Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes<br />

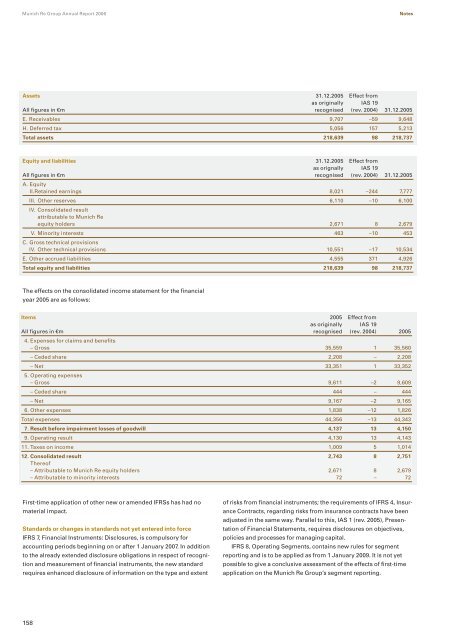

Assets 31.12.2005 Effect from<br />

as originally IAS 19<br />

All figures in €m recognised (rev. 2004) 31.12.2005<br />

E. <strong>Re</strong>ceivables 9,707 –59 9,648<br />

H. Deferred tax 5,056 157 5,213<br />

Total assets 218,639 98 218,737<br />

Equity and liabilities 31.12.2005 Effect from<br />

as orignally IAS 19<br />

All figures in €m<br />

A. Equity<br />

recognised (rev. 2004) 31.12.2005<br />

II.<strong>Re</strong>tained earnings 8,021 –244 7,777<br />

III. Other reserves<br />

IV. Consolidated result<br />

attributable to <strong>Munich</strong> <strong>Re</strong><br />

6,110 –10 6,100<br />

equity holders 2,671 8 2,679<br />

V. Minority interests<br />

C. Gross technical provisions<br />

463 –10 453<br />

IV. Other technical provisions 10,551 –17 10,534<br />

E. Other accrued liabilities 4,555 371 4,926<br />

Total equity and liabilities 218,639 98 218,737<br />

The effects on the consolidated income statement for the financial<br />

year 2005 are as follows:<br />

Items 2005 Effect from<br />

as originally IAS 19<br />

All figures in €m<br />

4. Expenses for claims and benefits<br />

recognised (rev. 2004) 2005<br />

– Gross 35,559 1 35,560<br />

– Ceded share 2,208 – 2,208<br />

– Net<br />

5. Operating expenses<br />

33,351 1 33,352<br />

– Gross 9,611 –2 9,609<br />

– Ceded share 444 – 444<br />

– Net 9,167 –2 9,165<br />

6. Other expenses 1,838 –12 1,826<br />

Total expenses 44,356 –13 44,343<br />

7. <strong>Re</strong>sult before impairment losses of goodwill 4,137 13 4,150<br />

9. Operating result 4,130 13 4,143<br />

11. Taxes on income 1,009 5 1,014<br />

12. Consolidated result<br />

Thereof<br />

2,743 8 2,751<br />

– Attributable to <strong>Munich</strong> <strong>Re</strong> equity holders 2,671 8 2,679<br />

– Attributable to minority interests 72 – 72<br />

First-time application of other new or amended IFRSs has had no<br />

material impact.<br />

Standards or changes in standards not yet entered into force<br />

IFRS 7, Financial Instruments: Disclosures, is compulsory for<br />

accounting periods beginning on or after 1 January 2007. In addition<br />

to the already extended disclosure obligations in respect of recognition<br />

and measurement of financial instruments, the new standard<br />

requires enhanced disclosure of information on the type and extent<br />

158<br />

of risks from financial instruments; the requirements of IFRS 4, Insurance<br />

Contracts, regarding risks from insurance contracts have been<br />

adjusted in the same way. Parallel to this, IAS 1 (rev. 2005), Presentation<br />

of Financial Statements, requires disclosures on objectives,<br />

policies and processes for managing capital.<br />

IFRS 8, Operating Segments, contains new rules for segment<br />

reporting and is to be applied as from 1 January 2009. It is not yet<br />

possible to give a conclusive assessment of the effects of first-time<br />

application on the <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s segment reporting.