Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Munich Re Group Annual Report 2006 (PDF, 1.8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Re</strong>port <strong>2006</strong> Notes_Notes to the consolidated balance sheet – Assets<br />

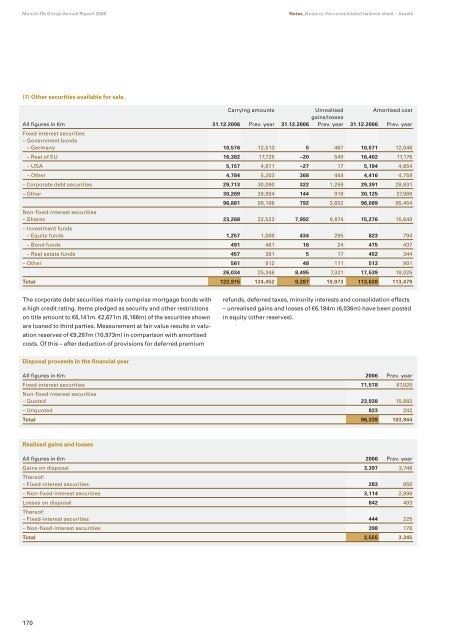

(7) Other securities available for sale<br />

Carrying amounts Unrealised<br />

gains/losses<br />

Amortised cost<br />

All figures in €m<br />

Fixed-interest securities<br />

– Government bonds<br />

31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year 31.12.<strong>2006</strong> Prev. year<br />

– Germany 10,576 12,513 5 467 10,571 12,046<br />

– <strong>Re</strong>st of EU 16,382 17,725 –20 549 16,402 17,176<br />

– USA 5,157 4,671 –27 17 5,184 4,654<br />

– Other 4,784 5,203 368 444 4,416 4,759<br />

– Corporate debt securities 29,713 30,090 322 1,259 29,391 28,831<br />

– Other 30,269 28,904 144 916 30,125 27,988<br />

Non-fixed-interest securities<br />

96,881 99,106 792 3,652 96,089 95,454<br />

– Shares<br />

– Investment funds<br />

23,268 22,523 7,992 6,874 15,276 15,649<br />

– Equity funds 1,257 1,089 434 295 823 794<br />

– Bond funds 491 461 16 24 475 437<br />

– <strong>Re</strong>al estate funds 457 361 5 17 452 344<br />

– Other 561 912 48 111 513 801<br />

26,034 25,346 8,495 7,321 17,539 18,025<br />

Total 122,915 124,452 9,287 10,973 113,628 113,479<br />

The corporate debt securities mainly comprise mortgage bonds with<br />

a high credit rating. Items pledged as security and other restrictions<br />

on title amount to €6,141m. €2,671m (6,166m) of the securities shown<br />

are loaned to third parties. Measurement at fair value results in valuation<br />

reserves of €9,287m (10,973m) in comparison with amortised<br />

costs. Of this – after deduction of provisions for deferred premium<br />

Disposal proceeds in the financial year<br />

170<br />

refunds, deferred taxes, minority interests and consolidation effects<br />

– unrealised gains and losses of €6,184m (6,036m) have been posted<br />

in equity (other reserves).<br />

All figures in €m <strong>2006</strong> Prev. year<br />

Fixed-interest securities<br />

Non-fixed-interest securities<br />

71,578 87,820<br />

– Quoted 23,938 15,882<br />

– Unquoted 823 242<br />

Total 96,339 103,944<br />

<strong>Re</strong>alised gains and losses<br />

All figures in €m <strong>2006</strong> Prev. year<br />

Gains on disposal 3,397 3,748<br />

Thereof:<br />

– Fixed-interest securities 283 850<br />

– Non-fixed-interest securities 3,114 2,898<br />

Losses on disposal 842 403<br />

Thereof:<br />

– Fixed-interest securities 444 225<br />

– Non-fixed-interest securities 398 178<br />

Total 2,555 3,345