2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Energy Prices<br />

Four main factors drove electricity and natural gas markets<br />

in Europe and the electricity market in Russia in <strong>2011</strong>:<br />

• international <strong>com</strong>modity prices (especially oil, gas, coal,<br />

and carbon-allowance prices)<br />

• macroeconomic and political developments<br />

• weather and natural disasters<br />

• the availability of hydroelectricity in Scandinavia.<br />

In the first half of the year, energy markets were driven largely<br />

by the unrest in North Africa and the Middle East and by the<br />

earthquake and tsunami in Japan. In the second half, Europe’s<br />

debt crisis and worse prospects for global economic growth<br />

became increasingly tangible factors, in part because initiatives<br />

by European governments to <strong>com</strong>bat the crisis remained<br />

largely ineffectual and because the United States’ fundamental<br />

budget and trade-balance problems remained unsolved.<br />

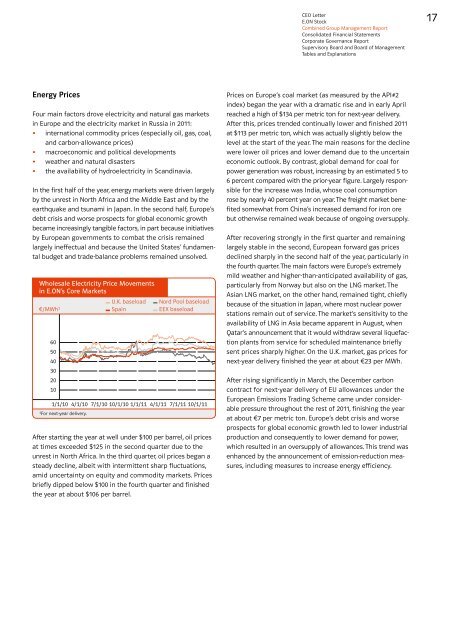

Wholesale Electricity Price Movements<br />

in E.ON’s Core Markets<br />

U.K. baseload Nord Pool baseload<br />

€/MWh1 Spain EEX baseload<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

1/1/10 4/1/10 7/1/10 10/1/10 1/1/11 4/1/11 7/1/11 10/1/11<br />

1For next-year delivery.<br />

After starting the year at well under $100 per barrel, oil prices<br />

at times exceeded $125 in the second quarter due to the<br />

unrest in North Africa. In the third quarter, oil prices began a<br />

steady decline, albeit with intermittent sharp fluctuations,<br />

amid uncertainty on equity and <strong>com</strong>modity markets. Prices<br />

briefly dipped below $100 in the fourth quarter and finished<br />

the year at about $106 per barrel.<br />

CEO Letter<br />

E.ON Stock<br />

Combined Group Management <strong>Report</strong><br />

Consolidated Financial Statements<br />

Corporate Governance <strong>Report</strong><br />

Supervisory Board and Board of Management<br />

Tables and Explanations<br />

Prices on Europe’s coal market (as measured by the API#2<br />

index) began the year with a dramatic rise and in early April<br />

reached a high of $134 per metric ton for next-year delivery.<br />

After this, prices trended continually lower and finished <strong>2011</strong><br />

at $113 per metric ton, which was actually slightly below the<br />

level at the start of the year. The main reasons for the decline<br />

were lower oil prices and lower demand due to the uncertain<br />

economic outlook. By contrast, global demand for coal for<br />

power generation was robust, increasing by an estimated 5 to<br />

6 percent <strong>com</strong>pared with the prior-year figure. Largely responsible<br />

for the increase was India, whose coal consumption<br />

rose by nearly 40 percent year on year. The freight market benefited<br />

somewhat from China’s increased demand for iron ore<br />

but otherwise remained weak because of ongoing oversupply.<br />

After recovering strongly in the first quarter and remaining<br />

largely stable in the second, European forward gas prices<br />

declined sharply in the second half of the year, particularly in<br />

the fourth quarter. The main factors were Europe’s extremely<br />

mild weather and higher-than-anticipated availability of gas,<br />

particularly from Norway but also on the LNG market. The<br />

Asian LNG market, on the other hand, remained tight, chiefly<br />

because of the situation in Japan, where most nuclear power<br />

stations remain out of service. The market’s sensitivity to the<br />

availability of LNG in Asia became apparent in August, when<br />

Qatar’s announcement that it would withdraw several liquefaction<br />

plants from service for scheduled maintenance briefly<br />

sent prices sharply higher. On the U.K. market, gas prices for<br />

next-year delivery finished the year at about €23 per MWh.<br />

After rising significantly in March, the December carbon<br />

contract for next-year delivery of EU allowances under the<br />

European Emissions Trading Scheme came under considerable<br />

pressure throughout the rest of <strong>2011</strong>, finishing the year<br />

at about €7 per metric ton. Europe’s debt crisis and worse<br />

prospects for global economic growth led to lower industrial<br />

production and consequently to lower demand for power,<br />

which resulted in an oversupply of allowances. This trend was<br />

enhanced by the announcement of emission-reduction measures,<br />

including measures to increase energy efficiency.<br />

17