Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

56<br />

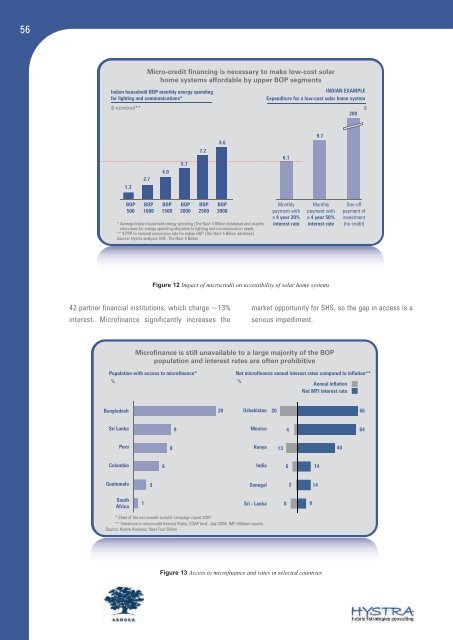

Micro-credit financing is necessary <strong>to</strong> make low-cost solar<br />

home systems af<strong>for</strong>dable by upper BOP segments<br />

Indian household BOP monthly energy spending<br />

INDIAN EXAMPLE<br />

<strong>for</strong> lighting and communications* Expenditure <strong>for</strong> a low-cost solar home system<br />

$ nominal** $<br />

200<br />

1.3<br />

BOP<br />

500<br />

2.7<br />

BOP<br />

1000<br />

BOP<br />

1500<br />

BOP<br />

2000<br />

BOP<br />

2500<br />

BOP<br />

3000<br />

42 partner financial institutions, which charge ~13%<br />

interest. Micr<strong>of</strong>inance significantly increases <strong>the</strong><br />

4.0<br />

5.7<br />

* Average Indian household energy spending (The Next 4 Billion database) and experts<br />

interviews <strong>for</strong> energy spending allocation <strong>to</strong> lighting and communication needs<br />

** $ PPP <strong>to</strong> nominal conversion rate <strong>for</strong> Indian BOP (The Next 4 Billion database)<br />

Source: Hystra analysis; IMF; The Next 4 Billion<br />

Bangladesh<br />

7.2<br />

8.6<br />

Figure 12 Impact <strong>of</strong> microcredit on accessibility <strong>of</strong> solar home systems<br />

6.1<br />

Monthly<br />

payment with<br />

a 4 year 20%<br />

interest rate<br />

9.7<br />

Monthly<br />

payment with<br />

a 4 year 50%<br />

interest rate<br />

Figure 13 <strong>Access</strong> <strong>to</strong> micr<strong>of</strong>inance and rates in selected countries<br />

One-<strong>of</strong>f<br />

payment <strong>of</strong><br />

investment<br />

(no credit)<br />

market opportunity <strong>for</strong> SHS, so <strong>the</strong> gap in access is a<br />

serious impediment.<br />

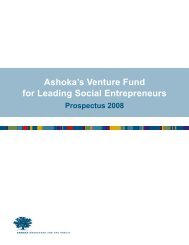

Micr<strong>of</strong>inance is still unavailable <strong>to</strong> a large majority <strong>of</strong> <strong>the</strong> BOP<br />

population and interest rates are <strong>of</strong>ten prohibitive<br />

Population with access <strong>to</strong> micr<strong>of</strong>inance* Net micr<strong>of</strong>inance annual interest rates compared <strong>to</strong> inflation**<br />

% %<br />

Annual inflation<br />

Net MFI interest rate<br />

Sri Lanka<br />

Peru<br />

Colombia<br />

Guatemala<br />

South<br />

Africa<br />

1<br />

3<br />

6<br />

8<br />

9<br />

20 Uzbekistan 20 66<br />

Mexico<br />

Kenya<br />

India<br />

Senegal<br />

Sri - Lanka<br />

* State <strong>of</strong> <strong>the</strong> microcredit summit campaign report 2007<br />

** Variations in microcredit Interest Rates, CGAP brief, July 2008; IMF Inflation reports<br />

Source: Hystra Analysis; Next Four Billion<br />

13<br />

8<br />

4<br />

6<br />

2<br />

9<br />

14<br />

14<br />

40<br />

64