SMS Siemag AG - Alu-web.de

SMS Siemag AG - Alu-web.de

SMS Siemag AG - Alu-web.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

E conoM ics<br />

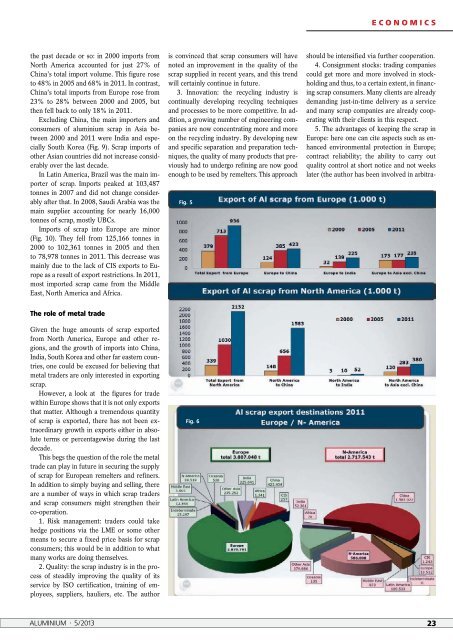

the past <strong>de</strong>ca<strong>de</strong> or so: in 2000 imports from<br />

North America accounted for just 27% of<br />

China’s total import volume. This figure rose<br />

to 48% in 2005 and 68% in 2011. In contrast,<br />

China’s total imports from Europe rose from<br />

23% to 28% between 2000 and 2005, but<br />

then fell back to only 18% in 2011.<br />

Excluding China, the main importers and<br />

consumers of aluminium scrap in Asia between<br />

2000 and 2011 were India and especially<br />

South Korea (Fig. 9). Scrap imports of<br />

other Asian countries did not increase consi<strong>de</strong>rably<br />

over the last <strong>de</strong>ca<strong>de</strong>.<br />

In Latin America, Brazil was the main importer<br />

of scrap. Imports peaked at 103,487<br />

tonnes in 2007 and did not change consi<strong>de</strong>rably<br />

after that. In 2008, Saudi Arabia was the<br />

main supplier accounting for nearly 16,000<br />

tonnes of scrap, mostly UBCs.<br />

Imports of scrap into Europe are minor<br />

(Fig. 10). They fell from 125,166 tonnes in<br />

2000 to 102,361 tonnes in 2005 and then<br />

to 78,978 tonnes in 2011. This <strong>de</strong>crease was<br />

mainly due to the lack of CIS exports to Europe<br />

as a result of export restrictions. In 2011,<br />

most imported scrap came from the Middle<br />

East, North America and Africa.<br />

is convinced that scrap consumers will have<br />

noted an improvement in the quality of the<br />

scrap supplied in recent years, and this trend<br />

will certainly continue in future.<br />

3. Innovation: the recycling industry is<br />

continually <strong>de</strong>veloping recycling techniques<br />

and processes to be more competitive. In addition,<br />

a growing number of engineering companies<br />

are now concentrating more and more<br />

on the recycling industry. By <strong>de</strong>veloping new<br />

and specific separation and preparation techniques,<br />

the quality of many products that previously<br />

had to un<strong>de</strong>rgo refining are now good<br />

enough to be used by remelters. This approach<br />

Fig. 5<br />

should be intensified via further cooperation.<br />

4. Consignment stocks: trading companies<br />

could get more and more involved in stockholding<br />

and thus, to a certain extent, in financing<br />

scrap consumers. Many clients are already<br />

<strong>de</strong>manding just-in-time <strong>de</strong>livery as a service<br />

and many scrap companies are already cooperating<br />

with their clients in this respect.<br />

5. The advantages of keeping the scrap in<br />

Europe: here one can cite aspects such as enhanced<br />

environmental protection in Europe;<br />

contract reliability; the ability to carry out<br />

quality control at short notice and not weeks<br />

later (the author has been involved in arbitra-<br />

the role of metal tra<strong>de</strong><br />

Given the huge amounts of scrap exported<br />

from North America, Europe and other regions,<br />

and the growth of imports into China,<br />

India, South Korea and other far eastern countries,<br />

one could be excused for believing that<br />

metal tra<strong>de</strong>rs are only interested in exporting<br />

scrap.<br />

However, a look at the figures for tra<strong>de</strong><br />

within Europe shows that it is not only exports<br />

that matter. Although a tremendous quantity<br />

of scrap is exported, there has not been extraordinary<br />

growth in exports either in absolute<br />

terms or percentagewise during the last<br />

<strong>de</strong>ca<strong>de</strong>.<br />

This begs the question of the role the metal<br />

tra<strong>de</strong> can play in future in securing the supply<br />

of scrap for European remelters and refiners.<br />

In addition to simply buying and selling, there<br />

are a number of ways in which scrap tra<strong>de</strong>rs<br />

and scrap consumers might strengthen their<br />

co-operation.<br />

1. Risk management: tra<strong>de</strong>rs could take<br />

hedge positions via the LME or some other<br />

means to secure a fixed price basis for scrap<br />

consumers; this would be in addition to what<br />

many works are doing themselves.<br />

2. Quality: the scrap industry is in the process<br />

of steadily improving the quality of its<br />

service by ISO certification, training of employees,<br />

suppliers, hauliers, etc. The author<br />

Fig. 6<br />

ALUMINIUM · 5/2013 23