2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

2011 Annual Report - OTCIQ.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

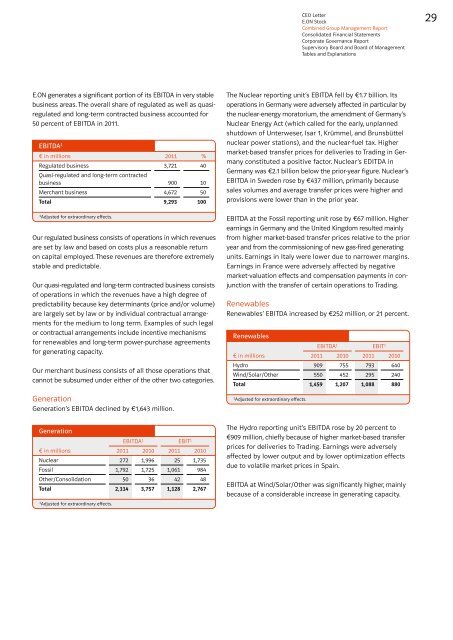

E.ON generates a significant portion of its EBITDA in very stable<br />

business areas. The overall share of regulated as well as quasiregulated<br />

and long-term contracted business accounted for<br />

50 percent of EBITDA in <strong>2011</strong>.<br />

EBITDA1 € in millions <strong>2011</strong> %<br />

Regulated business<br />

Quasi-regulated and long-term contracted<br />

3,721 40<br />

business 900 10<br />

Merchant business 4,672 50<br />

Total 9,293 100<br />

1 Adjusted for extraordinary effects.<br />

Our regulated business consists of operations in which revenues<br />

are set by law and based on costs plus a reasonable return<br />

on capital employed. These revenues are therefore extremely<br />

stable and predictable.<br />

Our quasi-regulated and long-term contracted business consists<br />

of operations in which the revenues have a high degree of<br />

predictability because key determinants (price and/or volume)<br />

are largely set by law or by individual contractual arrangements<br />

for the medium to long term. Examples of such legal<br />

or contractual arrangements include incentive mechanisms<br />

for renewables and long-term power-purchase agreements<br />

for generating capacity.<br />

Our merchant business consists of all those operations that<br />

cannot be subsumed under either of the other two categories.<br />

Generation<br />

Generation’s EBITDA declined by €1,643 million.<br />

Generation<br />

EBITDA<br />

€ in millions<br />

1 EBIT1 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Nuclear 272 1,996 25 1,735<br />

Fossil 1,792 1,725 1,061 984<br />

Other/Consolidation 50 36 42 48<br />

Total 2,114 3,757 1,128 2,767<br />

1 Adjusted for extraordinary effects.<br />

CEO Letter<br />

E.ON Stock<br />

Combined Group Management <strong>Report</strong><br />

Consolidated Financial Statements<br />

Corporate Governance <strong>Report</strong><br />

Supervisory Board and Board of Management<br />

Tables and Explanations<br />

The Nuclear reporting unit’s EBITDA fell by €1.7 billion. Its<br />

operations in Germany were adversely affected in particular by<br />

the nuclear-energy moratorium, the amendment of Germany’s<br />

Nuclear Energy Act (which called for the early, unplanned<br />

shutdown of Unterweser, Isar 1, Krümmel, and Brunsbüttel<br />

nuclear power stations), and the nuclear-fuel tax. Higher<br />

market-based transfer prices for deliveries to Trading in Germany<br />

constituted a positive factor. Nuclear’s EDITDA in<br />

Germany was €2.1 billion below the prior-year figure. Nuclear’s<br />

EBITDA in Sweden rose by €437 million, primarily because<br />

sales volumes and average transfer prices were higher and<br />

provisions were lower than in the prior year.<br />

EBITDA at the Fossil reporting unit rose by €67 million. Higher<br />

earnings in Germany and the United Kingdom resulted mainly<br />

from higher market-based transfer prices relative to the prior<br />

year and from the <strong>com</strong>missioning of new gas-fired generating<br />

units. Earnings in Italy were lower due to narrower margins.<br />

Earnings in France were adversely affected by negative<br />

market-valuation effects and <strong>com</strong>pensation payments in conjunction<br />

with the transfer of certain operations to Trading.<br />

Renewables<br />

Renewables’ EBITDA increased by €252 million, or 21 percent.<br />

Renewables<br />

EBITDA<br />

€ in millions<br />

1 EBIT1 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Hydro 909 755 793 640<br />

Wind/Solar/Other 550 452 295 240<br />

Total 1,459 1,207 1,088 880<br />

1 Adjusted for extraordinary effects.<br />

The Hydro reporting unit’s EBITDA rose by 20 percent to<br />

€909 million, chiefly because of higher market-based transfer<br />

prices for deliveries to Trading. Earnings were adversely<br />

affected by lower output and by lower optimization effects<br />

due to volatile market prices in Spain.<br />

EBITDA at Wind/Solar/Other was significantly higher, mainly<br />

because of a considerable increase in generating capacity.<br />

29