department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

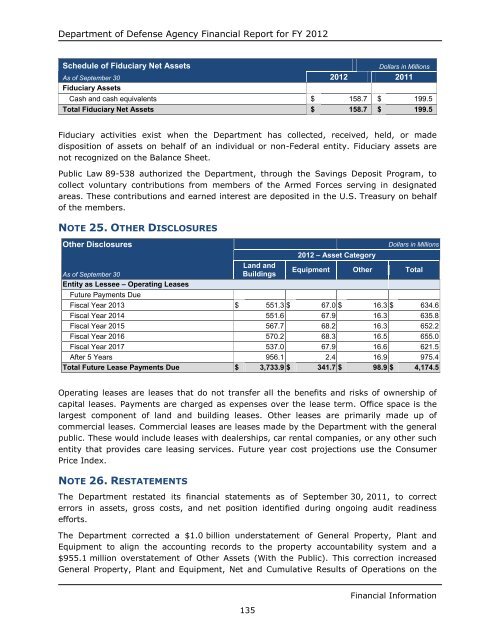

Schedule <strong>of</strong> Fiduciary Net Assets Dollars in Millions<br />

As <strong>of</strong> September 30 <strong>2012</strong> 2011<br />

Fiduciary Assets<br />

Cash and cash equivalents $ 158.7 $ 199.5<br />

Total Fiduciary Net Assets $ 158.7 $ 199.5<br />

Fiduciary activities exist when the Department has collected, received, held, or made<br />

disposition <strong>of</strong> assets on behalf <strong>of</strong> an individual or non-Federal entity. Fiduciary assets are<br />

not recognized on the Balance Sheet.<br />

Public Law 89-538 authorized the Department, through the Savings Deposit Program, to<br />

collect voluntary contributions from members <strong>of</strong> the Armed Forces serving in designated<br />

areas. These contributions and earned interest are deposited in the U.S. Treasury on behalf<br />

<strong>of</strong> the members.<br />

NOTE 25. OTHER DISCLOSURES<br />

Other Disclosures Dollars in Millions<br />

<strong>2012</strong> – Asset Category<br />

As <strong>of</strong> September 30<br />

Entity as Lessee – Operating Leases<br />

Future Payments Due<br />

Land and<br />

Buildings<br />

Equipment Other Total<br />

Fiscal Year 2013 $ 551.3 $ 67.0 $ 16.3 $ 634.6<br />

Fiscal Year 2014 551.6 67.9 16.3 635.8<br />

Fiscal Year 2015 567.7 68.2 16.3 652.2<br />

Fiscal Year 2016 570.2 68.3 16.5 655.0<br />

Fiscal Year 2017 537.0 67.9 16.6 621.5<br />

After 5 Years 956.1 2.4 16.9 975.4<br />

Total Future Lease Payments Due $ 3,733.9 $ 341.7 $ 98.9 $ 4,174.5<br />

Operating leases are leases that do not transfer all the benefits and risks <strong>of</strong> ownership <strong>of</strong><br />

capital leases. Payments are charged as expenses over the lease term. Office space is the<br />

largest component <strong>of</strong> land and building leases. Other leases are primarily made up <strong>of</strong><br />

commercial leases. Commercial leases are leases made by the Department with the general<br />

public. These would include leases with dealerships, car rental companies, or any other such<br />

entity that provides care leasing services. Future <strong>year</strong> cost projections use the Consumer<br />

Price Index.<br />

NOTE 26. RESTATEMENTS<br />

The Department restated its <strong>financial</strong> statements as <strong>of</strong> September 30, 2011, to correct<br />

errors in assets, gross costs, and net position identified during ongoing audit readiness<br />

efforts.<br />

The Department corrected a $1.0 billion understatement <strong>of</strong> General Property, Plant and<br />

Equipment to align the accounting records to the property accountability system and a<br />

$955.1 million overstatement <strong>of</strong> Other Assets (With the Public). This correction increased<br />

General Property, Plant and Equipment, Net and Cumulative Results <strong>of</strong> Operations on the<br />

135<br />

Financial Information