Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

Access to Energy for the Base of the - Ashoka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

82<br />

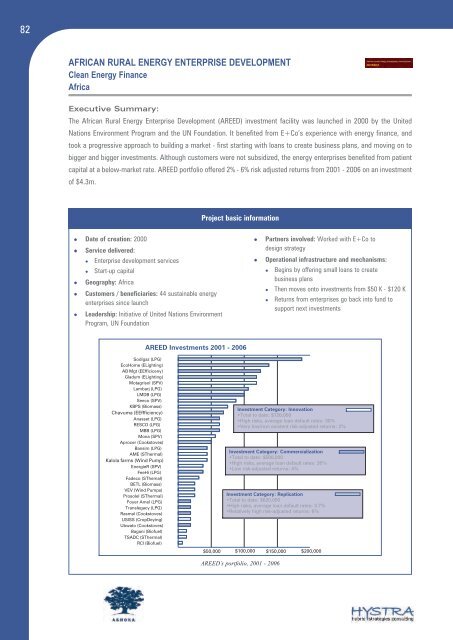

AFRICAN RURAL ENERGY ENTERPRISE DEVELOPMENT<br />

Clean <strong>Energy</strong> Finance<br />

Africa<br />

Executive Summary:<br />

The African Rural <strong>Energy</strong> Enterprise Development (AREED) investment facility was launched in 2000 by <strong>the</strong> United<br />

Nations Environment Program and <strong>the</strong> UN Foundation. It benefited from E+Co’s experience with energy finance, and<br />

<strong>to</strong>ok a progressive approach <strong>to</strong> building a market - first starting with loans <strong>to</strong> create business plans, and moving on <strong>to</strong><br />

bigger and bigger investments. Although cus<strong>to</strong>mers were not subsidized, <strong>the</strong> energy enterprises benefited from patient<br />

capital at a below-market rate. AREED portfolio <strong>of</strong>fered 2% - 6% risk adjusted returns from 2001 - 2006 on an investment<br />

<strong>of</strong> $4.3m.<br />

� Date <strong>of</strong> creation: 2000<br />

�� Service delivered:<br />

� Enterprise development services<br />

� Start-up capital<br />

� Geography: Africa<br />

� Cus<strong>to</strong>mers / beneficiaries: 44 sustainable energy<br />

enterprises since launch<br />

� Leadership: Initiative <strong>of</strong> United Nations Environment<br />

Program, UN Foundation<br />

Sodigaz (LPG)<br />

EcoHome (ELighting)<br />

AB Mgt (EEfficiceny)<br />

Gladym (ELighting)<br />

Motagrisol (SPV)<br />

Lambarj (LPG)<br />

LMDB (LPG)<br />

Seeco (SPV)<br />

KBPS (Biomass)<br />

Chavuma (EEffficiency)<br />

Anasset (LPG)<br />

RESCO (LPG)<br />

MBB (LPG)<br />

Mona (SPV)<br />

Aprocer (Cooks<strong>to</strong>ves)<br />

Bansim (LPG)<br />

AME (SThermal)<br />

Kalola farms (Wind Pump)<br />

EnergieR (SPV)<br />

FeeHi (LPG)<br />

Fadeco (SThemal)<br />

BETL (Biomass)<br />

VEV (Wind Pumps)<br />

Prosolel (SThermal)<br />

Foyer Amel (LPG)<br />

Translegacy (LPG)<br />

Rasmal (Cooks<strong>to</strong>ves)<br />

USISS (CropDeying)<br />

Ubwa<strong>to</strong> (Cooks<strong>to</strong>ves)<br />

Bagani (Bi<strong>of</strong>uel)<br />

TSADC (SThermal)<br />

RCI (Bi<strong>of</strong>uel)<br />

Project basic in<strong>for</strong>mation<br />

AREED Investments 2001 - 2006<br />

AREED’s portfolio, 2001 - 2006<br />

� Partners involved: Worked with E+Co <strong>to</strong><br />

design strategy<br />

� Operational infrastructure and mechanisms:<br />

� Begins by <strong>of</strong>fering small loans <strong>to</strong> create<br />

business plans<br />

� Then moves on<strong>to</strong> investments from $50 K - $120 K<br />

� Returns from enterprises go back in<strong>to</strong> fund <strong>to</strong><br />

support next investments<br />

Investment Category: Innovation<br />

•Total <strong>to</strong> date: $720,000<br />

•High risks, average loan default rates: 30%<br />

•Very low/non existent risk-adjusted returns: 2%<br />

Investment Category: Commercialization<br />

•Total <strong>to</strong> date: $500,000<br />

•High risks, average loan default rates: 26%<br />

•Low risk-adjusted returns: 4%<br />

Investment Category: Replication<br />

•Total <strong>to</strong> date: $620,000<br />

•High risks, average loan default rates: 3.7%<br />

•Relatively high risk-adjusted returns: 6%<br />

$50,000 $100,000 $150,000 $200,000