department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

The Department invests primarily in non-marketable, market-based securities. The value <strong>of</strong><br />

these securities fluctuates in tandem with the selling price <strong>of</strong> the equivalent marketable<br />

security. The securities are purchased with the intent to hold until maturity, thus balances<br />

are not adjusted to market value.<br />

The U.S. Treasury securities are issued to the earmarked funds as evidence <strong>of</strong> its receipts<br />

and are an asset to the Department and a liability to the U.S. Treasury. The Federal<br />

Government does not set aside assets to pay future benefits or other expenditures<br />

associated with earmarked funds. The cash generated from earmarked funds is deposited in<br />

the U.S. Treasury and used for general government purposes. Since the Department and<br />

the U.S. Treasury are both part <strong>of</strong> the Federal Government, these assets and liabilities<br />

<strong>of</strong>fset each other from the standpoint <strong>of</strong> the Federal Government as a whole. For this<br />

reason, they do not represent an asset or a liability in the U.S. Government wide <strong>financial</strong><br />

statements.<br />

The U.S. Treasury securities provide the Department with authority to draw upon the<br />

U.S. Treasury to make future benefit payments or other expenditures. When the<br />

Department requires redemption <strong>of</strong> these securities to make expenditures, the Government<br />

will finance them from accumulated cash balances, by raising taxes or other receipts,<br />

borrowing from the public or repaying less debt, or curtailing other expenditures. The<br />

Federal Government uses the same method to finance all other expenditures.<br />

Other Funds primarily consists <strong>of</strong> $2.0 billion in investments <strong>of</strong> the DoD Education Benefits<br />

Trust Fund, $817.9 million in investments <strong>of</strong> the Host Nation Support for U.S. Relocation<br />

Activities Trust Fund, and $316.7 million in investments <strong>of</strong> the Voluntary Separation<br />

Incentive Trust Fund.<br />

Other Investments consist <strong>of</strong> Military Housing Privatization Initiative limited partnerships.<br />

The limited partnerships support military housing at Army, Air Force, Navy and Marine<br />

Corps installations. This investment relates to limited partnerships that do not require<br />

Market Value Disclosure.<br />

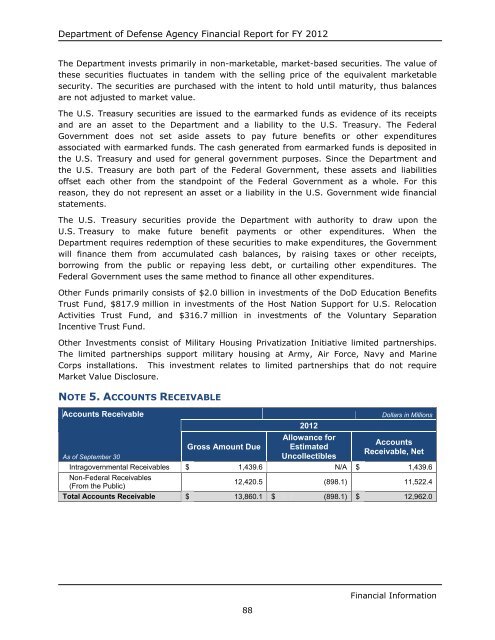

NOTE 5. ACCOUNTS RECEIVABLE<br />

Accounts Receivable<br />

<strong>2012</strong><br />

Dollars in Millions<br />

As <strong>of</strong> September 30<br />

Gross Amount Due<br />

Allowance for<br />

Estimated<br />

Uncollectibles<br />

Accounts<br />

Receivable, Net<br />

Intragovernmental Receivables $ 1,439.6 N/A $ 1,439.6<br />

Non-Federal Receivables<br />

(From the Public)<br />

12,420.5 (898.1) 11,522.4<br />

Total Accounts Receivable $ 13,860.1 $ (898.1) $ 12,962.0<br />

88<br />

Financial Information