2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 Earnings Situation<br />

Depreciation charges increased by €624 million to €7,081 million<br />

(€6,457 million). In the fourth quarter of <strong>2011</strong>, we recorded<br />

a total of €3 billion in impairment charges on assets and<br />

goodwill, mainly at generation businesses. Impairment charges<br />

totaling approximately €1.9 billion were necessary in Spain<br />

and Italy due to pessimistic forecasts for the long-term development<br />

of power prices, regulatory intervention, and reduced<br />

utilization of gas-fired and coal-fired power stations. Of these<br />

charges, €1.6 billion related to conventional power generation,<br />

€0.1 billion to renewable-source power generation, and<br />

€0.2 billion to our regional business in Italy. Power output and<br />

generation margins are also lower than anticipated in Hungary<br />

and Slovakia, necessitating impairment charges of €0.3 billion<br />

on power stations and €0.2 billion on our regional business in<br />

Hungary. The remaining impairment charges total €0.6 billion,<br />

of which €0.2 billion related to power stations and €0.2 billion<br />

to our regional business in the Benelux countries. The main<br />

reasons are that some older power stations were closed earlier<br />

than had been planned and that unfavorable market developments<br />

have led to lower earnings from heating plants and<br />

district heating. In addition, the amendment of Germany’s<br />

Nuclear Energy Act, which calls for the early, unplanned shutdown<br />

of NPPs in Germany, made it necessary to record<br />

impairment charges on assets (€219 million). The prior-year<br />

figure primarily reflects impairment charges of €2.6 billion<br />

on goodwill and other assets at operations in Italy, Spain, and<br />

France acquired from Enel/Acciona and Endesa.<br />

Other operating expenses rose by 30 percent, or €4,059 million,<br />

to €17,656 million (€13,597 million). This is mainly attributable<br />

to higher expenditures relating to currency differences of<br />

€6,761 million (€4,936 million), higher expenditures relating to<br />

derivative financial instruments of €5,685 million (€3,559 million),<br />

which primarily affect <strong>com</strong>modity derivates, and losses<br />

on the disposal of shareholdings and securities of €742 million<br />

(€75 million). The latter item mainly reflects negative effects<br />

from the reclassification of currency-translation effects in equity<br />

in the wake of the simplification of E.ON’s organizational setup.<br />

In<strong>com</strong>e from <strong>com</strong>panies accounted for under the equity<br />

method declined to €512 million (€663 million), primarily<br />

due to impairment charges resulting from the amendment<br />

of Germany’s Nuclear Energy Act, which calls for the early,<br />

unplanned shutdown of NPPs in Germany (€105 million).<br />

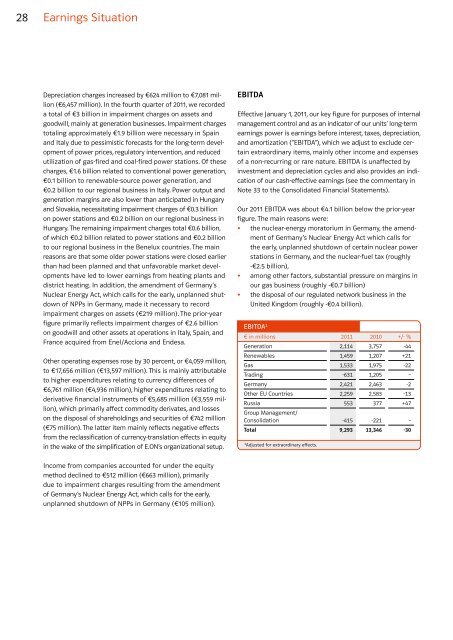

EBITDA<br />

Effective January 1, <strong>2011</strong>, our key figure for purposes of internal<br />

management control and as an indicator of our units’ long-term<br />

earnings power is earnings before interest, taxes, depreciation,<br />

and amortization (“EBITDA”), which we adjust to exclude certain<br />

extraordinary items, mainly other in<strong>com</strong>e and expenses<br />

of a non-recurring or rare nature. EBITDA is unaffected by<br />

investment and depreciation cycles and also provides an indication<br />

of our cash-effective earnings (see the <strong>com</strong>mentary in<br />

Note 33 to the Consolidated Financial Statements).<br />

Our <strong>2011</strong> EBITDA was about €4.1 billion below the prior-year<br />

figure. The main reasons were:<br />

• the nuclear-energy moratorium in Germany, the amendment<br />

of Germany’s Nuclear Energy Act which calls for<br />

the early, unplanned shutdown of certain nuclear power<br />

stations in Germany, and the nuclear-fuel tax (roughly<br />

-€2.5 billion),<br />

• among other factors, substantial pressure on margins in<br />

our gas business (roughly -€0.7 billion)<br />

• the disposal of our regulated network business in the<br />

United Kingdom (roughly -€0.4 billion).<br />

EBITDA1 € in millions <strong>2011</strong> 2010 +/- %<br />

Generation 2,114 3,757 -44<br />

Renewables 1,459 1,207 +21<br />

Gas 1,533 1,975 -22<br />

Trading -631 1,205 –<br />

Germany 2,421 2,463 -2<br />

Other EU Countries 2,259 2,583 -13<br />

Russia<br />

Group Management/<br />

553 377 +47<br />

Consolidation -415 -221 –<br />

Total 9,293 13,346 -30<br />

1 Adjusted for extraordinary effects.