Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Other information<br />

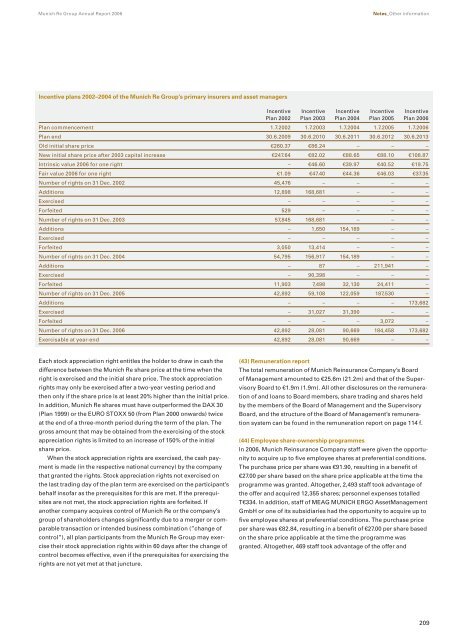

Incentive plans 2002–2004 of the <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s primary insurers and asset managers<br />

Incentive Incentive Incentive Incentive Incentive<br />

Plan 2002 Plan 2003 Plan 2004 Plan 2005 Plan <strong>2006</strong><br />

Plan commencement 1.7.2002 1.7.2003 1.7.2004 1.7.2005 1.7.<strong>2006</strong><br />

Plan end 30.6.2009 30.6.2010 30.6.2011 30.6.2012 30.6.2013<br />

Old initial share price €260.37 €86.24 – – –<br />

New initial share price after 2003 capital increase €247.64 €82.02 €88.65 €88.10 €108.87<br />

Intrinsic value <strong>2006</strong> for one right – €46.60 €39.97 €40.52 €19.75<br />

Fair value <strong>2006</strong> for one right €1.09 €47.40 €44.36 €46.03 €37.35<br />

Number of rights on 31 Dec. 2002 45,476 – – – –<br />

Additions 12,898 168,681 – – –<br />

Exercised – – – – –<br />

Forfeited 529 – – – –<br />

Number of rights on 31 Dec. 2003 57,845 168,681 – – –<br />

Additions – 1,650 154,189 – –<br />

Exercised – – – – –<br />

Forfeited 3,050 13,414 – – –<br />

Number of rights on 31 Dec. 2004 54,795 156,917 154,189 – –<br />

Additions – 87 – 211,941 –<br />

Exercised – 90,398 – – –<br />

Forfeited 11,903 7,498 32,130 24,411 –<br />

Number of rights on 31 Dec. 2005 42,892 59,108 122,059 187,530 –<br />

Additions – – – – 173,682<br />

Exercised – 31,027 31,390 – –<br />

Forfeited – – – 3,072 –<br />

Number of rights on 31 Dec. <strong>2006</strong> 42,892 28,081 90,669 184,458 173,682<br />

Exercisable at year-end 42,892 28,081 90,669 – –<br />

Each stock appreciation right entitles the holder to draw in cash the<br />

difference between the <strong>Munich</strong> <strong>Re</strong> share price at the time when the<br />

right is exercised and the initial share price. The stock appreciation<br />

rights may only be exercised after a two-year vesting period and<br />

then only if the share price is at least 20% higher than the initial price.<br />

In addition, <strong>Munich</strong> <strong>Re</strong> shares must have outperformed the DAX 30<br />

(Plan 1999) or the EURO STOXX 50 (from Plan 2000 onwards) twice<br />

at the end of a three-month period during the term of the plan. The<br />

gross amount that may be obtained from the exercising of the stock<br />

appreciation rights is limited to an increase of 150% of the initial<br />

share price.<br />

When the stock appreciation rights are exercised, the cash payment<br />

is made (in the respective national currency) by the company<br />

that granted the rights. Stock appreciation rights not exercised on<br />

the last trading day of the plan term are exercised on the participant’s<br />

behalf insofar as the prerequisites for this are met. If the prerequisites<br />

are not met, the stock appreciation rights are forfeited. If<br />

another company acquires control of <strong>Munich</strong> <strong>Re</strong> or the company’s<br />

group of shareholders changes significantly due to a merger or comparable<br />

transaction or intended business combination (”change of<br />

control”), all plan participants from the <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> may exercise<br />

their stock appreciation rights within 60 days after the change of<br />

control becomes effective, even if the prerequisites for exercising the<br />

rights are not yet met at that juncture.<br />

(43) <strong>Re</strong>muneration report<br />

The total remuneration of <strong>Munich</strong> <strong>Re</strong>insurance Company’s Board<br />

of Management amounted to €25.6m (21.2m) and that of the Supervisory<br />

Board to €1.9m (1.9m). All other disclosures on the remuneration<br />

of and loans to Board members, share trading and shares held<br />

by the members of the Board of Management and the Supervisory<br />

Board, and the structure of the Board of Management’s remuneration<br />

system can be found in the remuneration report on page 114 f.<br />

(44) Employee share-ownership programmes<br />

In <strong>2006</strong>, <strong>Munich</strong> <strong>Re</strong>insurance Company staff were given the opportunity<br />

to acquire up to five employee shares at preferential conditions.<br />

The purchase price per share was €91.90, resulting in a benefit of<br />

€27.00 per share based on the share price applicable at the time the<br />

programme was granted. Altogether, 2,493 staff took advantage of<br />

the offer and acquired 12,355 shares; personnel expenses totalled<br />

T€334. In addition, staff of MEAG MUNICH ERGO AssetManagement<br />

GmbH or one of its subsidiaries had the opportunity to acquire up to<br />

five employee shares at preferential conditions. The purchase price<br />

per share was €82.84, resulting in a benefit of €27.00 per share based<br />

on the share price applicable at the time the programme was<br />

granted. Altogether, 469 staff took advantage of the offer and<br />

209