Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Disclosures on the uncertainties of future cash flows from insurance contracts<br />

The actuarial interest rates relevant for the portfolio in calculating the<br />

provision for future policy benefits and the provision for outstanding<br />

claims are as follows:<br />

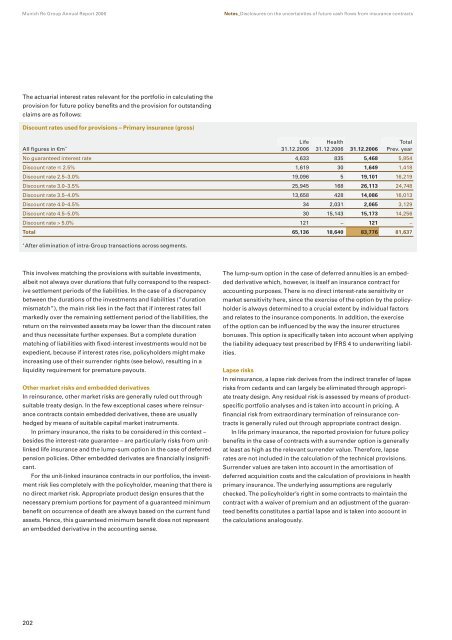

Discount rates used for provisions – Primary insurance (gross)<br />

Life Health Total<br />

All figures in €m * 31.12.<strong>2006</strong> 31.12.<strong>2006</strong> 31.12.<strong>2006</strong> Prev. year<br />

No guaranteed interest rate 4,633 835 5,468 5,854<br />

Discount rate 2.5% 1,619 30 1,649 1,418<br />

Discount rate 2.5–3.0% 19,096 5 19,101 16,219<br />

Discount rate 3.0–3.5% 25,945 168 26,113 24,748<br />

Discount rate 3.5–4.0% 13,658 428 14,086 16,013<br />

Discount rate 4.0–4.5% 34 2,031 2,065 3,129<br />

Discount rate 4.5–5.0% 30 15,143 15,173 14,256<br />

Discount rate > 5.0% 121 – 121 –<br />

Total 65,136 18,640 83,776 81,637<br />

* After elimination of intra-<strong>Group</strong> transactions across segments.<br />

This involves matching the provisions with suitable investments,<br />

albeit not always over durations that fully correspond to the respective<br />

settlement periods of the liabilities. In the case of a discrepancy<br />

between the durations of the investments and liabilities (”duration<br />

mismatch”), the main risk lies in the fact that if interest rates fall<br />

markedly over the remaining settlement period of the liabilities, the<br />

return on the reinvested assets may be lower than the discount rates<br />

and thus necessitate further expenses. But a complete duration<br />

matching of liabilities with fixed-interest investments would not be<br />

expedient, because if interest rates rise, policyholders might make<br />

increasing use of their surrender rights (see below), resulting in a<br />

liquidity requirement for premature payouts.<br />

Other market risks and embedded derivatives<br />

In reinsurance, other market risks are generally ruled out through<br />

suitable treaty design. In the few exceptional cases where reinsurance<br />

contracts contain embedded derivatives, these are usually<br />

hedged by means of suitable capital market instruments.<br />

In primary insurance, the risks to be considered in this context –<br />

besides the interest-rate guarantee – are particularly risks from unitlinked<br />

life insurance and the lump-sum option in the case of deferred<br />

pension policies. Other embedded derivates are financially insignificant.<br />

For the unit-linked insurance contracts in our portfolios, the investment<br />

risk lies completely with the policyholder, meaning that there is<br />

no direct market risk. Appropriate product design ensures that the<br />

necessary premium portions for payment of a guaranteed minimum<br />

benefit on occurrence of death are always based on the current fund<br />

assets. Hence, this guaranteed minimum benefit does not represent<br />

an embedded derivative in the accounting sense.<br />

202<br />

The lump-sum option in the case of deferred annuities is an embedded<br />

derivative which, however, is itself an insurance contract for<br />

accounting purposes. There is no direct interest-rate sensitivity or<br />

market sensitivity here, since the exercise of the option by the policyholder<br />

is always determined to a crucial extent by individual factors<br />

and relates to the insurance components. In addition, the exercise<br />

of the option can be influenced by the way the insurer structures<br />

bonuses. This option is specifically taken into account when applying<br />

the liability adequacy test prescribed by IFRS 4 to underwriting liabilities.<br />

Lapse risks<br />

In reinsurance, a lapse risk derives from the indirect transfer of lapse<br />

risks from cedants and can largely be eliminated through appropriate<br />

treaty design. Any residual risk is assessed by means of productspecific<br />

portfolio analyses and is taken into account in pricing. A<br />

financial risk from extraordinary termination of reinsurance contracts<br />

is generally ruled out through appropriate contract design.<br />

In life primary insurance, the reported provision for future policy<br />

benefits in the case of contracts with a surrender option is generally<br />

at least as high as the relevant surrender value. Therefore, lapse<br />

rates are not included in the calculation of the technical provisions.<br />

Surrender values are taken into account in the amortisation of<br />

deferred acquisition costs and the calculation of provisions in health<br />

primary insurance. The underlying assumptions are regularly<br />

checked. The policyholder’s right in some contracts to maintain the<br />

contract with a waiver of premium and an adjustment of the guaranteed<br />

benefits constitutes a partial lapse and is taken into account in<br />

the calculations analogously.