <strong>2011</strong>, €47 million (2010: €12 million) in<br />

deferred tax liabilities were recognized for the differences<br />

between net assets and the tax bases of subsidiaries and<br />

associated <strong>com</strong>panies (the so-called “outside basis differences”).<br />

Deferred tax liabilities were not recognized for subsidiaries<br />

and associated <strong>com</strong>panies to the extent that the Company can<br />

control the reversal effect and that it is therefore probable<br />

that temporary differences will not be reversed in the foreseeable<br />

future. Accordingly, deferred tax liabilities were not<br />

recognized for temporary differences of €1,434 million (2010:<br />

€1,833 million) at subsidiaries and associated <strong>com</strong>panies, as<br />

E.ON is able to control the timing of their reversal and the<br />

temporary difference will not reverse in the foreseeable future.<br />

Changes in tax rates in the United Kingdom, Hungary and a<br />

number of other countries resulted in tax in<strong>com</strong>e of €34 million<br />

in total. In 2010, changes in foreign tax rates produced deferred<br />

tax in<strong>com</strong>e of €54 million in total.<br />

The differences between the <strong>2011</strong> base in<strong>com</strong>e tax rate of<br />

30 percent (2010: 30 percent) applicable in Germany and the<br />

effective tax rate are reconciled as follows:<br />

<strong>2011</strong> 2010<br />

€ in<br />

millions %<br />

€ in<br />

millions %<br />

Expected corporate in<strong>com</strong>e tax -873 30.0 2,719 30.0<br />

Credit for dividend distributions -37 1.3 -96 -1.0<br />

Foreign tax rate differentials -163 5.6 -148 -1.6<br />

Changes in tax rate/tax law -34 1.2 -54 -0.6<br />

Tax effects on tax-free in<strong>com</strong>e -8 0.3 -743 -8.2<br />

Tax effects on equity accounting -144 4.9 -196 -2.2<br />

Other1 223 -7.7 464 5.1<br />

Effective in<strong>com</strong>e taxes/tax rate -1,036 35.6 1,946 21.5<br />

1 In <strong>2011</strong>, including €258 million primarily in tax effects on dividends and disposals; in 2010, including €358 million due to goodwill impairment.<br />

99