Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

148<br />

6<br />

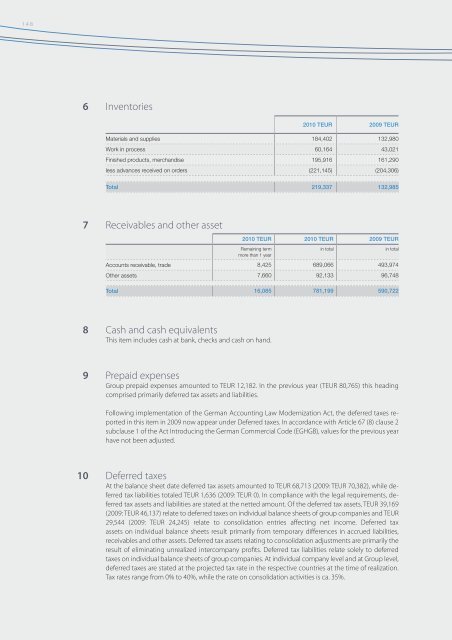

Inventories<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Materials and supplies 184,402 132,980<br />

Work in process 60,164 43,021<br />

Finished products, merchandise 195,916 161,290<br />

less advances received on orders (221,145) (204,306)<br />

Total 219,337 132,985<br />

7<br />

Receivables and other asset<br />

<strong>2010</strong> TEUR <strong>2010</strong> TEUR 2009 TEUR<br />

Remaining term<br />

more than 1 year<br />

Accounts receivable, trade 8,425 689,066 493,974<br />

Other assets 7,660 92,133 96,748<br />

in total<br />

in total<br />

Total 16,085 781,199 590,722<br />

8<br />

Cash and cash equivalents<br />

This item includes cash at bank, checks and cash on hand.<br />

9<br />

Prepaid expenses<br />

Group prepaid expenses amounted to TEUR 12,182. In the previous year (TEUR 80,765) this heading<br />

comprised primarily deferred tax assets and liabilities.<br />

Following implementation of the German Accounting Law Modernization Act, the deferred taxes reported<br />

in this item in 2009 now appear under Deferred taxes. In accordance with Article 67 (8) clause 2<br />

subclause 1 of the Act Introducing the German Commercial Code (EGHGB), values for the previous year<br />

have not been adjusted.<br />

10<br />

Deferred taxes<br />

At the balance sheet date deferred tax assets amounted to TEUR 68,713 (2009: TEUR 70,382), while deferred<br />

tax liabilities totaled TEUR 1,636 (2009: TEUR 0). In compliance with the legal requirements, deferred<br />

tax assets and liabilities are stated at the netted amount. Of the deferred tax assets, TEUR 39,169<br />

(2009: TEUR 46,137) relate to deferred taxes on individual balance sheets of group companies and TEUR<br />

29,544 (2009: TEUR 24,245) relate to consolidation entries affecting net income. Deferred tax<br />

assets on individual balance sheets result primarily from temporary differences in accrued liabilities,<br />

receivables and other assets. Deferred tax assets relating to consolidation adjustments are primarily the<br />

result of eliminating unrealized intercompany profits. Deferred tax liabilities relate solely to deferred<br />

taxes on individual balance sheets of group companies. At individual company level and at Group level,<br />

deferred taxes are stated at the projected tax rate in the respective countries at the time of realization.<br />

Tax rates range from 0% to 40%, while the rate on consolidation activities is ca. 35%.

![Geschäftsbericht 2012 [PDF, 13 MB] - Zelisko](https://img.yumpu.com/22524926/1/184x260/geschaftsbericht-2012-pdf-13-mb-zelisko.jpg?quality=85)