department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

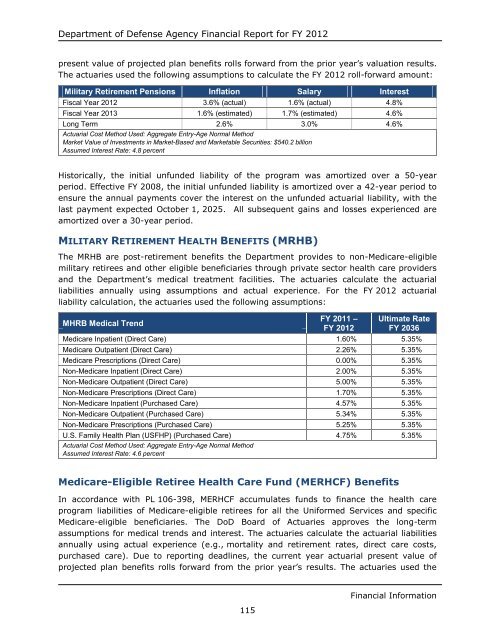

present value <strong>of</strong> projected plan benefits rolls forward from the prior <strong>year</strong>’s valuation results.<br />

The actuaries used the following assumptions to calculate the FY <strong>2012</strong> roll-forward amount:<br />

Military Retirement Pensions Inflation Salary Interest<br />

Fiscal Year <strong>2012</strong> 3.6% (actual) 1.6% (actual) 4.8%<br />

Fiscal Year 2013 1.6% (estimated) 1.7% (estimated) 4.6%<br />

Long Term 2.6% 3.0% 4.6%<br />

Actuarial Cost Method Used: Aggregate Entry-Age Normal Method<br />

Market Value <strong>of</strong> Investments in Market-Based and Marketable Securities: $540.2 billion<br />

Assumed Interest Rate: 4.8 percent<br />

Historically, the initial unfunded liability <strong>of</strong> the program was amortized over a 50-<strong>year</strong><br />

period. Effective FY 2008, the initial unfunded liability is amortized over a 42-<strong>year</strong> period to<br />

ensure the annual payments cover the interest on the unfunded actuarial liability, with the<br />

last payment expected October 1, 2025. All subsequent gains and losses experienced are<br />

amortized over a 30-<strong>year</strong> period.<br />

MILITARY RETIREMENT HEALTH BENEFITS (MRHB)<br />

The MRHB are post-retirement benefits the Department provides to non-Medicare-eligible<br />

military retirees and other eligible beneficiaries through private sector health care providers<br />

and the Department’s medical treatment facilities. The actuaries calculate the actuarial<br />

liabilities annually using assumptions and actual experience. For the FY <strong>2012</strong> actuarial<br />

liability calculation, the actuaries used the following assumptions:<br />

MHRB Medical Trend<br />

115<br />

FY 2011 –<br />

FY <strong>2012</strong><br />

Ultimate Rate<br />

FY 2036<br />

Medicare Inpatient (Direct Care) 1.60% 5.35%<br />

Medicare Outpatient (Direct Care) 2.26% 5.35%<br />

Medicare Prescriptions (Direct Care) 0.00% 5.35%<br />

Non-Medicare Inpatient (Direct Care) 2.00% 5.35%<br />

Non-Medicare Outpatient (Direct Care) 5.00% 5.35%<br />

Non-Medicare Prescriptions (Direct Care) 1.70% 5.35%<br />

Non-Medicare Inpatient (Purchased Care) 4.57% 5.35%<br />

Non-Medicare Outpatient (Purchased Care) 5.34% 5.35%<br />

Non-Medicare Prescriptions (Purchased Care) 5.25% 5.35%<br />

U.S. Family Health Plan (USFHP) (Purchased Care)<br />

Actuarial Cost Method Used: Aggregate Entry-Age Normal Method<br />

Assumed Interest Rate: 4.6 percent<br />

4.75% 5.35%<br />

Medicare-Eligible Retiree Health Care Fund (MERHCF) Benefits<br />

In accordance with PL 106-398, MERHCF accumulates funds to finance the health care<br />

program liabilities <strong>of</strong> Medicare-eligible retirees for all the Uniformed Services and specific<br />

Medicare-eligible beneficiaries. The DoD Board <strong>of</strong> Actuaries approves the long-term<br />

assumptions for medical trends and interest. The actuaries calculate the actuarial liabilities<br />

annually using actual experience (e.g., mortality and retirement rates, direct care costs,<br />

purchased care). Due to <strong>report</strong>ing deadlines, the current <strong>year</strong> actuarial present value <strong>of</strong><br />

projected plan benefits rolls forward from the prior <strong>year</strong>’s results. The actuaries used the<br />

Financial Information