Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Notes to the consolidated balance sheet – Equity and liabilities<br />

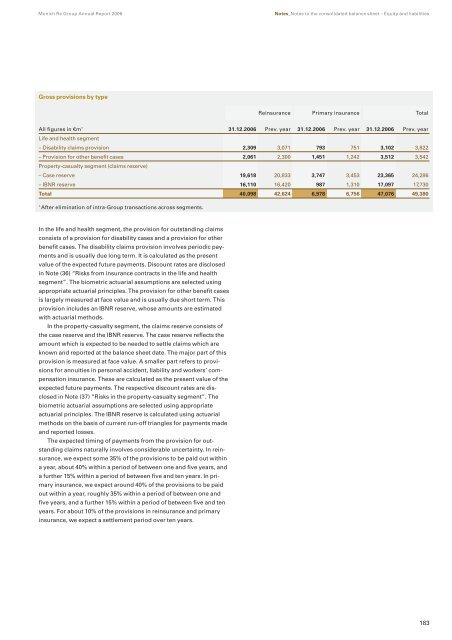

Gross provisions by type<br />

<strong>Re</strong>insurance Primary insurance Total<br />

All figures in €m * 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year<br />

Life and health segment<br />

– Disability claims provision 2,309 3,071 793 751 3,102 3,822<br />

– Provision for other benefit cases 2,061 2,300 1,451 1,242 3,512 3,542<br />

Property-casualty segment (claims reserve)<br />

– Case reserve 19,618 20,833 3,747 3,453 23,365 24,286<br />

– IBNR reserve 16,110 16,420 987 1,310 17,097 17,730<br />

Total 40,098 42,624 6,978 6,756 47,076 49,380<br />

* After elimination of intra-<strong>Group</strong> transactions across segments.<br />

In the life and health segment, the provision for outstanding claims<br />

consists of a provision for disability cases and a provision for other<br />

benefit cases. The disability claims provision involves periodic payments<br />

and is usually due long term. It is calculated as the present<br />

value of the expected future payments. Discount rates are disclosed<br />

in Note (36) “Risks from insurance contracts in the life and health<br />

segment”. The biometric actuarial assumptions are selected using<br />

appropriate actuarial principles. The provision for other benefit cases<br />

is largely measured at face value and is usually due short term. This<br />

provision includes an IBNR reserve, whose amounts are estimated<br />

with actuarial methods.<br />

In the property-casualty segment, the claims reserve consists of<br />

the case reserve and the IBNR reserve. The case reserve reflects the<br />

amount which is expected to be needed to settle claims which are<br />

known and reported at the balance sheet date. The major part of this<br />

provision is measured at face value. A smaller part refers to provisions<br />

for annuities in personal accident, liability and workers’ compensation<br />

insurance. These are calculated as the present value of the<br />

expected future payments. The respective discount rates are disclosed<br />

in Note (37) “Risks in the property-casualty segment”. The<br />

biometric actuarial assumptions are selected using appropriate<br />

actuarial principles. The IBNR reserve is calculated using actuarial<br />

methods on the basis of current run-off triangles for payments made<br />

and reported losses.<br />

The expected timing of payments from the provision for outstanding<br />

claims naturally involves considerable uncertainty. In reinsurance,<br />

we expect some 35% of the provisions to be paid out within<br />

a year, about 40% within a period of between one and five years, and<br />

a further 15% within a period of between five and ten years. In primary<br />

insurance, we expect around 40% of the provisions to be paid<br />

out within a year, roughly 35% within a period of between one and<br />

five years, and a further 15% within a period of between five and ten<br />

years. For about 10% of the provisions in reinsurance and primary<br />

insurance, we expect a settlement period over ten years.<br />

183