department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

Section 2801) and includes a series <strong>of</strong> authorities that allow the Department to work with<br />

the private sector to renovate and build military family housing. The MHPI accelerates the<br />

construction <strong>of</strong> new housing built to market standards, and leverages private sector capital.<br />

One <strong>of</strong> the goals <strong>of</strong> the Department is to obtain private sector capital to leverage<br />

government dollars. The Department provides protection to the private sector partner<br />

against specific risks, such as base closure or member deployment.<br />

Armament Retooling and Manufacturing Support Initiative<br />

The ARMS Initiative, Title 10 United States Code 4551-4555, is a loan guarantee program<br />

designed to encourage commercial use <strong>of</strong> the Army’s inactive ammunition plants through<br />

incentives for businesses willing to locate to a government ammunition production facility.<br />

The production capacity <strong>of</strong> these facilities is greater than current military requirements;<br />

however, this capacity may be needed by the military in the future. Revenues from property<br />

rentals are used to help <strong>of</strong>fset the overhead costs for the operation, maintenance and<br />

environmental cleanup at the facilities.<br />

In an effort to preclude any additional loan liability, the Army instituted an ARMS loan<br />

guarantee moratorium in FY 2004. The Army continues to operate under the moratorium<br />

and does not anticipate new loans.<br />

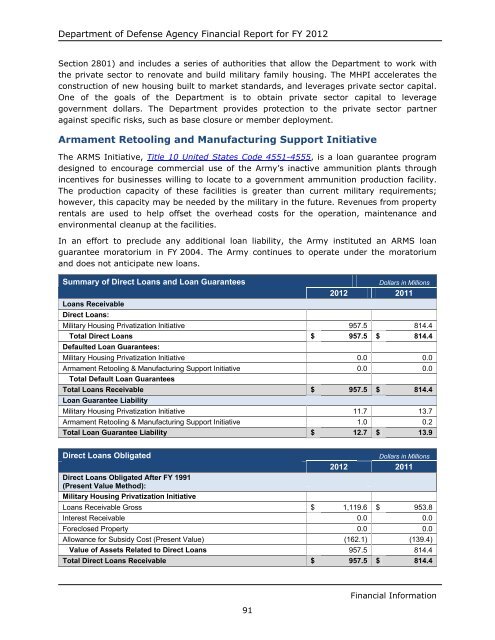

Summary <strong>of</strong> Direct Loans and Loan Guarantees Dollars in Millions<br />

<strong>2012</strong> 2011<br />

Loans Receivable<br />

Direct Loans:<br />

Military Housing Privatization Initiative 957.5 814.4<br />

Total Direct Loans<br />

Defaulted Loan Guarantees:<br />

$ 957.5 $ 814.4<br />

Military Housing Privatization Initiative 0.0 0.0<br />

Armament Retooling & Manufacturing Support Initiative<br />

Total Default Loan Guarantees<br />

0.0 0.0<br />

Total Loans Receivable<br />

Loan Guarantee Liability<br />

$ 957.5 $ 814.4<br />

Military Housing Privatization Initiative 11.7 13.7<br />

Armament Retooling & Manufacturing Support Initiative 1.0 0.2<br />

Total Loan Guarantee Liability $ 12.7 $ 13.9<br />

Direct Loans Obligated Dollars in Millions<br />

<strong>2012</strong> 2011<br />

Direct Loans Obligated After FY 1991<br />

(Present Value Method):<br />

Military Housing Privatization Initiative<br />

Loans Receivable Gross $ 1,119.6 $ 953.8<br />

Interest Receivable 0.0 0.0<br />

Foreclosed Property 0.0 0.0<br />

Allowance for Subsidy Cost (Present Value) (162.1) (139.4)<br />

Value <strong>of</strong> Assets Related to Direct Loans 957.5 814.4<br />

Total Direct Loans Receivable $ 957.5 $ 814.4<br />

91<br />

Financial Information