bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

161<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

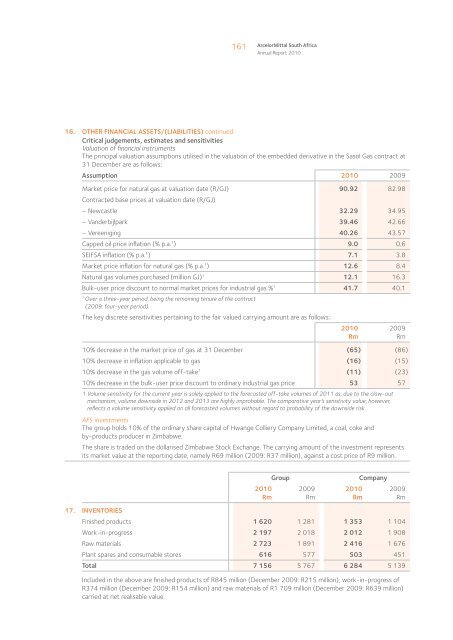

16. OTHER FINANCIAL ASSETS/(LIABILITIES) continued<br />

Critical judgements, estimates and sensitivities<br />

Valuation of financial instruments<br />

The principal valuation assumptions utilised in the valuation of the embedded derivative in the Sasol Gas contract at<br />

31 December are as follows:<br />

Assumption 2010 2009<br />

Market price for natural gas at valuation date (R/GJ) 90.92 82.98<br />

Contracted base prices at valuation date (R/GJ)<br />

– Newcastle 32.29 34.95<br />

– Vanderbijlpark 39.46 42.66<br />

– Vereeniging 40.26 43.57<br />

Capped oil price inflation (% p.a. 1 ) 9.0 0.6<br />

SEIFSA inflation (% p.a. 1 ) 7.1 3.8<br />

Market price inflation for natural gas (% p.a. 1 ) 12.6 8.4<br />

Natural gas volumes purchased (million GJ) 1 12.1 16.3<br />

Bulk-user price discount to normal market prices for industrial gas % 1 41.7 40.1<br />

1<br />

Over a three-year period, being the remaining tenure of the contract<br />

(2009: four-year period).<br />

The key discrete sensitivities pertaining to the fair valued carrying amount are as follows:<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

10% decrease in the market price of gas at 31 December (65) (86)<br />

10% decrease in inflation applicable to gas (16) (15)<br />

10% decrease in the gas volume off-take 1 (11) (23)<br />

10% decrease in the bulk-user price discount to ordinary industrial gas price 53 57<br />

1 Volume sensitivity for the current year is solely applied to the forecasted off-take volumes of 2011 as, due to the claw-out<br />

mechanism, volume downside in 2012 and 2013 are highly improbable. The comparative year’s sensitivity value, however,<br />

reflects a volume sensitivity applied on all forecasted volumes without regard to probability of the downside risk<br />

AFS investments<br />

The group holds 10% of the ordinary share capital of Hwange Colliery Company Limited, a coal, coke and<br />

by-products producer in Zimbabwe.<br />

The share is traded on the dollarised Zimbabwe Stock Exchange. The carrying amount of the investment represents<br />

its market value at the reporting date, namely R69 million (2009: R37 million), against a cost price of R9 million.<br />

Group<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

Company<br />

2009<br />

Rm<br />

17. INVENTORIES<br />

Finished products 1 620 1 281 1 353 1 104<br />

Work-in-progress 2 197 2 018 2 012 1 908<br />

Raw materials 2 723 1 891 2 416 1 676<br />

Plant spares and consumable stores 616 577 503 451<br />

Total 7 156 5 767 6 284 5 139<br />

Included in the above are finished products of R845 million (December 2009: R215 million), work-in-progress of<br />

R374 million (December 2009: R154 million) and raw materials of R1 709 million (December 2009: R639 million)<br />

carried at net realisable value.