bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

160<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

Group<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

Company<br />

2009<br />

Rm<br />

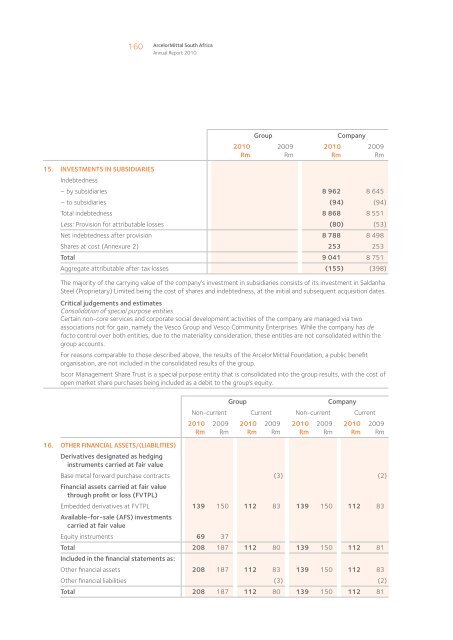

15. INVESTMENTS IN SUBSIDIARIES<br />

Indebtedness<br />

– by subsidiaries 8 962 8 645<br />

– to subsidiaries (94) (94)<br />

Total indebtedness 8 868 8 551<br />

Less: Provision for attributable losses (80) (53)<br />

Net indebtedness after provision 8 788 8 498<br />

Shares at cost (Annexure 2) 253 253<br />

Total 9 041 8 751<br />

Aggregate attributable after tax losses (155) (398)<br />

The majority of the carrying value of the company's investment in subsidiaries consists of its investment in Saldanha<br />

Steel (Proprietary) Limited being the cost of shares and indebtedness, at the initial and subsequent acquisition dates.<br />

Critical judgements and estimates<br />

Consolidation of special purpose entities<br />

Certain non-core services and corporate social development activities of the company are managed via two<br />

associations not for gain, namely the Vesco Group and Vesco Community Enterprises. While the company has de<br />

facto control over both entities, due to the materiality consideration, these entities are not consolidated within the<br />

group accounts.<br />

For reasons comparable to those described above, the results of the <strong>ArcelorMittal</strong> Foundation, a public benefit<br />

organisation, are not included in the consolidated results of the group.<br />

Iscor Management Share Trust is a special purpose entity that is consolidated into the group results, with the cost of<br />

open market share purchases being included as a debit to the group’s equity.<br />

Group<br />

Company<br />

Non-current Current Non-current Current<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

16. OTHER FINANCIAL ASSETS/(LIABILITIES)<br />

Derivatives designated as hedging<br />

instruments carried at fair value<br />

Base metal forward purchase contracts (3) (2)<br />

Financial assets carried at fair value<br />

through profit or loss (FVTPL)<br />

Embedded derivatives at FVTPL 139 150 112 83 139 150 112 83<br />

Available-for-sale (AFS) investments<br />

carried at fair value<br />

Equity instruments 69 37<br />

Total 208 187 112 80 139 150 112 81<br />

Included in the financial statements as:<br />

Other financial assets 208 187 112 83 139 150 112 83<br />

Other financial liabilities (3) (2)<br />

Total 208 187 112 80 139 150 112 81