Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 149<br />

11<br />

Capital stock<br />

The capital stock of <strong>Knorr</strong>-<strong>Bremse</strong> <strong>AG</strong> is divided up into 2,600,000 bearer shares, each with a nominal<br />

value of EUR 26. Stella Vermögensverwaltungs-GmbH and KB Holding GmbH, both based in Grünwald/<br />

Germany, have informed <strong>Knorr</strong>-<strong>Bremse</strong> <strong>AG</strong> that directly or indirectly, they hold a majority interest in<br />

<strong>Knorr</strong>-<strong>Bremse</strong> <strong>AG</strong>.<br />

12<br />

Capital reserves<br />

Capital reserves are unchanged from the previous year. Like the legal reserve, they are subject to the<br />

restrictions of § 150 of the German Corporation Law (AktG).<br />

13<br />

Retained earnings<br />

In addition to the legal reserve, retained earnings include the accumulated earnings of the companies<br />

included in consolidation, where these have not been distributed. Furthermore this heading reflects all<br />

Group items that exert an influence on shareholders’ equity. The legal reserve for <strong>Knorr</strong>-<strong>Bremse</strong> <strong>AG</strong> is<br />

unchanged at TEUR 6,607. Combined with TEUR 153 in capital reserves, the legal reserve stands at its<br />

statutory maximum.<br />

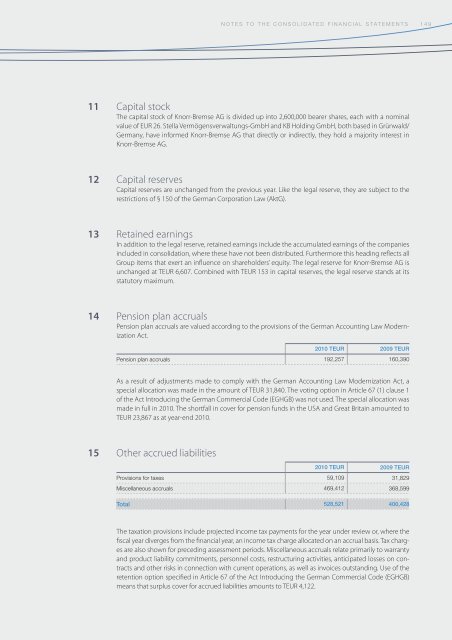

14<br />

Pension plan accruals<br />

Pension plan accruals are valued according to the provisions of the German Accounting Law Modernization<br />

Act.<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Pension plan accruals 192,257 160,390<br />

As a result of adjustments made to comply with the German Accounting Law Modernization Act, a<br />

special allocation was made in the amount of TEUR 31,840. The voting option in Article 67 (1) clause 1<br />

of the Act Introducing the German Commercial Code (EGHGB) was not used. The special allocation was<br />

made in full in <strong>2010</strong>. The shortfall in cover for pension funds in the USA and Great Britain amounted to<br />

TEUR 23,867 as at year-end <strong>2010</strong>.<br />

15<br />

Other accrued liabilities<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Provisions for taxes 59,109 31,829<br />

Miscellaneous accruals 469,412 368,599<br />

Total 528,521 400,428<br />

The taxation provisions include projected income tax payments for the year under review or, where the<br />

fiscal year diverges from the financial year, an income tax charge allocated on an accrual basis. Tax charges<br />

are also shown for preceding assessment periods. Miscellaneous accruals relate primarily to warranty<br />

and product liability commitments, personnel costs, restructuring activities, anticipated losses on contracts<br />

and other risks in connection with current operations, as well as invoices outstanding. Use of the<br />

retention option specified in Article 67 of the Act Introducing the German Commercial Code (EGHGB)<br />

means that surplus cover for accrued liabilities amounts to TEUR 4,122.

![Geschäftsbericht 2012 [PDF, 13 MB] - Zelisko](https://img.yumpu.com/22524926/1/184x260/geschaftsbericht-2012-pdf-13-mb-zelisko.jpg?quality=85)