Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes<br />

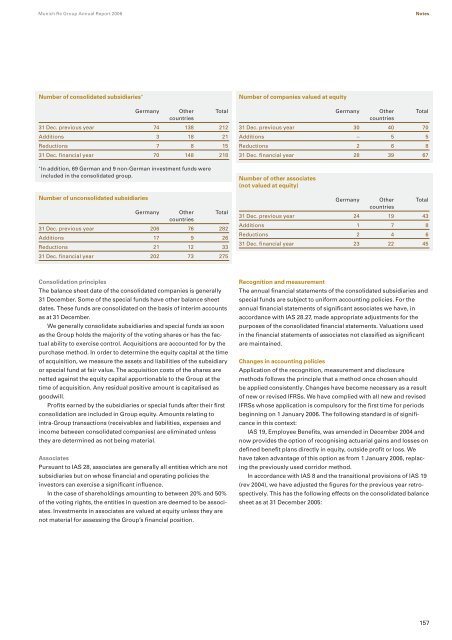

Number of consolidated subsidiaries *<br />

Germany Other<br />

countries<br />

Total<br />

31 Dec. previous year 74 138 212<br />

Additions 3 18 21<br />

<strong>Re</strong>ductions 7 8 15<br />

31 Dec. financial year 70 148 218<br />

* In addition, 69 German and 9 non-German investment funds were<br />

included in the consolidated group.<br />

Number of unconsolidated subsidiaries<br />

Germany Other<br />

countries<br />

Total<br />

31 Dec. previous year 206 76 282<br />

Additions 17 9 26<br />

<strong>Re</strong>ductions 21 12 33<br />

31 Dec. financial year 202 73 275<br />

Consolidation principles<br />

The balance sheet date of the consolidated companies is generally<br />

31 December. Some of the special funds have other balance sheet<br />

dates. These funds are consolidated on the basis of interim accounts<br />

as at 31 December.<br />

We generally consolidate subsidiaries and special funds as soon<br />

as the <strong>Group</strong> holds the majority of the voting shares or has the factual<br />

ability to exercise control. Acquisitions are accounted for by the<br />

purchase method. In order to determine the equity capital at the time<br />

of acquisition, we measure the assets and liabilities of the subsidiary<br />

or special fund at fair value. The acquisition costs of the shares are<br />

netted against the equity capital apportionable to the <strong>Group</strong> at the<br />

time of acquisition. Any residual positive amount is capitalised as<br />

goodwill.<br />

Profits earned by the subsidiaries or special funds after their first<br />

consolidation are included in <strong>Group</strong> equity. Amounts relating to<br />

intra-<strong>Group</strong> transactions (receivables and liabilities, expenses and<br />

income between consolidated companies) are eliminated unless<br />

they are determined as not being material.<br />

Associates<br />

Pursuant to IAS 28, associates are generally all entities which are not<br />

subsidiaries but on whose financial and operating policies the<br />

investors can exercise a significant influence.<br />

In the case of shareholdings amounting to between 20% and 50%<br />

of the voting rights, the entities in question are deemed to be associates.<br />

Investments in associates are valued at equity unless they are<br />

not material for assessing the <strong>Group</strong>’s financial position.<br />

Number of companies valued at equity<br />

Germany Other<br />

countries<br />

Total<br />

31 Dec. previous year 30 40 70<br />

Additions – 5 5<br />

<strong>Re</strong>ductions 2 6 8<br />

31 Dec. financial year 28 39 67<br />

Number of other associates<br />

(not valued at equity)<br />

Germany Other<br />

countries<br />

Total<br />

31 Dec. previous year 24 19 43<br />

Additions 1 7 8<br />

<strong>Re</strong>ductions 2 4 6<br />

31 Dec. financial year 23 22 45<br />

<strong>Re</strong>cognition and measurement<br />

The annual financial statements of the consolidated subsidiaries and<br />

special funds are subject to uniform accounting policies. For the<br />

annual financial statements of significant associates we have, in<br />

accordance with IAS 28.27, made appropriate adjustments for the<br />

purposes of the consolidated financial statements. Valuations used<br />

in the financial statements of associates not classified as significant<br />

are maintained.<br />

Changes in accounting policies<br />

Application of the recognition, measurement and disclosure<br />

methods follows the principle that a method once chosen should<br />

be applied consistently. Changes have become necessary as a result<br />

of new or revised IFRSs. We have complied with all new and revised<br />

IFRSs whose application is compulsory for the first time for periods<br />

beginning on 1 January <strong>2006</strong>. The following standard is of significance<br />

in this context:<br />

IAS 19, Employee Benefits, was amended in December 2004 and<br />

now provides the option of recognising actuarial gains and losses on<br />

defined benefit plans directly in equity, outside profit or loss. We<br />

have taken advantage of this option as from 1 January <strong>2006</strong>, replacing<br />

the previously used corridor method.<br />

In accordance with IAS 8 and the transitional provisions of IAS 19<br />

(rev 2004), we have adjusted the figures for the previous year retrospectively.<br />

This has the following effects on the consolidated balance<br />

sheet as at 31 December 2005:<br />

157