vgbe energy journal 10 (2022) - International Journal for Generation and Storage of Electricity and Heat

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat. Issue 10 (2022). Technical Journal of the vgbe energy e.V. - Energy is us! NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy +++++++++++++++++++++++++++++++++++++++++++++++++++++++

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat.

Issue 10 (2022).

Technical Journal of the vgbe energy e.V. - Energy is us!

NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy

+++++++++++++++++++++++++++++++++++++++++++++++++++++++

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

Future-pro<strong>of</strong>, secure <strong>and</strong> climate-friendly electricity supply in Germany<br />

rona p<strong>and</strong>emic in 2020 <strong>and</strong> 2021. In particular,<br />

<strong>for</strong> 2020 as a whole, the statistics show a<br />

decrease in primary <strong>energy</strong> consumption, by<br />

7.1 % compared to 2019. This trend was seen<br />

<strong>for</strong> almost all <strong>energy</strong> sources <strong>and</strong> sectors; in<br />

the transport sector <strong>and</strong> <strong>for</strong> oil products, the<br />

Corona effects were particularly felt due to<br />

reduced commuting <strong>and</strong> travel. Industry<br />

also dem<strong>and</strong>ed less <strong>energy</strong>. The <strong>energy</strong> consumption<br />

<strong>of</strong> private households stagnated.<br />

Gross electricity consumption decreased by<br />

3.5 % from 575 TWh to 555 TWh, mainly due<br />

to Corona-related losses in industrial production.<br />

4 It is also thanks to Corona-related<br />

declines in dem<strong>and</strong> that Germany was able<br />

to achieve its climate targets <strong>for</strong> 2020.<br />

Greenhouse gas emissions fell by 4.8 % compared<br />

to 2019 to 729 million tonnes <strong>of</strong> CO 2<br />

equivalents. This means that greenhouse gas<br />

emissions in 2020 were 41.3 % below the<br />

comparable 1990 level <strong>of</strong> 1,242 million t CO 2<br />

equivalents. 5<br />

Currently available statistics <strong>for</strong> 2021 show<br />

a clear recovery in <strong>energy</strong> consumption.<br />

Similar to the collapse caused by Corona,<br />

the recovery is taking place across all <strong>energy</strong><br />

sources <strong>and</strong> sectors. For 2021 as a whole,<br />

gross electricity consumption increased by<br />

2.4 % to 569 TWh. The dem<strong>and</strong> level be<strong>for</strong>e<br />

the Corona crisis <strong>of</strong> 575 TWh in 2019 was<br />

thus almost reached again in 2021. Un<strong>for</strong>tunately,<br />

a comparable trend also applies to<br />

greenhouse gas emissions, which increased<br />

by 4.5 % compared to 2020 to 762 million t<br />

CO 2 equivalents, but still remained 4.8 % below<br />

the 2019 level (800 million t CO 2 equivalents).<br />

Natural gas consumption in 2021 increased<br />

by as much as 4.9 % <strong>and</strong>, at 3,288 PJ (112.2<br />

million tce), exceeded the 2019 level by<br />

2.3 %. Natural gas thus achieved a slightly<br />

higher share <strong>of</strong> 26.8 % in total primary <strong>energy</strong><br />

consumption (2020: 26.4 %). 6 The<br />

higher gas consumption was due to cool <strong>and</strong><br />

<strong>of</strong>ten windless weather in the first half <strong>of</strong><br />

2021: as a result, gas was needed more <strong>for</strong><br />

both heating <strong>and</strong> electricity generation.<br />

With the outbreak <strong>of</strong> the Ukraine war <strong>and</strong><br />

actual <strong>and</strong>/or threatened supply stops from<br />

Russia, natural gas is currently receiving<br />

special attention <strong>and</strong> will continue to do so<br />

<strong>for</strong> the next few years. Compared to ‘normal’<br />

times, Russia has currently greatly reduced<br />

its deliveries. For example, the share <strong>of</strong> supplies<br />

from Russia has dropped to 35 % (January<br />

<strong>2022</strong>) to 26 % (June <strong>2022</strong>), <strong>and</strong> in July<br />

<strong>and</strong> early August <strong>2022</strong> had contributed only<br />

<strong>10</strong> % to covering natural gas consumption<br />

in Germany. 7 The latter figure is also ex-<br />

4<br />

Working Group on Energy Balances, data as <strong>of</strong><br />

April <strong>2022</strong><br />

5<br />

Federal Environment Agency, press release <strong>of</strong><br />

15 March <strong>2022</strong><br />

6<br />

Working Group on Energy Balances, Energy<br />

Consumption in Germany in 2021<br />

7<br />

BDEW, Natural gas data current, as <strong>of</strong><br />

15.8.<strong>2022</strong><br />

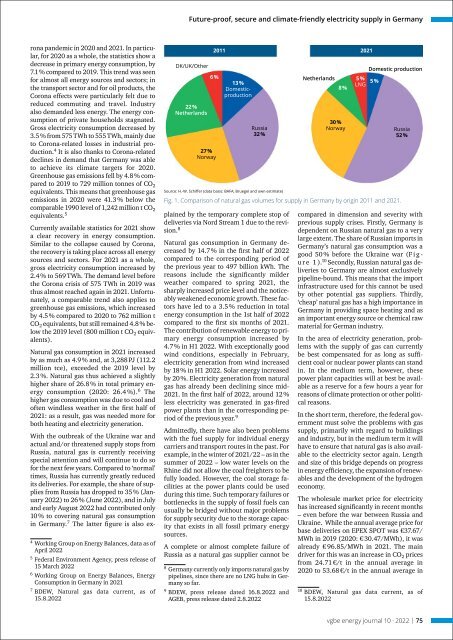

DK/UK/Other<br />

22 %<br />

Netherl<strong>and</strong>s<br />

2011 2021<br />

6 %<br />

27 %<br />

Norway<br />

13 %<br />

Domesticproduction<br />

Russia<br />

32 %<br />

Source: H.-W. Schiffer (data basis: BAFA, Bruegel <strong>and</strong> own estimate)<br />

plained by the temporary complete stop <strong>of</strong><br />

deliveries via Nord Stream 1 due to the revision.<br />

8<br />

Natural gas consumption in Germany decreased<br />

by 14.7 % in the first half <strong>of</strong> <strong>2022</strong><br />

compared to the corresponding period <strong>of</strong><br />

the previous year to 497 billion kWh. The<br />

reasons include the significantly milder<br />

weather compared to spring 2021, the<br />

sharply increased price level <strong>and</strong> the noticeably<br />

weakened economic growth. These factors<br />

have led to a 3.5 % reduction in total<br />

<strong>energy</strong> consumption in the 1st half <strong>of</strong> <strong>2022</strong><br />

compared to the first six months <strong>of</strong> 2021.<br />

The contribution <strong>of</strong> renewable <strong>energy</strong> to primary<br />

<strong>energy</strong> consumption increased by<br />

4.7 % in H1 <strong>2022</strong>. With exceptionally good<br />

wind conditions, especially in February,<br />

electricity generation from wind increased<br />

by 18 % in H1 <strong>2022</strong>. Solar <strong>energy</strong> increased<br />

by 20 %. <strong>Electricity</strong> generation from natural<br />

gas has already been declining since mid-<br />

2021. In the first half <strong>of</strong> <strong>2022</strong>, around 12 %<br />

less electricity was generated in gas-fired<br />

power plants than in the corresponding period<br />

<strong>of</strong> the previous year. 9<br />

Admittedly, there have also been problems<br />

with the fuel supply <strong>for</strong> individual <strong>energy</strong><br />

carriers <strong>and</strong> transport routes in the past. For<br />

example, in the winter <strong>of</strong> 2021/22 – as in the<br />

summer <strong>of</strong> <strong>2022</strong> – low water levels on the<br />

Rhine did not allow the coal freighters to be<br />

fully loaded. However, the coal storage facilities<br />

at the power plants could be used<br />

during this time. Such temporary failures or<br />

bottlenecks in the supply <strong>of</strong> fossil fuels can<br />

usually be bridged without major problems<br />

<strong>for</strong> supply security due to the storage capacity<br />

that exists in all fossil primary <strong>energy</strong><br />

sources.<br />

A complete or almost complete failure <strong>of</strong><br />

Russia as a natural gas supplier cannot be<br />

Netherl<strong>and</strong>s<br />

8 %<br />

30 %<br />

Norway<br />

Domestic production<br />

5 %<br />

LNG 5 %<br />

Fig. 1. Comparison <strong>of</strong> natural gas volumes <strong>for</strong> supply in Germany by origin 2011 <strong>and</strong> 2021.<br />

8<br />

Germany currently only imports natural gas by<br />

pipelines, since there are no LNG hubs in Germany<br />

so far.<br />

9<br />

BDEW, press release dated 16.8.<strong>2022</strong> <strong>and</strong><br />

AGEB, press release dated 2.8.<strong>2022</strong><br />

Russia<br />

52 %<br />

compared in dimension <strong>and</strong> severity with<br />

previous supply crises. Firstly, Germany is<br />

dependent on Russian natural gas to a very<br />

large extent. The share <strong>of</strong> Russian imports in<br />

Germany’s natural gas consumption was a<br />

good 50 % be<strong>for</strong>e the Ukraine war (F i g -<br />

ure 1). <strong>10</strong> Secondly, Russian natural gas deliveries<br />

to Germany are almost exclusively<br />

pipeline-bound. This means that the import<br />

infrastructure used <strong>for</strong> this cannot be used<br />

by other potential gas suppliers. Thirdly,<br />

‘cheap’ natural gas has a high importance in<br />

Germany in providing space heating <strong>and</strong> as<br />

an important <strong>energy</strong> source or chemical raw<br />

material <strong>for</strong> German industry.<br />

In the area <strong>of</strong> electricity generation, problems<br />

with the supply <strong>of</strong> gas can currently<br />

be best compensated <strong>for</strong> as long as sufficient<br />

coal or nuclear power plants can st<strong>and</strong><br />

in. In the medium term, however, these<br />

power plant capacities will at best be available<br />

as a reserve <strong>for</strong> a few hours a year <strong>for</strong><br />

reasons <strong>of</strong> climate protection or other political<br />

reasons.<br />

In the short term, there<strong>for</strong>e, the federal government<br />

must solve the problems with gas<br />

supply, primarily with regard to buildings<br />

<strong>and</strong> industry, but in the medium term it will<br />

have to ensure that natural gas is also available<br />

to the electricity sector again. Length<br />

<strong>and</strong> size <strong>of</strong> this bridge depends on progress<br />

in <strong>energy</strong> efficiency, the expansion <strong>of</strong> renewables<br />

<strong>and</strong> the development <strong>of</strong> the hydrogen<br />

economy.<br />

The wholesale market price <strong>for</strong> electricity<br />

has increased significantly in recent months<br />

– even be<strong>for</strong>e the war between Russia <strong>and</strong><br />

Ukraine. While the annual average price <strong>for</strong><br />

base deliveries on EPEX SPOT was €37.67/<br />

MWh in 2019 (2020: € 30.47/MWh), it was<br />

already € 96.85/MWh in 2021. The main<br />

driver <strong>for</strong> this was an increase in CO 2 prices<br />

from 24.71 €/t in the annual average in<br />

2020 to 53.68 €/t in the annual average in<br />

<strong>10</strong><br />

BDEW, Natural gas data current, as <strong>of</strong><br />

15.8.<strong>2022</strong><br />

<strong>vgbe</strong> <strong>energy</strong> <strong>journal</strong> <strong>10</strong> · <strong>2022</strong> | 75