vgbe energy journal 10 (2022) - International Journal for Generation and Storage of Electricity and Heat

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat. Issue 10 (2022). Technical Journal of the vgbe energy e.V. - Energy is us! NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy +++++++++++++++++++++++++++++++++++++++++++++++++++++++

vgbe energy journal - International Journal for Generation and Storage of Electricity and Heat.

Issue 10 (2022).

Technical Journal of the vgbe energy e.V. - Energy is us!

NOTICE: Please feel free to read this free copy of the vgbe energy journal. This is our temporary contribution to support experience exchange in the energy industry during Corona times. The printed edition, subscription as well as further services are available on our website, www.vgbe.energy

+++++++++++++++++++++++++++++++++++++++++++++++++++++++

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

Future-pro<strong>of</strong>, secure <strong>and</strong> climate-friendly electricity supply in Germany<br />

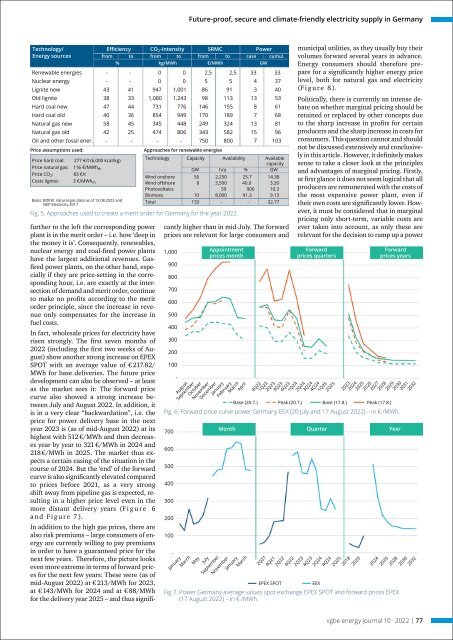

Technology/ Efficiency CO 2 -Intensity SRMC Power<br />

Energy sources from to from to from to case cumul.<br />

% kg/MWh €/MWh GW<br />

Renewable energies - - 0 0 2,5 2,5 33 33<br />

Nuclear <strong>energy</strong> - - 0 0 5 5 4 37<br />

Lignite new 43 41 947 1,001 86 91 3 40<br />

Old lignite 38 33 1,080 1,243 98 113 13 53<br />

Hard coal new 47 44 731 776 146 155 8 61<br />

Hard coal old 40 36 854 949 170 189 7 68<br />

Natural gas new 58 45 345 448 249 324 13 81<br />

Natural gas old 42 25 474 806 343 582 15 96<br />

Oil <strong>and</strong> other fossil ener. - - - - 750 800 7 <strong>10</strong>3<br />

Price assumptions used:<br />

Approaches <strong>for</strong> renewable energies<br />

Price hard coal: 277 €/t (6,000 kcal/kg)<br />

Technology Capacity Availability Available<br />

capacity<br />

Price natural gas: 116 €/MWh th<br />

GW h/a % GW<br />

Costs lignite: 3 €/MWh th Wind <strong>of</strong>fshore 8 3,500 40.0 3.20<br />

Price CO 2 : 83 €/t<br />

Wind onshore 56 2,250 25.7 14.38<br />

Photovoltaics 59 900 <strong>10</strong>.3 6.06<br />

Biomass <strong>10</strong> 8,000 91.3 9.13<br />

Total 133 - - 32.77<br />

Basis: BDEW, natural gas data as <strong>of</strong> 15.08.<strong>2022</strong> <strong>and</strong><br />

NEP <strong>Electricity</strong> 2017<br />

Fig. 5. Approaches used to create a merit order <strong>for</strong> Germany <strong>for</strong> the year <strong>2022</strong>.<br />

further to the left the corresponding power<br />

plant is in the merit order – i.e. how ‘deep in<br />

the money it is’. Consequently, renewables,<br />

nuclear <strong>energy</strong> <strong>and</strong> coal-fired power plants<br />

have the largest additional revenues. Gasfired<br />

power plants, on the other h<strong>and</strong>, especially<br />

if they are price-setting in the corresponding<br />

hour, i.e. are exactly at the intersection<br />

<strong>of</strong> dem<strong>and</strong> <strong>and</strong> merit order, continue<br />

to make no pr<strong>of</strong>its according to the merit<br />

order principle, since the increase in revenue<br />

only compensates <strong>for</strong> the increase in<br />

fuel costs.<br />

In fact, wholesale prices <strong>for</strong> electricity have<br />

risen strongly. The first seven months <strong>of</strong><br />

<strong>2022</strong> (including the first two weeks <strong>of</strong> August)<br />

show another strong increase on EPEX<br />

SPOT with an average value <strong>of</strong> € 217.82/<br />

MWh <strong>for</strong> base deliveries. The future price<br />

development can also be observed – at least<br />

as the market sees it: The <strong>for</strong>ward price<br />

curve also showed a strong increase between<br />

July <strong>and</strong> August <strong>2022</strong>. In addition, it<br />

is in a very clear “backwardation”, i.e. the<br />

price <strong>for</strong> power delivery base in the next<br />

year 2023 is (as <strong>of</strong> mid-August <strong>2022</strong>) at its<br />

highest with 512 €/MWh <strong>and</strong> then decreases<br />

year by year to 321 €/MWh in 2024 <strong>and</strong><br />

218 €/MWh in 2025. The market thus expects<br />

a certain easing <strong>of</strong> the situation in the<br />

course <strong>of</strong> 2024. But the ‘end’ <strong>of</strong> the <strong>for</strong>ward<br />

curve is also significantly elevated compared<br />

to prices be<strong>for</strong>e 2021, as a very strong<br />

shift away from pipeline gas is expected, resulting<br />

in a higher price level even in the<br />

more distant delivery years (F i g u r e 6<br />

<strong>and</strong> Figure 7).<br />

In addition to the high gas prices, there are<br />

also risk premiums – large consumers <strong>of</strong> <strong>energy</strong><br />

are currently willing to pay premiums<br />

in order to have a guaranteed price <strong>for</strong> the<br />

next few years. There<strong>for</strong>e, the picture looks<br />

even more extreme in terms <strong>of</strong> <strong>for</strong>ward prices<br />

<strong>for</strong> the next few years: These were (as <strong>of</strong><br />

mid-August <strong>2022</strong>) at € 213/MWh <strong>for</strong> 2023,<br />

at € 143/MWh <strong>for</strong> 2024 <strong>and</strong> at € 88/MWh<br />

<strong>for</strong> the delivery year 2025 – <strong>and</strong> thus significantly<br />

higher than in mid-July. The <strong>for</strong>ward<br />

prices are relevant <strong>for</strong> large consumers <strong>and</strong><br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

<strong>10</strong>0<br />

-<br />

August<br />

September<br />

October<br />

Appointment<br />

prices month<br />

November<br />

December<br />

January<br />

February<br />

March<br />

April<br />

4Q22<br />

1Q23<br />

2Q23<br />

3Q23<br />

4Q23<br />

1Q24<br />

2Q24<br />

3Q24<br />

4Q24<br />

municipal utilities, as they usually buy their<br />

volumes <strong>for</strong>ward several years in advance.<br />

Energy consumers should there<strong>for</strong>e prepare<br />

<strong>for</strong> a significantly higher <strong>energy</strong> price<br />

level, both <strong>for</strong> natural gas <strong>and</strong> electricity<br />

(Figure 8).<br />

Politically, there is currently an intense debate<br />

on whether marginal pricing should be<br />

retained or replaced by other concepts due<br />

to the sharp increase in pr<strong>of</strong>its <strong>for</strong> certain<br />

producers <strong>and</strong> the sharp increase in costs <strong>for</strong><br />

consumers. This question cannot <strong>and</strong> should<br />

not be discussed extensively <strong>and</strong> conclusively<br />

in this article. However, it definitely makes<br />

sense to take a closer look at the principles<br />

<strong>and</strong> advantages <strong>of</strong> marginal pricing. Firstly,<br />

at first glance it does not seem logical that all<br />

producers are remunerated with the costs <strong>of</strong><br />

the most expensive power plant, even if<br />

their own costs are significantly lower. However,<br />

it must be considered that in marginal<br />

pricing only short-term, variable costs are<br />

ever taken into account, as only these are<br />

relevant <strong>for</strong> the decision to ramp up a power<br />

Forward<br />

prices quarters<br />

1Q25<br />

2Q25<br />

2023<br />

2024<br />

2025<br />

2026<br />

2027<br />

2028<br />

2029<br />

Forward<br />

prices years<br />

Base (20.7.) Peak (20.7.) Base (17.8.) Peak (17.8.)<br />

Fig. 6. Forward price curve power Germany EEX (20 July <strong>and</strong> 17 August <strong>2022</strong>) – in € /MWh.<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

<strong>10</strong>0<br />

-<br />

January<br />

March<br />

May<br />

July<br />

September<br />

Month Quarter Year<br />

November<br />

January<br />

March<br />

2Q21<br />

EPEX SPOT<br />

4Q21<br />

2Q22<br />

4Q22<br />

2Q23<br />

4Q23<br />

EEX<br />

2Q24<br />

4Q24<br />

2Q25<br />

2018<br />

Fig 7. Power Germany average values spot exchange EPEX SPOT <strong>and</strong> <strong>for</strong>ward prices EPEX<br />

(17 August <strong>2022</strong>) – in € /MWh.<br />

2020<br />

2030<br />

2031<br />

2032<br />

2024<br />

2026<br />

2028<br />

2030<br />

2032<br />

<strong>vgbe</strong> <strong>energy</strong> <strong>journal</strong> <strong>10</strong> · <strong>2022</strong> | 77