2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Of this total, an amount of €160 million related to goodwill<br />

written down because fair values less costs to sell within<br />

the “Other regional units” segment were no longer sufficient<br />

to cover their corresponding carrying amounts.<br />

The goodwill of virtually all cash-generating units whose goodwill<br />

is material in relation to the total carrying amount of<br />

all goodwill shows a surplus of recoverable amounts over the<br />

respective carrying amounts and, therefore, based on current<br />

assessment of the economic situation, only a significant change<br />

in the valuation parameters discount rate and growth rate<br />

would necessitate the recognition of goodwill impairment.<br />

Impairments were additionally recognized on property, plant<br />

and equipment in the amount of approximately €2,720 million.<br />

This amount relates primarily to generation assets in the<br />

Generation global unit and breaks down into generating capacity<br />

in Spain (€822 million) and Italy (€768 million), along with<br />

a total of €579 million in four other countries. In the regional<br />

units, impairments had to be recognized at the Hungary<br />

(€173 million) and Netherlands (€163 million) regional units.<br />

These charges related mostly to locally controlled heat-run<br />

power plants.<br />

Moreover, intangible assets had to be written down in the<br />

amount of €247 million, relating primarily to the activities of<br />

the Renewables global unit (€144 million), the Germany<br />

regional unit (€45 million) and the Gas global unit (€29 million).<br />

During the year, in the context of tests performed in response<br />

to triggering events, intangible assets and property, plant and<br />

equipment were written down by €109 million and €138 million,<br />

respectively.<br />

In the context of the 2010 goodwill impairment tests, a total<br />

of €1,067 million in impairment charges had to be recognized<br />

at the former Italy Non- regulated (€957 million) and Spain<br />

(€110 million) cash-generating units. Impairments were additionally<br />

recognized on other non-current assets in the amount<br />

of €1,496 million. This amount included €984 million charged<br />

to property, plant and equipment, primarily at the former<br />

Central Europe (€391 million), Spain (€338 million) and Italy<br />

(€255 million) market units. Impairments had to be recognized<br />

on intangible assets at the former Italy (€430 million)<br />

and Climate & Renewables (€82 million) market units.<br />

Intangible Assets<br />

CEO Letter<br />

E.ON Stock<br />

Combined Group Management <strong>Report</strong><br />

Consolidated Financial Statements<br />

Corporate Governance <strong>Report</strong><br />

Supervisory Board and Board of Management<br />

Tables and Explanations<br />

In <strong>2011</strong>, the Company recorded an amortization expense of<br />

€451 million (2010: €489 million). Impairment charges on<br />

intangible assets, including those already mentioned at the<br />

affected units, amounted to €356 million in <strong>2011</strong> (2010:<br />

€618 million).<br />

Reversals of impairments on intangible assets totaled<br />

€0 million in <strong>2011</strong> (2010: €22 million).<br />

Intangible assets include emission rights from different<br />

trading systems with a carrying amount of €309 million<br />

(2010: €512 million).<br />

€59 million in research and development costs as defined by<br />

IAS 38 were expensed in <strong>2011</strong> (2010: €61 million).<br />

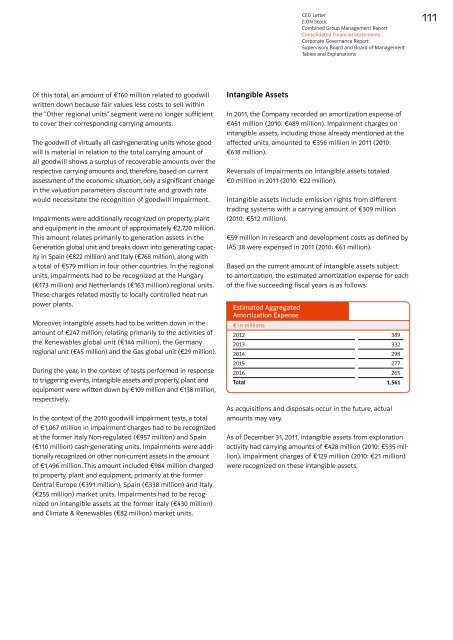

Based on the current amount of intangible assets subject<br />

to amortization, the estimated amortization expense for each<br />

of the five succeeding fiscal years is as follows:<br />

Estimated Aggregated<br />

Amortization Expense<br />

€ in millions<br />

2012 389<br />

2013 332<br />

2014 298<br />

2015 277<br />

2016 265<br />

Total 1,561<br />

As acquisitions and disposals occur in the future, actual<br />

amounts may vary.<br />

As of December 31, <strong>2011</strong>, intangible assets from exploration<br />

activity had carrying amounts of €428 million (2010: €535 million).<br />

Impairment charges of €129 million (2010: €21 million)<br />

were recognized on these intangible assets.<br />

111