department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

identify processes needing additional attention or correction. The added reviews, coupled<br />

with ongoing review <strong>of</strong> deceased retiree and annuitant accounts, has allowed DFAS to<br />

provide a more comprehensive and concise accounting <strong>of</strong> outlays in military retirement.<br />

Root Causes. Eligibility for military retired pay ends on the retiree’s date <strong>of</strong> death. Prompt<br />

<strong>report</strong>ing <strong>of</strong> a deceased retiree's death can help avoid delay and possible <strong>financial</strong> hardship<br />

to surviving beneficiaries, family members or executors, who are required to return any<br />

unearned payments <strong>of</strong> the decedent's military retired pay. The delay in notifying the payroll<br />

activity <strong>of</strong> the death <strong>of</strong> a Military Retiree results in unavoidable overpayments to deceased<br />

retirees. Our review <strong>of</strong> confirmed overpayments to deceased retirees in FY <strong>2012</strong> disclosed<br />

that the Department recovered approximately 96 percent <strong>of</strong> the overpayments within<br />

60 days, demonstrating the effectiveness <strong>of</strong> controls within the retired pay system once the<br />

Department is notified <strong>of</strong> a retiree’s death.<br />

Corrective Actions. The Department’s control processes to prevent, identify, and reduce<br />

overpayments to deceased retirees and annuitants include:<br />

• Validating existence <strong>of</strong> retiree and/or annuitant, if living outside the United States;<br />

• Annual certification <strong>of</strong> existence for all annuitants<br />

• Periodic random certifications for retirees over a certain age;<br />

• Validating Military Retiree existence if payments are returned and/or if account was<br />

suspended for several months due to bad check/correspondence address.<br />

Early detection and data mining efforts, along with partnerships with other Federal and state<br />

entities, also are used. The Department takes a proactive approach to ensure the accuracy<br />

<strong>of</strong> Military retiree payments, routinely comparing retired and annuitant payroll master file<br />

databases with the Social Security Administration’s death master file and periodically<br />

comparing records with the Office <strong>of</strong> Personnel Management’s deceased files, Department <strong>of</strong><br />

Veterans Affairs’ database, and with<br />

individual states with sizable retiree and<br />

annuitant populations (e.g., Texas,<br />

California, and Florida). Payments for<br />

Military retirees identified as deceased<br />

are suspended pending validation <strong>of</strong><br />

death or validation <strong>of</strong> continued<br />

eligibility. The Department's expanded<br />

definition <strong>of</strong> acceptable source<br />

documents for notice <strong>of</strong> death has<br />

allowed DFAS to initiate earlier<br />

reclamation actions, thereby increasing<br />

faster recovery <strong>of</strong> funds paid after date<br />

<strong>of</strong> death.<br />

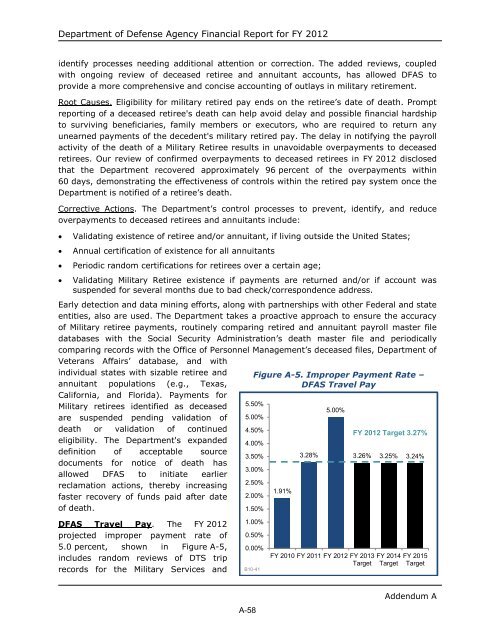

DFAS Travel Pay. The FY <strong>2012</strong><br />

projected improper payment rate <strong>of</strong><br />

5.0 percent, shown in Figure A-5,<br />

includes random reviews <strong>of</strong> DTS trip<br />

records for the Military Services and<br />

A-58<br />

Figure A-5. Improper Payment Rate –<br />

DFAS Travel Pay<br />

5.50%<br />

5.00%<br />

4.50%<br />

4.00%<br />

3.50%<br />

3.00%<br />

2.50%<br />

2.00%<br />

1.50%<br />

1.00%<br />

0.50%<br />

0.00%<br />

B10-41<br />

1.91%<br />

3.28%<br />

5.00%<br />

FY 2010 FY 2011 FY <strong>2012</strong> FY 2013<br />

Target<br />

FY <strong>2012</strong> Target 3.27%<br />

3.26% 3.25% 3.24%<br />

FY 2014<br />

Target<br />

FY 2015<br />

Target<br />

Addendum A