Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Disclosures on the uncertainties of future cash flows from insurance contracts<br />

Disclosures on the uncertainties of future cash<br />

flows from insurance contracts<br />

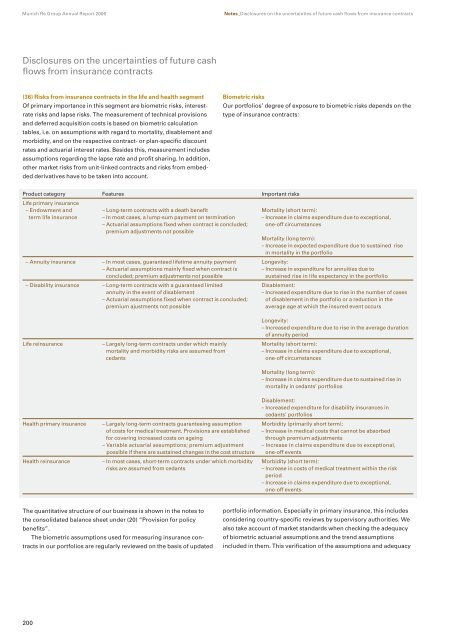

(36) Risks from insurance contracts in the life and health segment<br />

Of primary importance in this segment are biometric risks, interestrate<br />

risks and lapse risks. The measurement of technical provisions<br />

and deferred acquisition costs is based on biometric calculation<br />

tables, i.e. on assumptions with regard to mortality, disablement and<br />

morbidity, and on the respective contract- or plan-specific discount<br />

rates and actuarial interest rates. Besides this, measurement includes<br />

assumptions regarding the lapse rate and profit sharing. In addition,<br />

other market risks from unit-linked contracts and risks from embedded<br />

derivatives have to be taken into account.<br />

The quantitative structure of our business is shown in the notes to<br />

the consolidated balance sheet under (20) “Provision for policy<br />

benefits”.<br />

The biometric assumptions used for measuring insurance contracts<br />

in our portfolios are regularly reviewed on the basis of updated<br />

200<br />

Biometric risks<br />

Our portfolios’ degree of exposure to biometric risks depends on the<br />

type of insurance contracts:<br />

Product category<br />

Life primary insurance<br />

Features Important risks<br />

– Endowment and – Long-term contracts with a death benefit Mortality (short term):<br />

term life insurance – In most cases, a lump-sum payment on termination – Increase in claims expenditure due to exceptional,<br />

– Actuarial assumptions fixed when contract is concluded;<br />

premium adjustments not possible<br />

one-off circumstances<br />

Mortality (long term):<br />

– Increase in expected expenditure due to sustained rise<br />

in mortality in the portfolio<br />

– Annuity insurance – In most cases, guaranteed lifetime annuity payment Longevity:<br />

– Actuarial assumptions mainly fixed when contract is – Increase in expenditure for annuities due to<br />

concluded; premium adjustments not possible sustained rise in life expectancy in the portfolio<br />

– Disability insurance – Long-term contracts with a guaranteed limited Disablement:<br />

annuity in the event of disablement – Increased expenditure due to rise in the number of cases<br />

– Actuarial assumptions fixed when contract is concluded; of disablement in the portfolio or a reduction in the<br />

premium ajustments not possible average age at which the insured event occurs<br />

Life reinsurance – Largely long-term contracts under which mainly<br />

Longevity:<br />

– Increased expenditure due to rise in the average duration<br />

of annuity period<br />

Mortality (short term):<br />

mortality and morbidity risks are assumed from – Increase in claims expenditure due to exceptional,<br />

cedants one-off circumstances<br />

Mortality (long term):<br />

– Increase in claims expenditure due to sustained rise in<br />

mortality in cedants’ portfolios<br />

Health primary insurance – Largely long-term contracts guaranteeing assumption<br />

Disablement:<br />

– Increased expenditure for disability insurances in<br />

cedants’ portfolios<br />

Morbidity (primarily short term):<br />

of costs for medical treatment. Provisions are established – Increase in medical costs that cannot be absorbed<br />

for covering increased costs on ageing through premium adjustments<br />

– Variable actuarial assumptions; premium adjustment – Increase in claims expenditure due to exceptional,<br />

possible if there are sustained changes in the cost structure one-off events<br />

Health reinsurance – In most cases, short-term contracts under which morbidity Morbidity (short term):<br />

risks are assumed from cedants – Increase in costs of medical treatment within the risk<br />

period<br />

– Increase in claims expenditure due to exceptional,<br />

one-off events<br />

portfolio information. Especially in primary insurance, this includes<br />

considering country-specific reviews by supervisory authorities. We<br />

also take account of market standards when checking the adequacy<br />

of biometric actuarial assumptions and the trend assumptions<br />

included in them. This verification of the assumptions and adequacy