Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Management report_Overview and key figures<br />

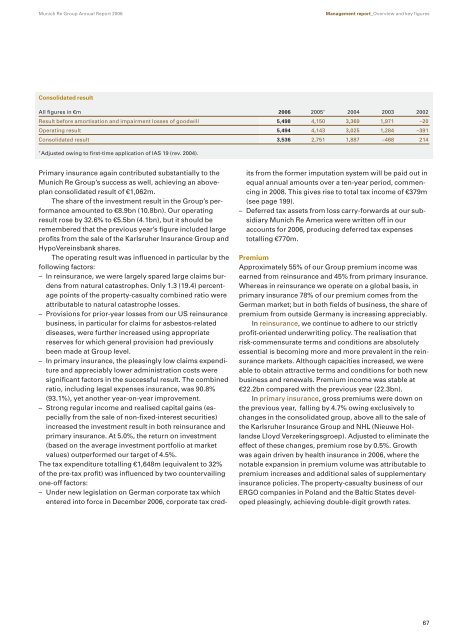

Consolidated result<br />

All figures in €m <strong>2006</strong> 2005 * 2004 2003 2002<br />

<strong>Re</strong>sult before amortisation and impairment losses of goodwill 5,498 4,150 3,369 1,971 –20<br />

Operating result 5,494 4,143 3,025 1,284 –391<br />

Consolidated result 3,536 2,751 1,887 –468 214<br />

* Adjusted owing to first-time application of IAS 19 (rev. 2004).<br />

Primary insurance again contributed substantially to the<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s success as well, achieving an aboveplan<br />

consolidated result of €1,062m.<br />

The share of the investment result in the <strong>Group</strong>’s performance<br />

amounted to €8.9bn (10.8bn). Our operating<br />

result rose by 32.6% to €5.5bn (4.1bn), but it should be<br />

remembered that the previous year’s figure included large<br />

profits from the sale of the Karlsruher Insurance <strong>Group</strong> and<br />

HypoVereinsbank shares.<br />

The operating result was influenced in particular by the<br />

following factors:<br />

– In reinsurance, we were largely spared large claims burdens<br />

from natural catastrophes. Only 1.3 (19.4) percentage<br />

points of the property-casualty combined ratio were<br />

attributable to natural catastrophe losses.<br />

– Provisions for prior-year losses from our US reinsurance<br />

business, in particular for claims for asbestos-related<br />

diseases, were further increased using appropriate<br />

reserves for which general provision had previously<br />

been made at <strong>Group</strong> level.<br />

– In primary insurance, the pleasingly low claims expenditure<br />

and appreciably lower administration costs were<br />

significant factors in the successful result. The combined<br />

ratio, including legal expenses insurance, was 90.8%<br />

(93.1%), yet another year-on-year improvement.<br />

– Strong regular income and realised capital gains (especially<br />

from the sale of non-fixed-interest securities)<br />

increased the investment result in both reinsurance and<br />

primary insurance. At 5.0%, the return on investment<br />

(based on the average investment portfolio at market<br />

values) outperformed our target of 4.5%.<br />

The tax expenditure totalling €1,648m (equivalent to 32%<br />

of the pre-tax profit) was influenced by two countervailing<br />

one-off factors:<br />

– Under new legislation on German corporate tax which<br />

entered into force in December <strong>2006</strong>, corporate tax cred-<br />

its from the former imputation system will be paid out in<br />

equal annual amounts over a ten-year period, commencing<br />

in 2008. This gives rise to total tax income of €379m<br />

(see page 199).<br />

– Deferred tax assets from loss carry-forwards at our subsidiary<br />

<strong>Munich</strong> <strong>Re</strong> America were written off in our<br />

accounts for <strong>2006</strong>, producing deferred tax expenses<br />

totalling €770m.<br />

Premium<br />

Approximately 55% of our <strong>Group</strong> premium income was<br />

earned from reinsurance and 45% from primary insurance.<br />

Whereas in reinsurance we operate on a global basis, in<br />

primary insurance 78% of our premium comes from the<br />

German market; but in both fields of business, the share of<br />

premium from outside Germany is increasing appreciably.<br />

In reinsurance, we continue to adhere to our strictly<br />

profit-oriented underwriting policy. The realisation that<br />

risk-commensurate terms and conditions are absolutely<br />

essential is becoming more and more prevalent in the reinsurance<br />

markets. Although capacities increased, we were<br />

able to obtain attractive terms and conditions for both new<br />

business and renewals. Premium income was stable at<br />

€22.2bn compared with the previous year (22.3bn).<br />

In primary insurance, gross premiums were down on<br />

the previous year, falling by 4.7% owing exclusively to<br />

changes in the consolidated group, above all to the sale of<br />

the Karlsruher Insurance <strong>Group</strong> and NHL (Nieuwe Hollandse<br />

Lloyd Verzekeringsgroep). Adjusted to eliminate the<br />

effect of these changes, premium rose by 0.5%. Growth<br />

was again driven by health insurance in <strong>2006</strong>, where the<br />

notable expansion in premium volume was attributable to<br />

premium increases and additional sales of supplementary<br />

insurance policies. The property-casualty business of our<br />

ERGO companies in Poland and the Baltic States developed<br />

pleasingly, achieving double-digit growth rates.<br />

67