2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Competition in the gas market and increasing trading volumes<br />

at virtual trading points and on gas exchanges could result<br />

in considerable risks for gas quantities purchased under longterm<br />

take-or-pay contracts. In addition, substantial price risks<br />

result from the fact that gas procurement prices are predominantly<br />

linked to the price of oil, whereas sales prices are<br />

guided by wholesale prices. In general, contracts between producers<br />

and importers are subject to periodic adjustments in<br />

line with current market conditions. E. ON Ruhrgas conducts<br />

intensive negotiations with producers. The negotiations with<br />

Gazprom have been unsuccessful thus far, and E.ON Ruhrgas<br />

has availed of its right under the existing contracts to initiate<br />

arbitration proceedings against Gazprom.<br />

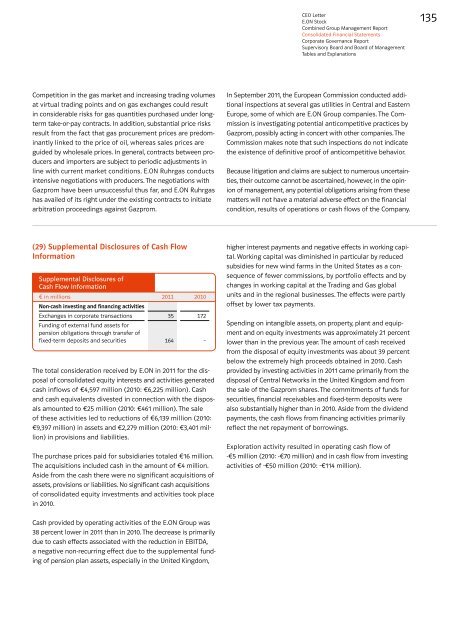

(29) Supplemental Disclosures of Cash Flow<br />

Information<br />

Supplemental Disclosures of<br />

Cash Flow Information<br />

€ in millions<br />

Non-cash investing and financing activities<br />

<strong>2011</strong> 2010<br />

Exchanges in corporate transactions<br />

Funding of external fund assets for<br />

pension obligations through transfer of<br />

35 172<br />

fixed-term deposits and securities 164 –<br />

The total consideration received by E.ON in <strong>2011</strong> for the disposal<br />

of consolidated equity interests and activities generated<br />

cash inflows of €4,597 million (2010: €6,225 million). Cash<br />

and cash equivalents divested in connection with the disposals<br />

amounted to €25 million (2010: €461 million). The sale<br />

of these activities led to reductions of €6,139 million (2010:<br />

€9,397 million) in assets and €2,279 million (2010: €3,401 million)<br />

in provisions and liabilities.<br />

The purchase prices paid for subsidiaries totaled €16 million.<br />

The acquisitions included cash in the amount of €4 million.<br />

Aside from the cash there were no significant acquisitions of<br />

assets, provisions or liabilities. No significant cash acquisitions<br />

of consolidated equity investments and activities took place<br />

in 2010.<br />

Cash provided by operating activities of the E.ON Group was<br />

38 percent lower in <strong>2011</strong> than in 2010. The decrease is primarily<br />

due to cash effects associated with the reduction in EBITDA,<br />

a negative non-recurring effect due to the supplemental funding<br />

of pension plan assets, especially in the United Kingdom,<br />

CEO Letter<br />

E.ON Stock<br />

Combined Group Management <strong>Report</strong><br />

Consolidated Financial Statements<br />

Corporate Governance <strong>Report</strong><br />

Supervisory Board and Board of Management<br />

Tables and Explanations<br />

In September <strong>2011</strong>, the European Commission conducted additional<br />

inspections at several gas utilities in Central and Eastern<br />

Europe, some of which are E. ON Group <strong>com</strong>panies. The Commission<br />

is investigating potential anti<strong>com</strong>petitive practices by<br />

Gazprom, possibly acting in concert with other <strong>com</strong>panies. The<br />

Commission makes note that such inspections do not indicate<br />

the existence of definitive proof of anti<strong>com</strong>petitive behavior.<br />

Because litigation and claims are subject to numerous uncertainties,<br />

their out<strong>com</strong>e cannot be ascertained; however, in the opinion<br />

of management, any potential obligations arising from these<br />

matters will not have a material adverse effect on the financial<br />

condition, results of operations or cash flows of the Company.<br />

higher interest payments and negative effects in working capital.<br />

Working capital was diminished in particular by reduced<br />

subsidies for new wind farms in the United States as a consequence<br />

of fewer <strong>com</strong>missions, by portfolio effects and by<br />

changes in working capital at the Trading and Gas global<br />

units and in the regional businesses. The effects were partly<br />

offset by lower tax payments.<br />

Spending on intangible assets, on property, plant and equipment<br />

and on equity investments was approximately 21 percent<br />

lower than in the previous year. The amount of cash received<br />

from the disposal of equity investments was about 39 percent<br />

below the extremely high proceeds obtained in 2010. Cash<br />

provided by investing activities in <strong>2011</strong> came primarily from the<br />

disposal of Central Networks in the United Kingdom and from<br />

the sale of the Gazprom shares. The <strong>com</strong>mitments of funds for<br />

securities, financial receivables and fixed-term deposits were<br />

also substantially higher than in 2010. Aside from the dividend<br />

payments, the cash flows from financing activities primarily<br />

reflect the net repayment of borrowings.<br />

Exploration activity resulted in operating cash flow of<br />

-€5 million (2010: -€70 million) and in cash flow from investing<br />

activities of -€50 million (2010: -€114 million).<br />

135