2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60 Forecast<br />

E.ON Group’s Strategic Course in Up<strong>com</strong>ing<br />

Financial Years<br />

Implementing Our Strategy<br />

In the years ahead, we will adjust E.ON’s business portfolio<br />

in line with our strategy of cleaner & better energy. Our main<br />

focus will be on expanding our operations in renewables,<br />

generation outside Europe, and decentralized energy solutions.<br />

These are the areas in which we see significant market opportunities<br />

and can capitalize on our capabilities. We will therefore<br />

direct our new growth investments at these businesses.<br />

In Europe, we will sharpen the focus of our current position.<br />

To achieve this, we will concentrate on activities in which we<br />

can leverage our expertise as well as cross-border and crossbu<br />

siness synergies of scale and scope into attractive returns.<br />

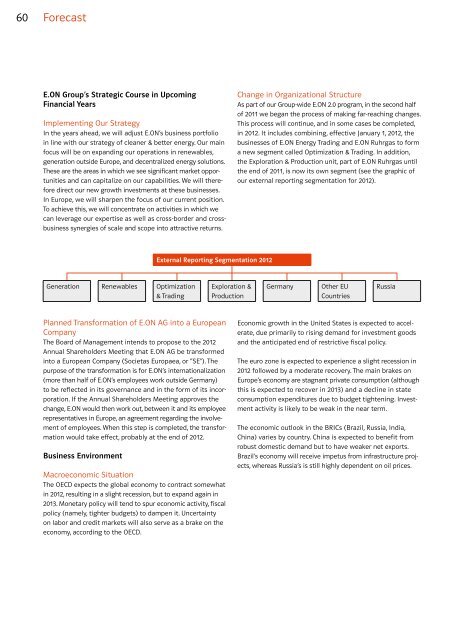

Generation Renewables Optimization<br />

& Trading<br />

Planned Transformation of E.ON AG into a European<br />

Company<br />

The Board of Management intends to propose to the 2012<br />

<strong>Annual</strong> Shareholders Meeting that E.ON AG be transformed<br />

into a European Company (Societas Europaea, or “SE”). The<br />

purpose of the transformation is for E.ON’s internationalization<br />

(more than half of E.ON’s employees work outside Germany)<br />

to be reflected in its governance and in the form of its incorporation.<br />

If the <strong>Annual</strong> Shareholders Meeting approves the<br />

change, E.ON would then work out, between it and its employee<br />

representatives in Europe, an agreement regarding the involvement<br />

of employees. When this step is <strong>com</strong>pleted, the transformation<br />

would take effect, probably at the end of 2012.<br />

Business Environment<br />

External <strong>Report</strong>ing Segmentation 2012<br />

Macroeconomic Situation<br />

The OECD expects the global economy to contract somewhat<br />

in 2012, resulting in a slight recession, but to expand again in<br />

2013. Monetary policy will tend to spur economic activity, fiscal<br />

policy (namely, tighter budgets) to dampen it. Uncertainty<br />

on labor and credit markets will also serve as a brake on the<br />

economy, according to the OECD.<br />

Exploration &<br />

Production<br />

Change in Organizational Structure<br />

As part of our Group-wide E.ON 2.0 program, in the second half<br />

of <strong>2011</strong> we began the process of making far-reaching changes.<br />

This process will continue, and in some cases be <strong>com</strong>pleted,<br />

in 2012. It includes <strong>com</strong>bining, effective January 1, 2012, the<br />

businesses of E.ON Energy Trading and E.ON Ruhrgas to form<br />

a new segment called Optimization & Trading. In addition,<br />

the Exploration & Production unit, part of E.ON Ruhrgas until<br />

the end of <strong>2011</strong>, is now its own segment (see the graphic of<br />

our external reporting segmentation for 2012).<br />

Germany Other EU<br />

Countries<br />

Russia<br />

Economic growth in the United States is expected to accelerate,<br />

due primarily to rising demand for investment goods<br />

and the anticipated end of restrictive fiscal policy.<br />

The euro zone is expected to experience a slight recession in<br />

2012 followed by a moderate recovery. The main brakes on<br />

Europe’s economy are stagnant private consumption (although<br />

this is expected to recover in 2013) and a decline in state<br />

consumption expenditures due to budget tightening. Investment<br />

activity is likely to be weak in the near term.<br />

The economic outlook in the BRICs (Brazil, Russia, India,<br />

China) varies by country. China is expected to benefit from<br />

robust domestic demand but to have weaker net exports.<br />

Brazil’s economy will receive impetus from infrastructure projects,<br />

whereas Russia’s is still highly dependent on oil prices.