Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Annual Report 2010 - Knorr-Bremse AG.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

152<br />

23<br />

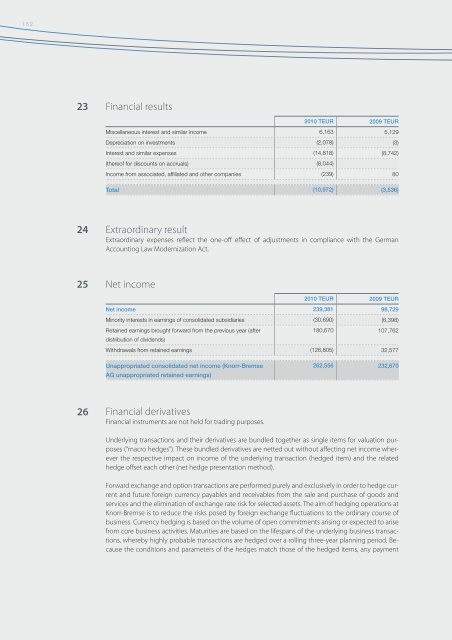

Financial results<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Miscellaneous interest and similar income 6,163 5,129<br />

Depreciation on investments (2,078) (3)<br />

Interest and similar expenses (14,818) (8,742)<br />

(thereof for discounts on accruals) (8,044)<br />

Income from associated, affiliated and other companies (239) 80<br />

Total (10,972) (3,536)<br />

24<br />

Extraordinary result<br />

Extraordinary expenses reflect the one-off effect of adjustments in compliance with the German<br />

Accounting Law Modernization Act.<br />

25<br />

Net income<br />

<strong>2010</strong> TEUR 2009 TEUR<br />

Net income 239,381 98,729<br />

Minority interests in earnings of consolidated subsidiaries (30,690) (6,398)<br />

Retained earnings brought forward from the previous year (after<br />

180,670 107,762<br />

distribution of dividends)<br />

Withdrawals from retained earnings (126,805) 32,577<br />

Unappropriated consolidated net income (<strong>Knorr</strong>-<strong>Bremse</strong><br />

<strong>AG</strong> unappropriated retained earnings)<br />

262,556 232,670<br />

26<br />

Financial derivatives<br />

Financial instruments are not held for trading purposes.<br />

Underlying transactions and their derivatives are bundled together as single items for valuation purposes<br />

(“macro hedges”). These bundled derivatives are netted out without affecting net income wherever<br />

the respective impact on income of the underlying transaction (hedged item) and the related<br />

hedge offset each other (net hedge presentation method).<br />

Forward exchange and option transactions are performed purely and exclusively in order to hedge current<br />

and future foreign currency payables and receivables from the sale and purchase of goods and<br />

services and the elimination of exchange rate risk for selected assets. The aim of hedging operations at<br />

<strong>Knorr</strong>-<strong>Bremse</strong> is to reduce the risks posed by foreign exchange fluctuations to the ordinary course of<br />

business. Currency hedging is based on the volume of open commitments arising or expected to arise<br />

from core business activities. Maturities are based on the lifespans of the underlying business transactions,<br />

whereby highly probable transactions are hedged over a rolling three-year planning period. Because<br />

the conditions and parameters of the hedges match those of the hedged items, any payment

![Geschäftsbericht 2012 [PDF, 13 MB] - Zelisko](https://img.yumpu.com/22524926/1/184x260/geschaftsbericht-2012-pdf-13-mb-zelisko.jpg?quality=85)