2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

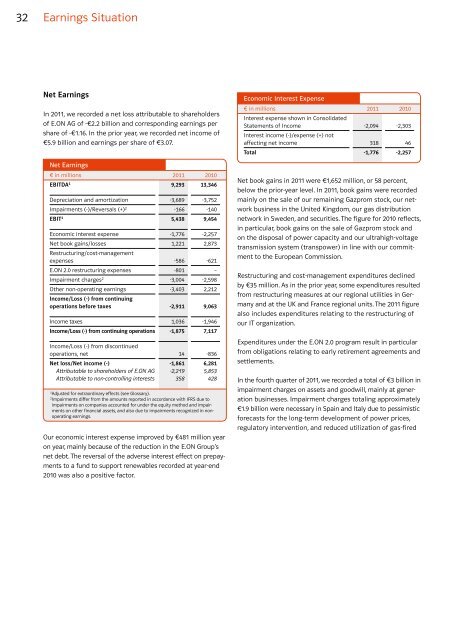

32 Earnings Situation<br />

Net Earnings<br />

In <strong>2011</strong>, we recorded a net loss attributable to shareholders<br />

of E.ON AG of -€2.2 billion and corresponding earnings per<br />

share of -€1.16. In the prior year, we recorded net in<strong>com</strong>e of<br />

€5.9 billion and earnings per share of €3.07.<br />

Net Earnings<br />

€ in millions <strong>2011</strong> 2010<br />

EBITDA1 9,293 13,346<br />

Depreciation and amortization -3,689 -3,752<br />

Impairments (-)/Reversals (+) 2 -166 -140<br />

EBIT1 5,438 9,454<br />

Economic interest expense -1,776 -2,257<br />

Net book gains/losses<br />

Restructuring/cost-management<br />

1,221 2,873<br />

expenses -586 -621<br />

E.ON 2.0 restructuring expenses -801 –<br />

Impairment charges2 -3,004 -2,598<br />

Other non-operating earnings<br />

In<strong>com</strong>e/Loss (-) from continuing<br />

-3,403 2,212<br />

operations before taxes -2,911 9,063<br />

In<strong>com</strong>e taxes 1,036 -1,946<br />

In<strong>com</strong>e/Loss (-) from continuing operations -1,875 7,117<br />

In<strong>com</strong>e/Loss (-) from discontinued<br />

operations, net 14 -836<br />

Net loss/Net in<strong>com</strong>e (-) -1,861 6,281<br />

Attributable to shareholders of E.ON AG -2,219 5,853<br />

Attributable to non-controlling interests 358 428<br />

1 Adjusted for extraordinary effects (see Glossary).<br />

2 Impairments differ from the amounts reported in accordance with IFRS due to<br />

impairments on <strong>com</strong>panies accounted for under the equity method and impairments<br />

on other financial assets, and also due to impairments recognized in nonoperating<br />

earnings.<br />

Our economic interest expense improved by €481 million year<br />

on year, mainly because of the reduction in the E.ON Group’s<br />

net debt. The reversal of the adverse interest effect on prepayments<br />

to a fund to support renewables recorded at year-end<br />

2010 was also a positive factor.<br />

Economic Interest Expense<br />

€ in millions<br />

Interest expense shown in Consolidated<br />

<strong>2011</strong> 2010<br />

Statements of In<strong>com</strong>e<br />

Interest in<strong>com</strong>e (-)/expense (+) not<br />

-2,094 -2,303<br />

affecting net in<strong>com</strong>e 318 46<br />

Total -1,776 -2,257<br />

Net book gains in <strong>2011</strong> were €1,652 million, or 58 percent,<br />

below the prior-year level. In <strong>2011</strong>, book gains were recorded<br />

mainly on the sale of our remaining Gazprom stock, our network<br />

business in the United Kingdom, our gas distribution<br />

network in Sweden, and securities. The figure for 2010 reflects,<br />

in particular, book gains on the sale of Gazprom stock and<br />

on the disposal of power capacity and our ultrahigh-voltage<br />

transmission system (transpower) in line with our <strong>com</strong>mitment<br />

to the European Commission.<br />

Restructuring and cost-management expenditures declined<br />

by €35 million. As in the prior year, some expenditures resulted<br />

from restructuring measures at our regional utilities in Germany<br />

and at the UK and France regional units. The <strong>2011</strong> figure<br />

also includes expenditures relating to the restructuring of<br />

our IT organization.<br />

Expenditures under the E.ON 2.0 program result in particular<br />

from obligations relating to early retirement agreements and<br />

settlements.<br />

In the fourth quarter of <strong>2011</strong>, we recorded a total of €3 billion in<br />

impairment charges on assets and goodwill, mainly at generation<br />

businesses. Impairment charges totaling approximately<br />

€1.9 billion were necessary in Spain and Italy due to pessimistic<br />

forecasts for the long-term development of power prices,<br />

regulatory intervention, and reduced utilization of gas-fired