Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

80<br />

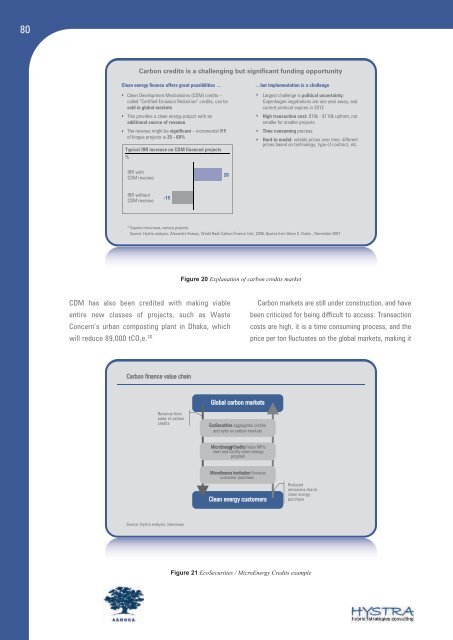

Carbon credits is a challenging but significant funding opportunity<br />

Clean energy finance <strong>of</strong>fers great possibilities …<br />

� Clean Development Mechanisms (CDM) credits –<br />

called “Certified Emission Reduction” credits, can be<br />

sold in global markets<br />

� This provides a clean energy project with an<br />

additional source <strong>of</strong> revenue<br />

� The revenue might be significant – incremental IRR<br />

<strong>of</strong> biogas projects is 25 - 60%<br />

Typical IRR increase on CDM financed projects<br />

%<br />

IRR with<br />

CDM revenue<br />

IRR without<br />

CDM revenue<br />

* Experts interviews, various projects<br />

Source: Hystra analysis; Alexandre Kossoy, World Bank Carbon Finance Unit, 2006; Quotes from Glenn S. Hodes , November 2007<br />

CDM has also been credited with making viable<br />

entire new classes <strong>of</strong> projects, such as Waste<br />

Concern’s urban composting plant in Dhaka, which<br />

will reduce 89,000 tCO2e. 20<br />

-15<br />

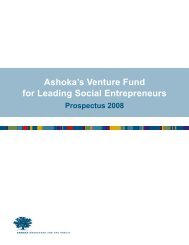

Carbon finance value chain<br />

Revenue from<br />

sales <strong>of</strong> carbon<br />

credits<br />

Source: Hystra analysis; interviews<br />

20<br />

Figure 20 Explanation <strong>of</strong> carbon credits market<br />

Global carbon markets<br />

EcoSecurities aggregates credits<br />

and sells on carbon markets<br />

Micro<strong>Energy</strong> Credits helps MFIs<br />

start and certify clean energy<br />

program<br />

Micr<strong>of</strong>inance Institution finances<br />

cus<strong>to</strong>mer purchase<br />

Clean energy cus<strong>to</strong>mers<br />

…but implementation is a challenge<br />

� Largest challenge is political uncertainty:<br />

Copenhagen negotiations are one year away, and<br />

current pro<strong>to</strong>col expires in 2012<br />

� High transaction cost: $70k - $110k upfront, not<br />

smaller <strong>for</strong> smaller projects<br />

� Time consuming process<br />

� Hard <strong>to</strong> model: volatile prices over time, different<br />

prices based on technology, type <strong>of</strong> contract, etc.<br />

Figure 21 EcoSecurities / Micro<strong>Energy</strong> Credits example<br />

Carbon markets are still under construction, and have<br />

been criticized <strong>for</strong> being difficult <strong>to</strong> access. Transaction<br />

costs are high, it is a time consuming process, and <strong>the</strong><br />

price per <strong>to</strong>n fluctuates on <strong>the</strong> global markets, making it<br />

Reduced<br />

emissions due <strong>to</strong><br />

clean energy<br />

purchase