department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

• Continued work with Contracting Officers to simplify contract terms and eliminate the<br />

need for manual calculations.<br />

The Department is very pleased with the continuing success <strong>of</strong> its pre-payment review using<br />

BAM. Since its initial roll out in August 2008, more than $4.5 billion in improper payments<br />

have been prevented. The ongoing payment error analyses allow for the continual<br />

enhancement <strong>of</strong> BAM logic and improved disbursement accuracy.<br />

Another initiative to reduce improper payments includes outreach to reduce vendor billing<br />

errors caused by duplicate manual and electronic submission <strong>of</strong> invoices. In addition, the<br />

Department conducts manual reviews to ensure it meets all Certifying Officer Legislation<br />

requirements prior to certifying payment, such as ensuring proper documentation and<br />

correct payment amounts before disbursement.<br />

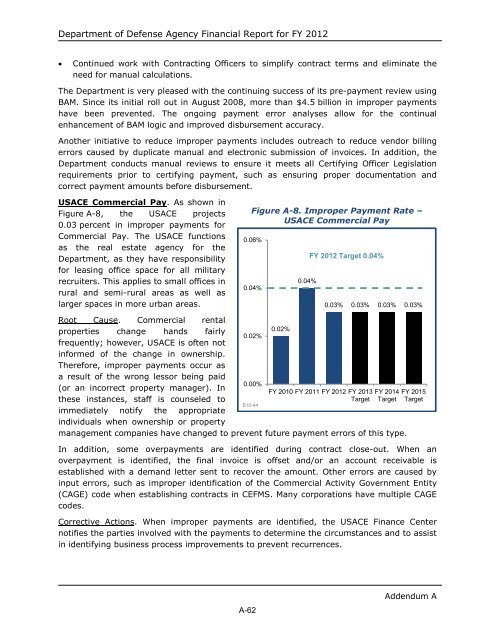

USACE Commercial Pay. As shown in<br />

Figure A-8, the USACE projects<br />

0.03 percent in improper payments for<br />

Commercial Pay. The USACE functions<br />

as the real estate <strong>agency</strong> for the<br />

Department, as they have responsibility<br />

for leasing <strong>of</strong>fice space for all military<br />

recruiters. This applies to small <strong>of</strong>fices in<br />

rural and semi-rural areas as well as<br />

larger spaces in more urban areas.<br />

Root Cause. Commercial rental<br />

properties change hands fairly<br />

frequently; however, USACE is <strong>of</strong>ten not<br />

informed <strong>of</strong> the change in ownership.<br />

Therefore, improper payments occur as<br />

a result <strong>of</strong> the wrong lessor being paid<br />

(or an incorrect property manager). In<br />

these instances, staff is counseled to<br />

immediately notify the appropriate<br />

individuals when ownership or property<br />

A-62<br />

Figure A-8. Improper Payment Rate –<br />

USACE Commercial Pay<br />

0.06%<br />

0.04%<br />

0.02%<br />

0.00%<br />

management companies have changed to prevent future payment errors <strong>of</strong> this type.<br />

B10-44<br />

In addition, some overpayments are identified during contract close-out. When an<br />

overpayment is identified, the final invoice is <strong>of</strong>fset and/or an account receivable is<br />

established with a demand letter sent to recover the amount. Other errors are caused by<br />

input errors, such as improper identification <strong>of</strong> the Commercial Activity Government Entity<br />

(CAGE) code when establishing contracts in CEFMS. Many corporations have multiple CAGE<br />

codes.<br />

Corrective Actions. When improper payments are identified, the USACE Finance Center<br />

notifies the parties involved with the payments to determine the circumstances and to assist<br />

in identifying business process improvements to prevent recurrences.<br />

0.02%<br />

0.04%<br />

FY <strong>2012</strong> Target 0.04%<br />

FY 2010 FY 2011 FY <strong>2012</strong> FY 2013<br />

Target<br />

0.03% 0.03% 0.03% 0.03%<br />

FY 2014<br />

Target<br />

FY 2015<br />

Target<br />

Addendum A