department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

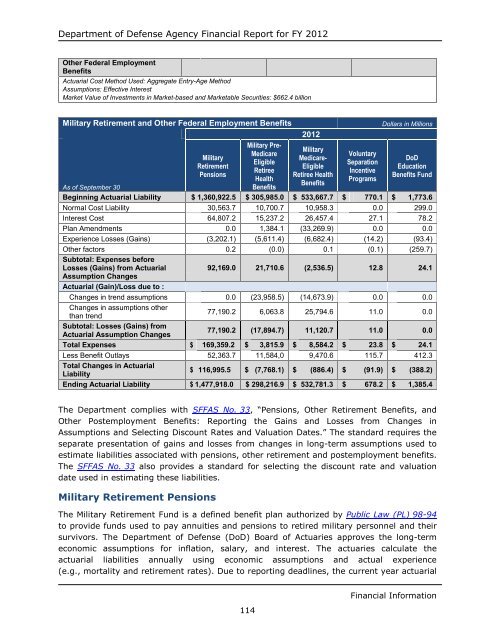

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

Other Federal Employment<br />

Benefits<br />

Actuarial Cost Method Used: Aggregate Entry-Age Method<br />

Assumptions: Effective Interest<br />

Market Value <strong>of</strong> Investments in Market-based and Marketable Securities: $662.4 billion<br />

Military Retirement and Other Federal Employment Benefits Dollars in Millions<br />

As <strong>of</strong> September 30<br />

Military<br />

Retirement<br />

Pensions<br />

Military Pre-<br />

Medicare<br />

Eligible<br />

Retiree<br />

Health<br />

Benefits<br />

<strong>2012</strong><br />

Military<br />

Medicare-<br />

Eligible<br />

Retiree Health<br />

Benefits<br />

Voluntary<br />

Separation<br />

Incentive<br />

Programs<br />

DoD<br />

Education<br />

Benefits Fund<br />

Beginning Actuarial Liability $ 1,360,922.5 $ 305,985.0 $ 533,667.7 $ 770.1 $ 1,773.6<br />

Normal Cost Liability 30,563.7 10,700.7 10,958.3 0.0 299.0<br />

Interest Cost 64,807.2 15,237.2 26,457.4 27.1 78.2<br />

Plan Amendments 0.0 1,384.1 (33,269.9) 0.0 0.0<br />

Experience Losses (Gains) (3,202.1) (5,611.4) (6,682.4) (14.2) (93.4)<br />

Other factors<br />

Subtotal: Expenses before<br />

0.2 (0.0) 0.1 (0.1) (259.7)<br />

Losses (Gains) from Actuarial<br />

Assumption Changes<br />

Actuarial (Gain)/Loss due to :<br />

92,169.0 21,710.6 (2,536.5) 12.8 24.1<br />

Changes in trend assumptions 0.0 (23,958.5) (14,673.9) 0.0 0.0<br />

Changes in assumptions other<br />

than trend<br />

77,190.2 6,063.8 25,794.6 11.0 0.0<br />

Subtotal: Losses (Gains) from<br />

Actuarial Assumption Changes<br />

77,190.2 (17,894.7) 11,120.7 11.0 0.0<br />

Total Expenses $ 169,359.2 $ 3,815.9 $ 8,584.2 $ 23.8 $ 24.1<br />

Less Benefit Outlays 52,363.7 11,584,0 9,470.6 115.7 412.3<br />

Total Changes in Actuarial<br />

Liability<br />

$ 116,995.5 $ (7,768.1) $ (886.4) $ (91.9) $ (388.2)<br />

Ending Actuarial Liability $ 1,477,918.0 $ 298,216.9 $ 532,781.3 $ 678.2 $ 1,385.4<br />

The Department complies with SFFAS No. 33, “Pensions, Other Retirement Benefits, and<br />

Other Postemployment Benefits: Reporting the Gains and Losses from Changes in<br />

Assumptions and Selecting Discount Rates and Valuation Dates.” The standard requires the<br />

separate presentation <strong>of</strong> gains and losses from changes in long-term assumptions used to<br />

estimate liabilities associated with pensions, other retirement and postemployment benefits.<br />

The SFFAS No. 33 also provides a standard for selecting the discount rate and valuation<br />

date used in estimating these liabilities.<br />

Military Retirement Pensions<br />

The Military Retirement Fund is a defined benefit plan authorized by Public Law (PL) 98-94<br />

to provide funds used to pay annuities and pensions to retired military personnel and their<br />

survivors. The Department <strong>of</strong> Defense (DoD) Board <strong>of</strong> Actuaries approves the long-term<br />

economic assumptions for inflation, salary, and interest. The actuaries calculate the<br />

actuarial liabilities annually using economic assumptions and actual experience<br />

(e.g., mortality and retirement rates). Due to <strong>report</strong>ing deadlines, the current <strong>year</strong> actuarial<br />

114<br />

Financial Information