Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong><br />

With offices in New York and Hong Kong, MEAG is internationally<br />

oriented, offering global competence and knowhow<br />

across a wide range of asset classes to institutional<br />

investors and private clients. In July <strong>2006</strong>, MEAG acquired<br />

a 19% stake in PICC Asset Management Company Ltd.<br />

(PAMC) in Shanghai – the asset manager of one of the<br />

largest Chinese insurance groups, the People’s Insurance<br />

Company of China (PICC <strong>Group</strong>).<br />

Important tools of corporate management<br />

<strong>Munich</strong> <strong>Re</strong>’s value-based management philosophy<br />

The <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s objective is to analyse risk from<br />

every conceivable angle and to handle it successfully,<br />

thereby creating lasting value for its shareholders, clients<br />

and staff. A guiding principle of our corporate thinking and<br />

activity is to increase <strong>Munich</strong> <strong>Re</strong>’s share price on a sustained<br />

basis. The main features of this shareholder value<br />

approach in practice are the consistent application of<br />

robust, value-based management systems within the<br />

<strong>Group</strong> and a clear focus on future prospects of success.<br />

Besides value-based performance measures, we<br />

observe a range of important additional conditions in managing<br />

our business. These conditions may be reflected in<br />

supplementary targets within the <strong>Group</strong>, or in isolated<br />

cases may even determine a unit’s short-term orientation<br />

in a particular situation. They include the rules of local<br />

accounting systems, tax aspects, liquidity requirements,<br />

supervisory parameters, and our shareholders’ legitimate<br />

interest in attractive regular cash distributions and an<br />

appropriate return on the overall capital invested.<br />

The key factor in our business decisions is to increase<br />

corporate value, which we do in the following ways:<br />

– We assess business activities not only according to their<br />

earnings potential but also relative to the extent of the<br />

risks assumed, which is material in measuring added<br />

value. Only the risk-return relationship reveals how<br />

beneficial an activity is from the shareholder’s point of<br />

view.<br />

52<br />

Management report_<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong><br />

– With clearly defined value-based performance indicators,<br />

we ensure the necessary comparability of alternative<br />

measures and initiatives as the basis for setting priorities.<br />

– We clearly assign responsibilities and make the levers<br />

for adding value transparent for both management and<br />

staff.<br />

– We closely link strategic and operative planning. All initiatives<br />

are ultimately geared to the overriding financial<br />

objective of enhancing corporate value.<br />

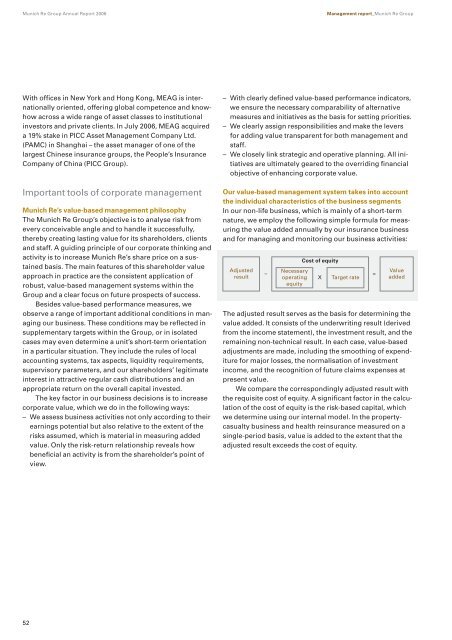

Our value-based management system takes into account<br />

the individual characteristics of the business segments<br />

In our non-life business, which is mainly of a short-term<br />

nature, we employ the following simple formula for measuring<br />

the value added annually by our insurance business<br />

and for managing and monitoring our business activities:<br />

Adjusted<br />

result<br />

–<br />

Necessary<br />

operating<br />

equity<br />

Cost of equity<br />

The adjusted result serves as the basis for determining the<br />

value added. It consists of the underwriting result (derived<br />

from the income statement), the investment result, and the<br />

remaining non-technical result. In each case, value-based<br />

adjustments are made, including the smoothing of expenditure<br />

for major losses, the normalisation of investment<br />

income, and the recognition of future claims expenses at<br />

present value.<br />

We compare the correspondingly adjusted result with<br />

the requisite cost of equity. A significant factor in the calculation<br />

of the cost of equity is the risk-based capital, which<br />

we determine using our internal model. In the propertycasualty<br />

business and health reinsurance measured on a<br />

single-period basis, value is added to the extent that the<br />

adjusted result exceeds the cost of equity.<br />

X<br />

Target rate<br />

=<br />

Value<br />

added