vgbe energy journal 10 (2022) - International Journal for Generation and Storage of Electricity and Heat

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat. Issue 10 (2022). Technical Journal of the vgbe energy e.V. - Energy is us! NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy +++++++++++++++++++++++++++++++++++++++++++++++++++++++

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat.

Issue 10 (2022).

Technical Journal of the vgbe energy e.V. - Energy is us!

NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy

+++++++++++++++++++++++++++++++++++++++++++++++++++++++

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

Future-pro<strong>of</strong>, secure <strong>and</strong> climate-friendly electricity supply in Germany<br />

250<br />

200<br />

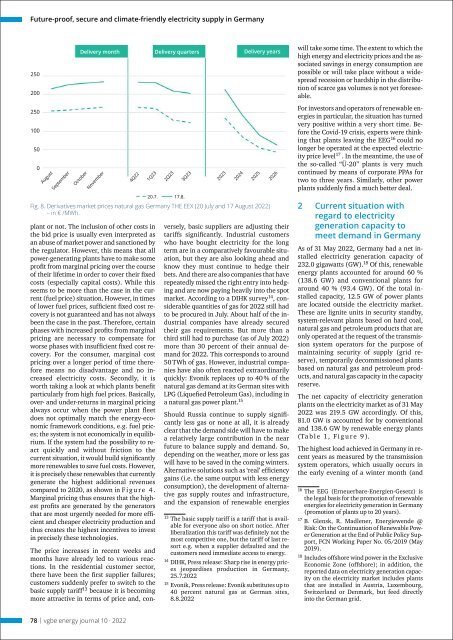

Delivery month Delivery quarters Delivery years<br />

will take some time. The extent to which the<br />

high <strong>energy</strong> <strong>and</strong> electricity prices <strong>and</strong> the associated<br />

savings in <strong>energy</strong> consumption are<br />

possible or will take place without a widespread<br />

recession or hardship in the distribution<br />

<strong>of</strong> scarce gas volumes is not yet <strong>for</strong>eseeable.<br />

250<br />

<strong>10</strong>0<br />

50<br />

0<br />

August<br />

September<br />

October<br />

November<br />

4Q22<br />

1Q23<br />

plant or not. The inclusion <strong>of</strong> other costs in<br />

the bid price is usually even interpreted as<br />

an abuse <strong>of</strong> market power <strong>and</strong> sanctioned by<br />

the regulator. However, this means that all<br />

power-generating plants have to make some<br />

pr<strong>of</strong>it from marginal pricing over the course<br />

<strong>of</strong> their lifetime in order to cover their fixed<br />

costs (especially capital costs). While this<br />

seems to be more than the case in the current<br />

(fuel price) situation. However, in times<br />

<strong>of</strong> lower fuel prices, sufficient fixed cost recovery<br />

is not guaranteed <strong>and</strong> has not always<br />

been the case in the past. There<strong>for</strong>e, certain<br />

phases with increased pr<strong>of</strong>its from marginal<br />

pricing are necessary to compensate <strong>for</strong><br />

worse phases with insufficient fixed cost recovery.<br />

For the consumer, marginal cost<br />

pricing over a longer period <strong>of</strong> time there<strong>for</strong>e<br />

means no disadvantage <strong>and</strong> no increased<br />

electricity costs. Secondly, it is<br />

worth taking a look at which plants benefit<br />

particularly from high fuel prices. Basically,<br />

over- <strong>and</strong> under-returns in marginal pricing<br />

always occur when the power plant fleet<br />

does not optimally match the <strong>energy</strong>-economic<br />

framework conditions, e.g. fuel prices;<br />

the system is not economically in equilibrium.<br />

If the system had the possibility to react<br />

quickly <strong>and</strong> without friction to the<br />

current situation, it would build significantly<br />

more renewables to save fuel costs. However,<br />

it is precisely these renewables that currently<br />

generate the highest additional revenues<br />

compared to 2020, as shown in F i g u r e 4 .<br />

Marginal pricing thus ensures that the highest<br />

pr<strong>of</strong>its are generated by the generators<br />

that are most urgently needed <strong>for</strong> more efficient<br />

<strong>and</strong> cheaper electricity production <strong>and</strong><br />

thus creates the highest incentives to invest<br />

in precisely these technologies.<br />

2Q23<br />

20.7. 17.8.<br />

Fig. 8. Derivatives market prices natural gas Germany THE EEX (20 July <strong>and</strong> 17 August <strong>2022</strong>)<br />

– in € /MWh.<br />

3Q23<br />

2023<br />

2024<br />

2025<br />

2026<br />

The price increases in recent weeks <strong>and</strong><br />

months have already led to various reactions.<br />

In the residential customer sector,<br />

there have been the first supplier failures;<br />

customers suddenly prefer to switch to the<br />

basic supply tariff 13 because it is becoming<br />

more attractive in terms <strong>of</strong> price <strong>and</strong>, conversely,<br />

basic suppliers are adjusting their<br />

tariffs significantly. Industrial customers<br />

who have bought electricity <strong>for</strong> the long<br />

term are in a comparatively favourable situation,<br />

but they are also looking ahead <strong>and</strong><br />

know they must continue to hedge their<br />

bets. And there are also companies that have<br />

repeatedly missed the right entry into hedging<br />

<strong>and</strong> are now paying heavily into the spot<br />

market. According to a DIHK survey 14 , considerable<br />

quantities <strong>of</strong> gas <strong>for</strong> <strong>2022</strong> still had<br />

to be procured in July. About half <strong>of</strong> the industrial<br />

companies have already secured<br />

their gas requirements. But more than a<br />

third still had to purchase (as <strong>of</strong> July <strong>2022</strong>)<br />

more than 30 percent <strong>of</strong> their annual dem<strong>and</strong><br />

<strong>for</strong> <strong>2022</strong>. This corresponds to around<br />

50 TWh <strong>of</strong> gas. However, industrial companies<br />

have also <strong>of</strong>ten reacted extraordinarily<br />

quickly: Evonik replaces up to 40 % <strong>of</strong> the<br />

natural gas dem<strong>and</strong> at its German sites with<br />

LPG (Liquefied Petroleum Gas), including in<br />

a natural gas power plant. 15<br />

Should Russia continue to supply significantly<br />

less gas or none at all, it is already<br />

clear that the dem<strong>and</strong> side will have to make<br />

a relatively large contribution in the near<br />

future to balance supply <strong>and</strong> dem<strong>and</strong>. So,<br />

depending on the weather, more or less gas<br />

will have to be saved in the coming winters.<br />

Alternative solutions such as ‘real’ efficiency<br />

gains (i.e. the same output with less <strong>energy</strong><br />

consumption), the development <strong>of</strong> alternative<br />

gas supply routes <strong>and</strong> infrastructure,<br />

<strong>and</strong> the expansion <strong>of</strong> renewable energies<br />

13<br />

The basic supply tariff is a tariff that is available<br />

<strong>for</strong> everyone also on short notice. After<br />

liberalization this tariff was definitely not the<br />

most competitive one, but the tariff <strong>of</strong> last resort<br />

e.g. when a supplier defaulted <strong>and</strong> the<br />

customers need immediate access to <strong>energy</strong>.<br />

14<br />

DIHK, Press release: Sharp rise in <strong>energy</strong> prices<br />

jeopardises production in Germany,<br />

25.7.<strong>2022</strong><br />

15<br />

Evonik, Press release: Evonik substitutes up to<br />

40 percent natural gas at German sites,<br />

8.8.<strong>2022</strong><br />

For investors <strong>and</strong> operators <strong>of</strong> renewable energies<br />

in particular, the situation has turned<br />

very positive within a very short time. Be<strong>for</strong>e<br />

the Covid-19 crisis, experts were thinking<br />

that plants leaving the EEG 16 could no<br />

longer be operated at the expected electricity<br />

price level 17 . In the meantime, the use <strong>of</strong><br />

the so-called “Ü-20” plants is very much<br />

continued by means <strong>of</strong> corporate PPAs <strong>for</strong><br />

two to three years. Similarly, other power<br />

plants suddenly find a much better deal.<br />

2 Current situation with<br />

regard to electricity<br />

generation capacity to<br />

meet dem<strong>and</strong> in Germany<br />

As <strong>of</strong> 31 May <strong>2022</strong>, Germany had a net installed<br />

electricity generation capacity <strong>of</strong><br />

232.0 gigawatts (GW). 18 Of this, renewable<br />

<strong>energy</strong> plants accounted <strong>for</strong> around 60 %<br />

(138.6 GW) <strong>and</strong> conventional plants <strong>for</strong><br />

around 40 % (93.4 GW). Of the total installed<br />

capacity, 12.5 GW <strong>of</strong> power plants<br />

are located outside the electricity market.<br />

These are lignite units in security st<strong>and</strong>by,<br />

system-relevant plants based on hard coal,<br />

natural gas <strong>and</strong> petroleum products that are<br />

only operated at the request <strong>of</strong> the transmission<br />

system operators <strong>for</strong> the purpose <strong>of</strong><br />

maintaining security <strong>of</strong> supply (grid reserve),<br />

temporarily decommissioned plants<br />

based on natural gas <strong>and</strong> petroleum products,<br />

<strong>and</strong> natural gas capacity in the capacity<br />

reserve.<br />

The net capacity <strong>of</strong> electricity generation<br />

plants on the electricity market as <strong>of</strong> 31 May<br />

<strong>2022</strong> was 219.5 GW accordingly. Of this,<br />

81.0 GW is accounted <strong>for</strong> by conventional<br />

<strong>and</strong> 138.6 GW by renewable <strong>energy</strong> plants<br />

(Table 1, Figure 9).<br />

The highest load achieved in Germany in recent<br />

years as measured by the transmission<br />

system operators, which usually occurs in<br />

the early evening <strong>of</strong> a winter month (<strong>and</strong><br />

16<br />

The EEG (Erneuerbare-Energien-Gesetz) is<br />

the legal basis <strong>for</strong> the promotion <strong>of</strong> renewable<br />

energies <strong>for</strong> electricity generation in Germany<br />

(promotion <strong>of</strong> plants up to 20 years).<br />

17<br />

B. Glensk, R. Madlener, Energiewende @<br />

Risk: On the Continuation <strong>of</strong> Renewable Power<br />

<strong>Generation</strong> at the End <strong>of</strong> Public Policy Support,<br />

FCN Working Paper No. 05/2019 (May<br />

2019).<br />

18<br />

Includes <strong>of</strong>fshore wind power in the Exclusive<br />

Economic Zone (<strong>of</strong>fshore); in addition, the<br />

reported data on electricity generation capacity<br />

on the electricity market includes plants<br />

that are installed in Austria, Luxembourg,<br />

Switzerl<strong>and</strong> or Denmark, but feed directly<br />

into the German grid.<br />

78 | <strong>vgbe</strong> <strong>energy</strong> <strong>journal</strong> <strong>10</strong> · <strong>2022</strong>