Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 153<br />

flows or changes in value are offset in full. The <strong>Knorr</strong>-<strong>Bremse</strong> Group uses forward exchange contracts,<br />

currency options and cross currency swaps as hedging instruments.<br />

Not included in the hedging report are forward exchange derivatives with a nominal value of<br />

MEUR 28.0 and a negative net present value totaling MEUR 3.4. Currency futures contracts amounting<br />

to MEUR 876.6 in total (representing hedged risks) are included in macro hedges. Of this amount,<br />

MEUR 295.0 is attributable to the hedging of assets (micro hedges), MEUR 221.8 to the hedging of open<br />

contracts (micro hedges) and MEUR 359.8 to the hedging of high-probability transactions (portfolio<br />

hedges).<br />

Commodity futures contracts are used exclusively to hedge price risks arising on fluctuations in the<br />

purchase prices of raw materials used in <strong>Knorr</strong>-<strong>Bremse</strong> Group products (portfolio hedges). The volume<br />

of underlying transactions (hedged items) is calculated on the basis of high-probability requirements<br />

for raw materials over a rolling two-year planning period. The derivatives are based on reference indices<br />

traded on commodity futures exchanges. The effectiveness of the hedging relationship is retrospectively<br />

analyzed using statistical correlation techniques, showing a correlation in excess of 80%. Concluded<br />

contracts totaling MEUR 13.9 are carried in full in macro hedges.<br />

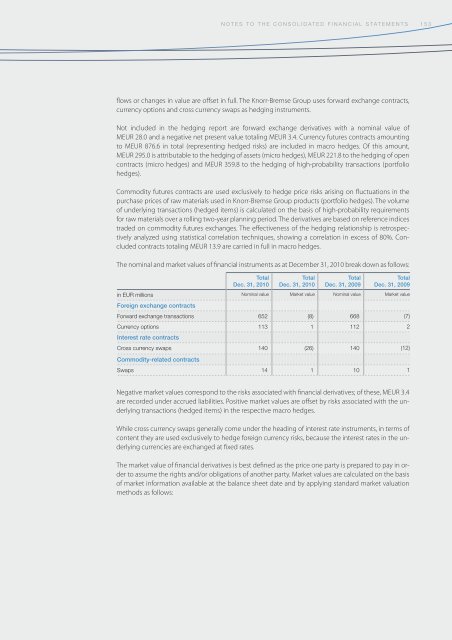

The nominal and market values of financial instruments as at December 31, <strong>2010</strong> break down as follows:<br />

Total<br />

Dec. 31, <strong>2010</strong><br />

Total<br />

Dec. 31, <strong>2010</strong><br />

Total<br />

Dec. 31, 2009<br />

Total<br />

Dec. 31, 2009<br />

in EUR millions Nominal value Market value Nominal value Market value<br />

Foreign exchange contracts<br />

Forward exchange transactions 652 (8) 668 (7)<br />

Currency options 113 1 112 2<br />

Interest rate contracts<br />

Cross currency swaps 140 (26) 140 (12)<br />

Commodity-related contracts<br />

Swaps 14 1 10 1<br />

Negative market values correspond to the risks associated with financial derivatives; of these, MEUR 3.4<br />

are recorded under accrued liabilities. Positive market values are offset by risks associated with the underlying<br />

transactions (hedged items) in the respective macro hedges.<br />

While cross currency swaps generally come under the heading of interest rate instruments, in terms of<br />

content they are used exclusively to hedge foreign currency risks, because the interest rates in the underlying<br />

currencies are exchanged at fixed rates.<br />

The market value of financial derivatives is best defined as the price one party is prepared to pay in order<br />

to assume the rights and/or obligations of another party. Market values are calculated on the basis<br />

of market information available at the balance sheet date and by applying standard market valuation<br />

methods as follows:

![Geschäftsbericht 2012 [PDF, 13 MB] - Zelisko](https://img.yumpu.com/22524926/1/184x260/geschaftsbericht-2012-pdf-13-mb-zelisko.jpg?quality=85)