Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Notes to the consolidated balance sheet – Assets<br />

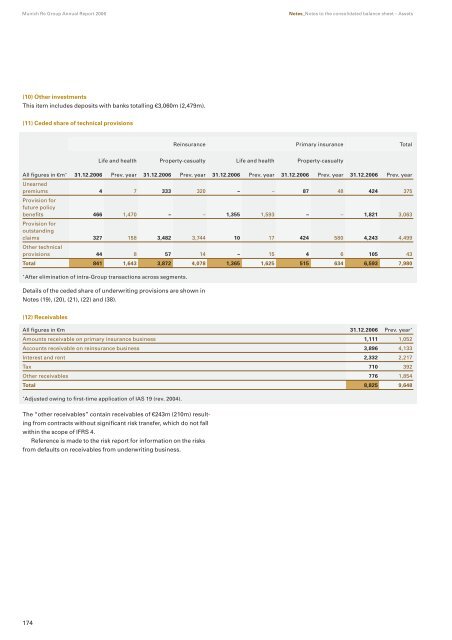

(10) Other investments<br />

This item includes deposits with banks totalling €3,060m (2,479m).<br />

(11) Ceded share of technical provisions<br />

174<br />

<strong>Re</strong>insurance Primary insurance Total<br />

Life and health Property-casualty Life and health Property-casualty<br />

All figures in €m * Unearned<br />

31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year<br />

premiums<br />

Provision for<br />

future policy<br />

4 7 333 320 – – 87 48 424 375<br />

benefits<br />

Provision for<br />

outstanding<br />

466 1,470 – – 1,355 1,593 – – 1,821 3,063<br />

claims<br />

Other technical<br />

327 158 3,482 3,744 10 17 424 580 4,243 4,499<br />

provisions 44 8 57 14 – 15 4 6 105 43<br />

Total 841 1,643 3,872 4,078 1,365 1,625 515 634 6,593 7,980<br />

* After elimination of intra-<strong>Group</strong> transactions across segments.<br />

Details of the ceded share of underwriting provisions are shown in<br />

Notes (19), (20), (21), (22) and (38).<br />

(12) <strong>Re</strong>ceivables<br />

All figures in €m 31.12.<strong>2006</strong> Prev. year *<br />

Amounts receivable on primary insurance business 1,111 1,052<br />

Accounts receivable on reinsurance business 3,896 4,133<br />

Interest and rent 2,332 2,217<br />

Tax 710 392<br />

Other receivables 776 1,854<br />

Total 8,825 9,648<br />

* Adjusted owing to first-time application of IAS 19 (rev. 2004).<br />

The “other receivables” contain receivables of €243m (210m) resulting<br />

from contracts without significant risk transfer, which do not fall<br />

within the scope of IFRS 4.<br />

<strong>Re</strong>ference is made to the risk report for information on the risks<br />

from defaults on receivables from underwriting business.