Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Notes to the consolidated income statement<br />

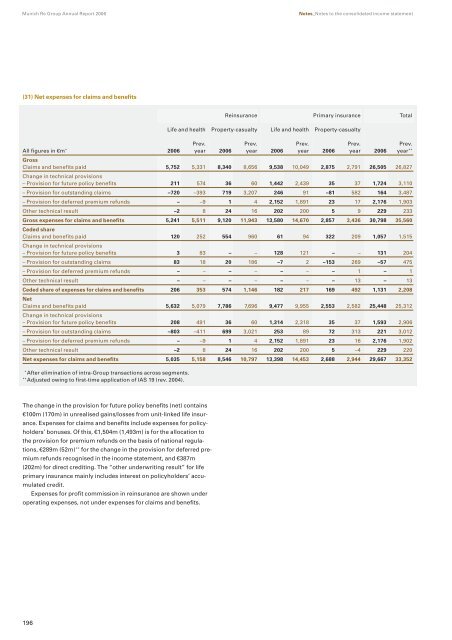

(31) Net expenses for claims and benefits<br />

The change in the provision for future policy benefits (net) contains<br />

€100m (170m) in unrealised gains/losses from unit-linked life insurance.<br />

Expenses for claims and benefits include expenses for policyholders’<br />

bonuses. Of this, €1,504m (1,493m) is for the allocation to<br />

the provision for premium refunds on the basis of national regulations,<br />

€289m (52m) ** for the change in the provision for deferred premium<br />

refunds recognised in the income statement, and €387m<br />

(202m) for direct crediting. The “other underwriting result” for life<br />

primary insurance mainly includes interest on policyholders’ accumulated<br />

credit.<br />

Expenses for profit commission in reinsurance are shown under<br />

operating expenses, not under expenses for claims and benefits.<br />

196<br />

<strong>Re</strong>insurance Primary insurance Total<br />

Life and health Property-casualty Life and health Property-casualty<br />

Prev. Prev. Prev. Prev. Prev.<br />

All figures in €m * <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year <strong>2006</strong> year **<br />

Gross<br />

Claims and benefits paid<br />

Change in technical provisions<br />

5,752 5,331 8,340 8,656 9,538 10,049 2,875 2,791 26,505 26,827<br />

– Provision for future policy benefits 211 574 36 60 1,442 2,439 35 37 1,724 3,110<br />

– Provision for outstanding claims –720 –393 719 3,207 246 91 –81 582 164 3,487<br />

– Provision for deferred premium refunds – –9 1 4 2,152 1,891 23 17 2,176 1,903<br />

Other technical result –2 8 24 16 202 200 5 9 229 233<br />

Gross expenses for claims and benefits<br />

Ceded share<br />

5,241 5,511 9,120 11,943 13,580 14,670 2,857 3,436 30,798 35,560<br />

Claims and benefits paid<br />

Change in technical provisions<br />

120 252 554 960 61 94 322 209 1,057 1,515<br />

– Provision for future policy benefits 3 83 – – 128 121 – – 131 204<br />

– Provision for outstanding claims 83 18 20 186 –7 2 –153 269 –57 475<br />

– Provision for deferred premium refunds – – – – – – – 1 – 1<br />

Other technical result – – – – – – – 13 – 13<br />

Ceded share of expenses for claims and benefits<br />

Net<br />

206 353 574 1,146 182 217 169 492 1,131 2,208<br />

Claims and benefits paid<br />

Change in technical provisions<br />

5,632 5,079 7,786 7,696 9,477 9,955 2,553 2,582 25,448 25,312<br />

– Provision for future policy benefits 208 491 36 60 1,314 2,318 35 37 1,593 2,906<br />

– Provision for outstanding claims –803 –411 699 3,021 253 89 72 313 221 3,012<br />

– Provision for deferred premium refunds – –9 1 4 2,152 1,891 23 16 2,176 1,902<br />

Other technical result –2 8 24 16 202 200 5 –4 229 220<br />

Net expenses for claims and benefits 5,035 5,158 8,546 10,797 13,398 14,453 2,688 2,944 29,667 33,352<br />

* After elimination of intra-<strong>Group</strong> transactions across segments.<br />

** Adjusted owing to first-time application of IAS 19 (rev. 2004).