Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Management report_Asset management<br />

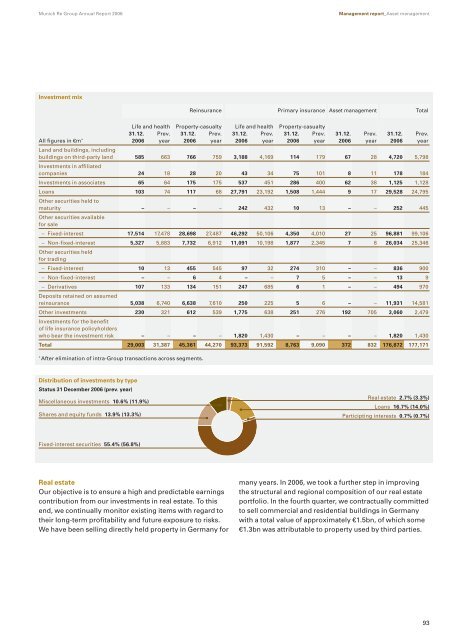

Investment mix<br />

Distribution of investments by type<br />

Status 31 December <strong>2006</strong> (prev. year)<br />

Miscellaneous investments 10.6% (11.9%)<br />

Shares and equity funds 13.9% (13.3%)<br />

Fixed-interest securities 55.4% (56.8%)<br />

<strong>Re</strong>al estate<br />

Our objective is to ensure a high and predictable earnings<br />

contribution from our investments in real estate. To this<br />

end, we continually monitor existing items with regard to<br />

their long-term profitability and future exposure to risks.<br />

We have been selling directly held property in Germany for<br />

<strong>Re</strong>insurance Primary insurance Asset management Total<br />

Life and health Property-casualty Life and health Property-casualty<br />

31.12. Prev. 31.12. Prev. 31.12. Prev. 31.12. Prev. 31.12. Prev. 31.12. Prev.<br />

All figures in €m * Land and buildings, including<br />

<strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year<br />

buildings on third-party land<br />

Investments in affiliated<br />

585 663 766 759 3,188 4,169 114 179 67 28 4,720 5,798<br />

companies 24 18 28 20 43 34 75 101 8 11 178 184<br />

Investments in associates 65 64 175 175 537 451 286 400 62 38 1,125 1,128<br />

Loans<br />

Other securities held to<br />

103 74 117 68 27,791 23,192 1,508 1,444 9 17 29,528 24,795<br />

maturity<br />

Other securities available<br />

for sale<br />

– – – – 242 432 10 13 – – 252 445<br />

– Fixed-interest 17,514 17,478 28,698 27,487 46,292 50,106 4,350 4,010 27 25 96,881 99,106<br />

– Non-fixed-interest<br />

Other securities held<br />

for trading<br />

5,327 5,883 7,732 6,912 11,091 10,198 1,877 2,345 7 8 26,034 25,346<br />

– Fixed-interest 10 13 455 545 97 32 274 310 – – 836 900<br />

– Non-fixed-interest – – 6 4 – – 7 5 – – 13 9<br />

– Derivatives<br />

Deposits retained on assumed<br />

107 133 134 151 247 685 6 1 – – 494 970<br />

reinsurance 5,038 6,740 6,638 7,610 250 225 5 6 – – 11,931 14,581<br />

Other investments<br />

Investments for the benefit<br />

of life insurance policyholders<br />

230 321 612 539 1,775 638 251 276 192 705 3,060 2,479<br />

who bear the investment risk – – – – 1,820 1,430 – – – – 1,820 1,430<br />

Total 29,003 31,387 45,361 44,270 93,373 91,592 8,763 9,090 372 832 176,872 177,171<br />

* After elimination of intra-<strong>Group</strong> transactions across segments.<br />

<strong>Re</strong>al estate 2.7% (3.3%)<br />

Loans 16.7% (14.0%)<br />

Participting interests 0.7% (0.7%)<br />

many years. In <strong>2006</strong>, we took a further step in improving<br />

the structural and regional composition of our real estate<br />

portfolio. In the fourth quarter, we contractually committed<br />

to sell commercial and residential buildings in Germany<br />

with a total value of approximately €1.5bn, of which some<br />

€1.3bn was attributable to property used by third parties.<br />

93