department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

department of defense agency financial report fiscal year 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Department <strong>of</strong> Defense Agency Financial Report for FY <strong>2012</strong><br />

$100.1 million. In past <strong>year</strong>s, DFAS<br />

<strong>report</strong>ed actual improper payments in<br />

Commercial Pay and did not use a<br />

statistically valid estimation process. The<br />

actual Commercial Pay improper<br />

payments are $318.3 million, versus the<br />

estimated $100.1 million in improper<br />

payments derived from statistical<br />

sampling methods.<br />

The main reason for the difference<br />

between the FY <strong>2012</strong> actual amount <strong>of</strong><br />

$318.3 million in improper payments and<br />

the $100.1 million in improper payments<br />

derived from statistical sampling is due<br />

to the sample design. The statistical<br />

sampling was based on the number <strong>of</strong><br />

invoices processed, in compliance with<br />

OMB guidance, but the sample was not<br />

stratified by invoice amount; therefore, a<br />

$10 million invoice has the same chance<br />

<strong>of</strong> being sampled as a $100 invoice. Also, vendors are required by law to return<br />

overpayments, and large overpayments are always noticed more quickly than immaterial<br />

overpayments.<br />

The DFAS identifies and prevents improper payments in DoD’s five largest commercial<br />

payment systems through use <strong>of</strong> the pre-payment Business Activity Monitoring (BAM) tool,<br />

initially deployed in August 2008. These systems, which account for 91 percent <strong>of</strong> all DoD<br />

commercial payment dollars, include MOCAS, CAPS-Windows, IAPS, One Pay, and EBS.<br />

These types <strong>of</strong> preventative program activities consistently prove to be the most cost<br />

effective.<br />

The DFAS identifies and monitors the root cause for all improper payments by researching<br />

supporting documentation and assigning a code that identifies the type <strong>of</strong> improper<br />

payment. In addition, improper payments detected by BAM in the pre-payment environment<br />

are reviewed and analyzed along with development <strong>of</strong> new integrity checks. Corrective<br />

action plans are developed through collaboration and monitored through DFAS post pay<br />

reviews and DFAS Site operational reviews. Developed project plans include testing and<br />

tracking <strong>of</strong> each individual Site plan.<br />

Root Causes. The majority <strong>of</strong> errors in commercial pay improper payments are caused by<br />

input errors into the payment systems.<br />

Corrective Actions. The ongoing corrective actions include:<br />

A-61<br />

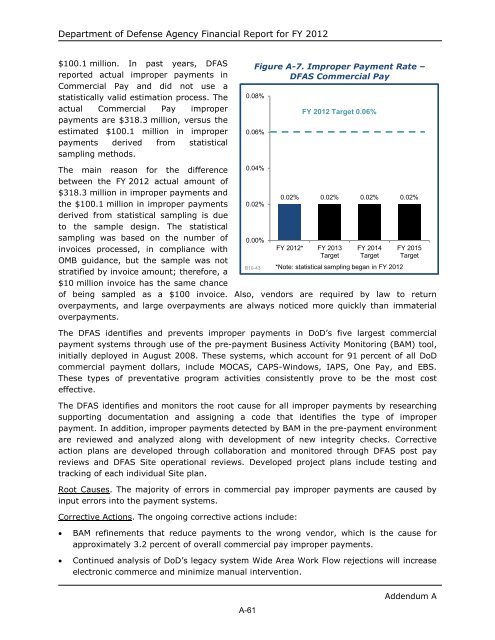

Figure A-7. Improper Payment Rate –<br />

DFAS Commercial Pay<br />

0.08%<br />

0.06%<br />

0.04%<br />

0.02%<br />

0.00%<br />

B10-43<br />

FY <strong>2012</strong> Target 0.06%<br />

0.02% 0.02% 0.02% 0.02%<br />

FY <strong>2012</strong>* FY 2013<br />

Target<br />

FY 2014<br />

Target<br />

*Note: statistical sampling began in FY <strong>2012</strong><br />

FY 2015<br />

Target<br />

• BAM refinements that reduce payments to the wrong vendor, which is the cause for<br />

approximately 3.2 percent <strong>of</strong> overall commercial pay improper payments.<br />

• Continued analysis <strong>of</strong> DoD’s legacy system Wide Area Work Flow rejections will increase<br />

electronic commerce and minimize manual intervention.<br />

Addendum A