Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

150<br />

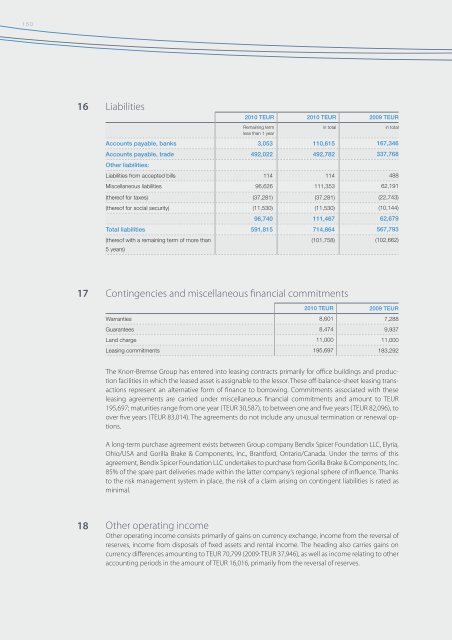

16<br />

Liabilities<br />

<strong>2010</strong> TEUR <strong>2010</strong> TEUR 2009 TEUR<br />

Remaining term<br />

less than 1 year<br />

Accounts payable, banks 3,053 110,615 167,346<br />

Accounts payable, trade 492,022 492,782 337,768<br />

Other liabilities:<br />

Liabilities from accepted bills 114 114 488<br />

Miscellaneous liabilities 96,626 111,353 62,191<br />

(thereof for taxes) (37,281) (37,281) (22,743)<br />

(thereof for social security) (11,530) (11,530) (10,144)<br />

in total<br />

in total<br />

96,740 111,467 62,679<br />

Total liabilities 591,815 714,864 567,793<br />

(thereof with a remaining term of more than<br />

(101,758) (102,662)<br />

5 years)<br />

17<br />

Contingencies and miscellaneous financial commitments<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Warranties 8,601 7,288<br />

Guarantees 8,474 9,937<br />

Land charge 11,000 11,000<br />

Leasing commitments 195,697 183,292<br />

The <strong>Knorr</strong>-<strong>Bremse</strong> Group has entered into leasing contracts primarily for office buildings and production<br />

facilities in which the leased asset is assignable to the lessor. These off-balance-sheet leasing transactions<br />

represent an alternative form of finance to borrowing. Commitments associated with these<br />

leasing agreements are carried under miscellaneous financial commitments and amount to TEUR<br />

195,697; maturities range from one year (TEUR 30,587), to between one and five years (TEUR 82,096), to<br />

over five years (TEUR 83,014). The agreements do not include any unusual termination or renewal options.<br />

A long-term purchase agreement exists between Group company Bendix Spicer Foundation LLC, Elyria,<br />

Ohio/USA and Gorilla Brake & Components, Inc., Brantford, Ontario/Canada. Under the terms of this<br />

agreement, Bendix Spicer Foundation LLC undertakes to purchase from Gorilla Brake & Components, Inc.<br />

85% of the spare part deliveries made within the latter company’s regional sphere of influence. Thanks<br />

to the risk management system in place, the risk of a claim arising on contingent liabilities is rated as<br />

minimal.<br />

18<br />

Other operating income<br />

Other operating income consists primarily of gains on currency exchange, income from the reversal of<br />

reserves, income from disposals of fixed assets and rental income. The heading also carries gains on<br />

currency differences amounting to TEUR 70,799 (2009: TEUR 37,946), as well as income relating to other<br />

accounting periods in the amount of TEUR 16,016, primarily from the reversal of reserves.

![Geschäftsbericht 2012 [PDF, 13 MB] - Zelisko](https://img.yumpu.com/22524926/1/184x260/geschaftsbericht-2012-pdf-13-mb-zelisko.jpg?quality=85)