Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

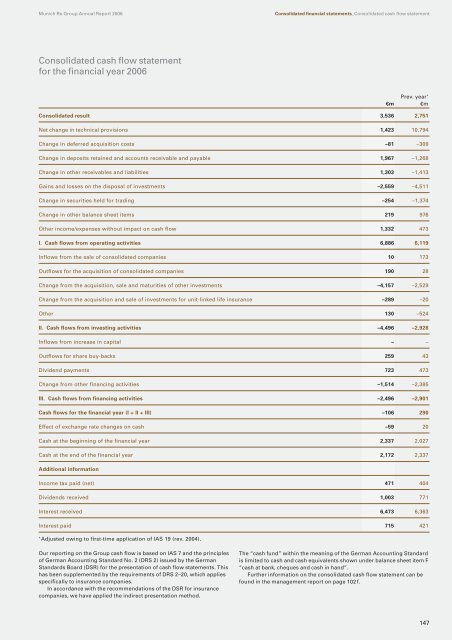

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Consolidated financial statements_Consolidated cash flow statement<br />

Consolidated cash flow statement<br />

for the financial year <strong>2006</strong><br />

Prev. year *<br />

€m €m<br />

Consolidated result 3,536 2,751<br />

Net change in technical provisions 1,423 10,794<br />

Change in deferred acquisition costs –81 –309<br />

Change in deposits retained and accounts receivable and payable 1,967 –1,268<br />

Change in other receivables and liabilities 1,303 –1,413<br />

Gains and losses on the disposal of investments –2,559 –4,511<br />

Change in securities held for trading –254 –1,374<br />

Change in other balance sheet items 219 976<br />

Other income/expenses without impact on cash flow 1,332 473<br />

I. Cash flows from operating activities 6,886 6,119<br />

Inflows from the sale of consolidated companies 10 173<br />

Outflows for the acquisition of consolidated companies 190 28<br />

Change from the acquisition, sale and maturities of other investments –4,157 –2,529<br />

Change from the acquisition and sale of investments for unit-linked life insurance –289 –20<br />

Other 130 –524<br />

II. Cash flows from investing activities –4,496 –2,928<br />

Inflows from increase in capital – –<br />

Outflows for share buy-backs 259 43<br />

Dividend payments 723 473<br />

Change from other financing activities –1,514 –2,385<br />

III. Cash flows from financing activities –2,496 –2,901<br />

Cash flows for the financial year (I + II + III) –106 290<br />

Effect of exchange rate changes on cash –59 20<br />

Cash at the beginning of the financial year 2,337 2,027<br />

Cash at the end of the financial year 2,172 2,337<br />

Additional information<br />

Income tax paid (net) 471 404<br />

Dividends received 1,003 771<br />

Interest received 6,473 6,363<br />

Interest paid 715 421<br />

* Adjusted owing to first-time application of IAS 19 (rev. 2004).<br />

Our reporting on the <strong>Group</strong> cash flow is based on IAS 7 and the principles<br />

of German Accounting Standard No. 2 (DRS 2) issued by the German<br />

Standards Board (DSR) for the presentation of cash flow statements. This<br />

has been supplemented by the requirements of DRS 2–20, which applies<br />

specifically to insurance companies.<br />

In accordance with the recommendations of the DSR for insurance<br />

companies, we have applied the indirect presentation method.<br />

The “cash fund” within the meaning of the German Accounting Standard<br />

is limited to cash and cash equivalents shown under balance sheet item F<br />

“cash at bank, cheques and cash in hand”.<br />

Further information on the consolidated cash flow statement can be<br />

found in the management report on page 102 f.<br />

147